If you’re selling and buying a resale HDB at the same time, managing your cashflow is tricky. Given the number of steps, it’s hard to know what you need to set aside during the HDB resale payment timeline.

When do you get the sale proceeds so you can make an offer for the new flat? And how much cash do you need to set aside for things like buyer stamp duty?

Read also: Selling and Buying HDB At the Same Time (How to Plan Your Timeline)

This article will cover all the payments that come up – and when – that you need to prepare for as both a seller and buyer.

We’ll answer questions like:

and more.

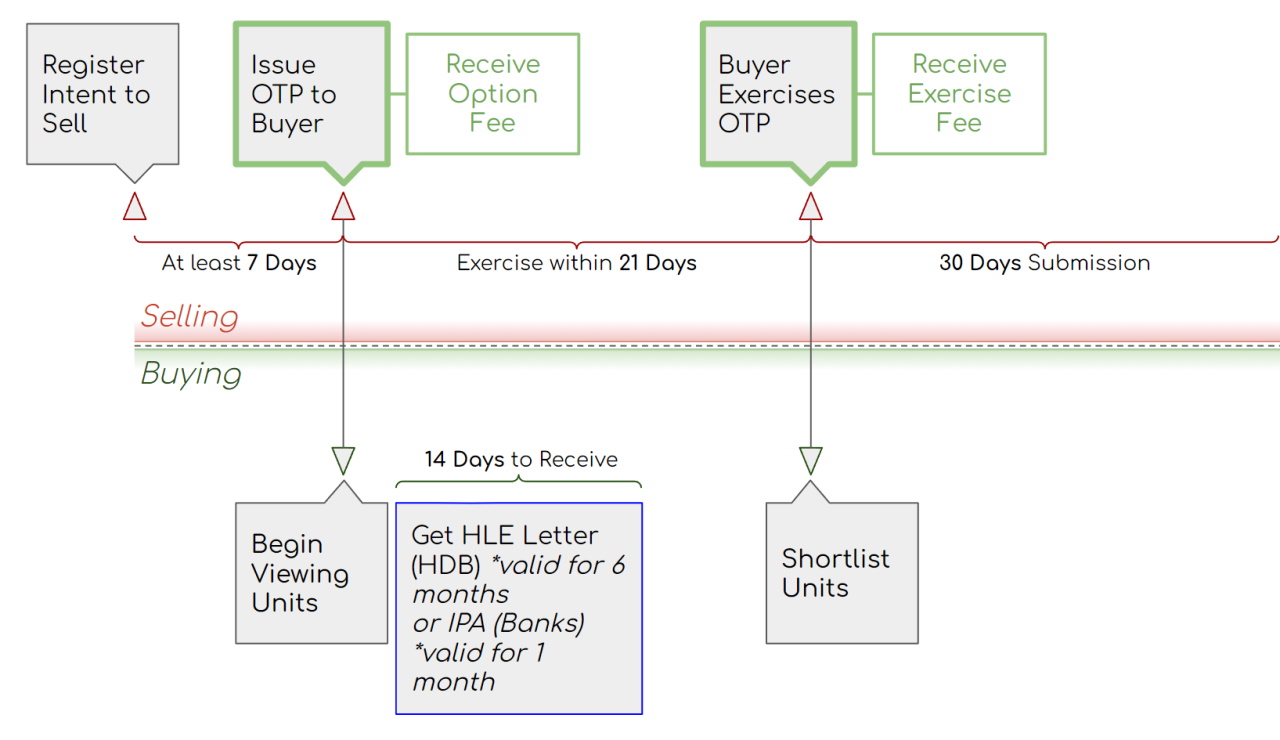

We covered the key phases of simultaneous selling and buying HDB in How to Plan Your Timeline, highlighting points like when to start looking for your new flat while completing the sale of your old one.

We’ll use the same four phases to break down the incoming and outgoing cashflow:

The first phase of this process has fewer transactions. You’ll be focused on styling and staging your flat for viewings while waiting for potential buyers.

