In the realm of Singapore’s real estate market, the interplay between interest rates and property dynamics is a crucial factor for both prospective homebuyers and savvy property investors.

A comprehensive understanding of the interest rate climate, including the determinants of these rates, the distinctions between fixed and floating interest rates, the influence on housing prices, historical trends, current rates from multiple banks, and the future outlook, is paramount for making informed decisions in this ever-evolving landscape.

What are the main factors influencing the interest rates?

On a macro level, interest rates are intricately tied to factors such as global economic conditions, central bank policies, inflation expectations, and market liquidity.

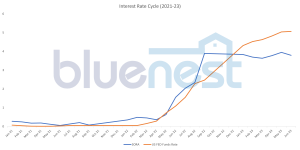

Fret not if you are not an economist! By keeping track of the interest rate determinations made by the U.S. Federal Reserve, you can effectively monitor the rates since its decisions have an impact on the broader global interest rate patterns, including Singapore’s. From the graph below it is evident that the interest rates in Singapore (SORA in this case) is highly correlated to the US FED rates.

Table 1: Data from FED rates and SORA for period 2021-23. You can follow the US Fed Rates and get historical data from sites like Trading Economics.

Having gained an understanding of the macro factors influencing interest rates, continue reading to discover the implications it has on your home purchase price, mortgage loan and other important considerations to keep in mind.

Are there any impact of interest rates on housing prices?

Economics 101: When interest rates are low, borrowing costs decrease, thereby increasing affordability and stimulating demand for properties. This heightened demand often leads to upward pressure on housing prices. Conversely, rising interest can dampen affordability, reducing demand and potentially causing a downward shift in property prices.

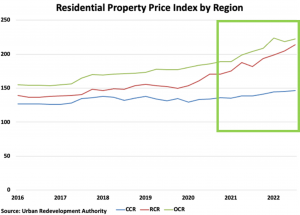

Interestingly, in Singapore’s real estate market, rising interest rates often have a bullish effect on home prices, contrary to other real estate markets. This suggests that as a potential homebuyer, there may be an opportunity to benefit from this exceptional trend. The resilience of the Singapore economy and property market is evident in the fact that even when interest increase, it fails to dampen the interest in real estate, with home prices typically rising alongside higher rates.

The graph below clearly illustrates the upward trend of the Residential Property Price Index from 2021 to 2023, coinciding with the previously mentioned rise in interest rates (table 1).

Table 2: Residential Property Price Index by Region, credits to Globalpropertyguide

Table 2: Residential Property Price Index by Region, credits to Globalpropertyguide

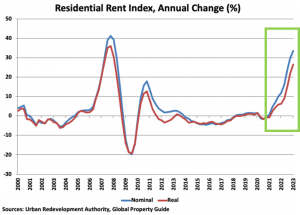

One of the consequences of high interest rates is that it can discourage first-time buyers and individuals looking to downsize, leading them to opt for the rental market instead. When interest rates are elevated, mortgage loans become more expensive, prompting landlords to make adjustments to accommodate the changes in rates.

Table 3: Residential Rent Index Annual Change %, credits to Globalpropertyguide

Table 3: Residential Rent Index Annual Change %, credits to Globalpropertyguide

What are the differences between Fixed and Floating interest rates?

For many individuals, choosing between fixed and floating interest rates can be a tough decision to make. In my view, neither option inherently outweighs the other, as the decision ultimately relies on your personal risk tolerance and financial stability.

i. Fixed Interest Rate:

With a fixed interest rate, the rate remains unchanged throughout a specific period, typically ranging from two to five years. This offers stability and predictability in monthly mortgage payments, shielding you from market fluctuations.

ii. Floating Interest Rate:

A floating interest rate, also known as a variable interest rate, can fluctuate based on market conditions. Floating rate housing loan is usually pegged to the Singapore Overnight Rate Average (SORA) or a Fixed Deposit Based Rate (FDR). Floating rates offer the potential for lower rates during periods of market decline but come with the risk of increased rates when the market rises.

Consider the following when choosing between these 2 options

- Is it crucial for you to have the assurance of consistent monthly payments? If so, a fixed-rate loan could be a more appropriate choice as it eliminates any unexpected surprises.