Once a buyer requests an OTP, things start to really progress. You’ll need to keep track of your cashflow as more fees are just up ahead.

Read also: How to Sell HDB – 5 Lessons We Learned From Record-Breaking Flat Sales

Deposit from Buyer: <= $5,000. Once you’ve found a buyer, you’ll receive a deposit of no more than $5,000. This comprises the Option Fee ($1 – 1,000) and Exercise Fee ($1 – $4,000) and is up to you to set. Save this to pay for the deposit for your next flat.

As a seller, you won’t have anything to pay at this point.

But you’ll need a private conveyancing lawyer for the sale of your HDB if you want to expedite the timeline, so start getting quotes here. Expect them to be in the ballpark of $1,300 to $2,000.

(Going with HDB conveyancing officers may add another 15 to 19 weeks to the entire selling and buying process, since they can usually only process the HDB Resale Application after your CPF has been refunded.)

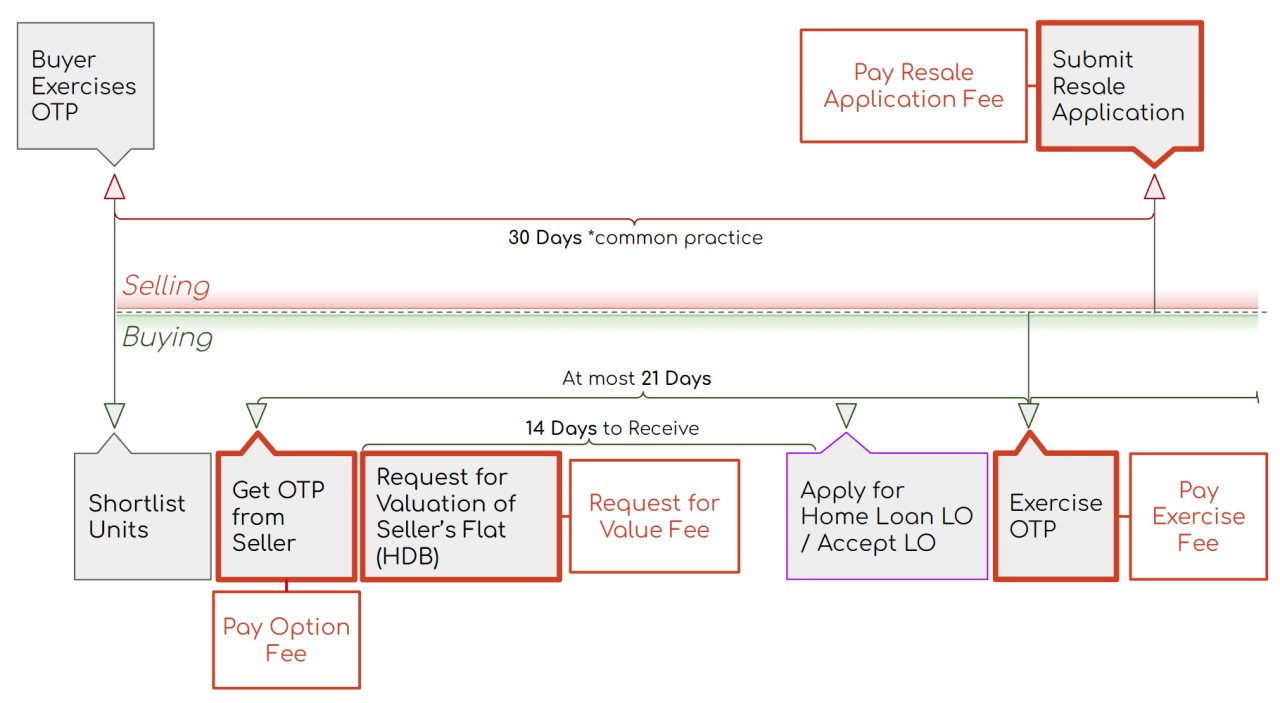

Phase 3 is when you start sorting out your home loan, shortlisting possible new homes, and getting the necessary cash ready:

None!