- What is your risk tolerance & financial stability to maintain the monthly housing loan payment?

- What is the market outlook? Consider the possibility of interest decreasing within the next 1 to 2 years, borrowers may prefer opting for a shorter lock-in period for their housing loan.

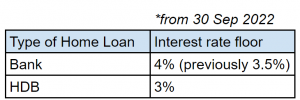

Also read up on the latest round of property cooling measure where there is an increase of 0.5% to the interest rate floor across HDB and Bank loans.

What are the current interest rates from multiple banks?

Let us provide you with a glimpse of the prevailing interest rates from various banks in Singapore:

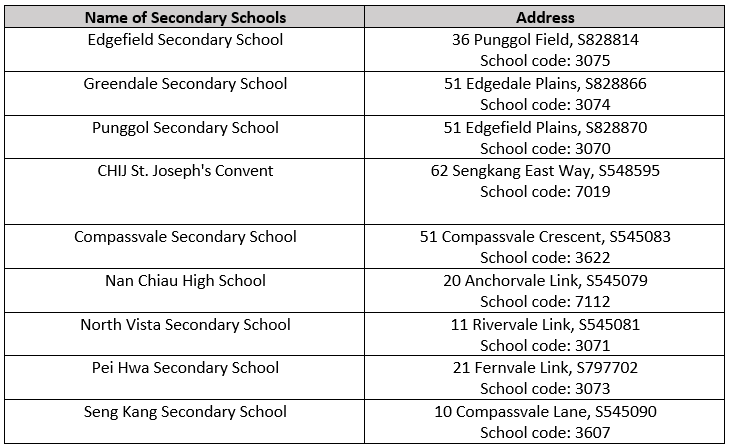

Cheapest Fixed Interest Rates (as of 13th July 2023)

- CIMB – 2 Years Fixed – 3.5%

- Bank of China – 3 Years Fixed – 3.4%

- Bank of China – 3 Years Fixed – 3.5%

Cheapest Floating Interest Rates (as of 13th July 2023):

- Hong Leong Finance – PPR- 2.15% (Lock-in 2 years), net 4.0%

- Bank of China – 3M SORA + 0.50% (Lock-in 2 years), net 4.19%

- Bank of China – 3M SORA + 0.55% (Lock-in 2 years), net 4.24%

You can find out the latest mortgage rates from portals like Propertyguru.

What can I anticipate regarding the future outlook of interest rates?

Looking forward, the trajectory of interest rates hinges upon various factors, including global economic conditions, inflation trends, and central bank policies. Interest rates in Singapore have seen significant hikes in recent times and buyers need to be mentally prepared for any potential rise.

Earlier we spoke about The U.S. Federal Reserve’s interest rate decisions having an impact on Singapore’s. In recent times, the U.S. Federal Reserve has been gradually increasing interest to manage economic growth and maintain stability. However, the pace of rate hikes has been slowing down since Feb 2023.

From the Fed Reserve table below we can observe that during Sep-Nov 2022, the interest rate hike peaked at +0.75% compared to recent period Feb-Jun 2023 where the interest rate hike averaged to only +0.25%.

Image credit: tradingeconomics

The outlook for interest rates suggests that we may be approaching a potential plateau or inflection point, indicating a potential stabilization or slower pace of increase in the near future.

Buyers need to be cognizant of this shift in interest rates and understand that the current level may become the new norm for a while. It is crucial to evaluate the affordability of mortgage rates based on this expectation. Consulting with financial advisors and mortgage specialists will provide buyers with insights into the potential impact of interest rate increases on their financial planning.

Staying well-informed, closely monitoring market trends, and seeking guidance from industry professionals are crucial when navigating Singapore’s dynamic real estate market.

Read more about the property market outlook for H2 2023 – Is now the right time to buy or sell

Conclusion

To navigate Singapore’s real estate market like an expert, you need to stay well-informed about all macro and micro factors such as market trends, property cooling measures, interest rates, new housing supply, etc. It is definitely not an easy task to be able to monitor all these and it is always advisable to seek guidance from industry professionals.

When deciding between fixed and floating rates, consider your personal risk tolerance and financial stability. Being prepared and having a thorough understanding of the situation will enable you to make informed decisions aligned with your own preferences.