Deposit for New Flat: <= $5,000. Once you’ve found a flat you like, you’ll need to pay a cash deposit for the flat. Same as your buyer, you’ll make this payment in two stages within a span of 21 days. First is the Option Fee (S$1-1,000) and then the Exercise Fee (S$1-4,000). Combined, this amount will not exceed S$5,000.

Request for Valuation Fee: $120. This is assuming you need a home loan. If you’re paying for the next flat all in cash, you can skip this. By the next working day after getting the OTP from the seller, you’ll submit a Request for Valuation to HDB. You’ll pay $120 (inclusive of GST) to HDB.

Resale Application Fee: $40 – 80. You’ll also need to pay a non-refundable Resale Application Fee for the sale of your current flat. The market practice is to submit the Resale Application 30 days after the buyer exercises the OTP, but this is negotiable if you need more time. HDB determines the application fee based on the size of your flat:

| 1- and 2-room flats | 3-room and bigger |

| $40 | $80 |

Admin Fee for Extension of Stay (If Applicable): $20. If you’re selling and buying a flat at the same time, you’ll likely need to request a Temporary Extension of Stay. Technically the buyer pays this admin fee when submitting the Resale Application, but be prepared to compensate them for all the costs associated with the extension.

Also read: Extension of Stay HDB: Traps to Avoid to Protect Both Sides

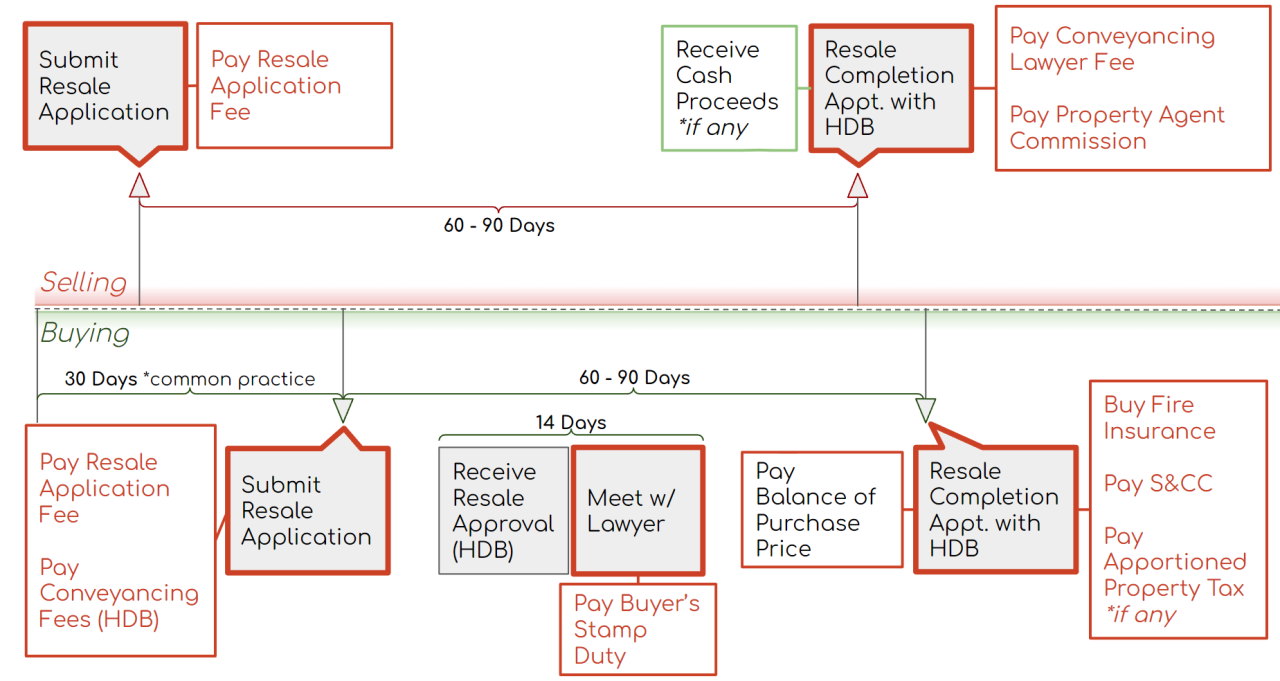

The last two months of the process are when the bulk of the payments take place:

Cash Proceeds for Sale of Flat, If Any: On or before the Resale Completion Appointment, you’ll get the cash proceeds as a cashier’s cheque after the deduction of loan repayments and CPF refunds. (If the deductions are more than the sale proceeds, you’ll need to top up in cash.)

CPF Refunds: If you used CPF to buy your old flat, this will be refunded to your account two weeks after the Resale Completion Appointment. You can only use the refunded CPF to pay for your new flat a week after that, so plan your timeline accordingly.

As the Seller

Property Tax: If you haven’t already, you’ll need to pay property tax for your HDB flat up until the end of the year.

Service and Conservancy Charges (S&CC): ~$20 – 110. You’ll continue paying this for your old flat until the day of completion.

Service Termination/Moving Costs (If Applicable): In some cases, you may have to pay an early termination or relocation cost if you’re still under contract for utilities, internet, or other services. The amount payable depends on the contract you signed, but the costs are usually no more than a couple hundred.

Moving Costs: ~$300 – 1,000. The Resale Completion Appointment is usually about 8 to 12 weeks after you submit the Resale Application. You’ll need to move out of your old flat by then so the buyers can take vacant possession of the flat after the appointment.

Private Conveyancing Lawyer Fees: $1,300 – 2,000. This could include a number of items such as title searches, caveats, registration and microfilming, and the discharge of mortgage (if any). Payable at the law firm prior to the Resale Completion Appointment using cash or CPF.

Property Agent Commission: 1 – 2% of the Sale Price, payable at the Resale Completion Appointment. (The standard market rate is 2%, but Bluenest charges just 1%.)

As the Buyer

Resale Application Fee: $40 – 80. You’ll need to submit another Resale Application as the buyer along with the application fee.

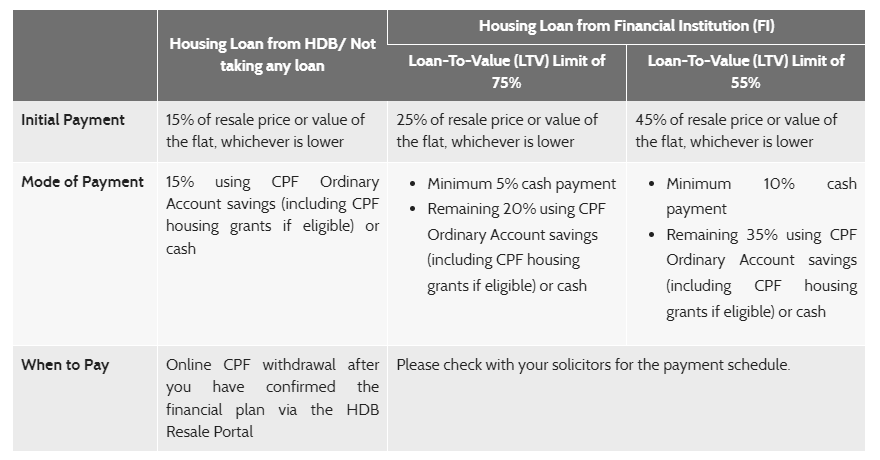

Initial Payment: 15 – 25% of Resale Price or Value of the Flat, whichever is lower. Payable using cash, CPF, or a mixture of both after endorsing the resale documents about four to five weeks after submitting the Resale Application.

This is only applicable if you’re using HDB’s conveyancing officers instead of a private lawyer. If you’re using the latter, they’ll release the CPF funds before the Resale Completion and you won’t need to worry about having the funds long before the CPF refunds come in.

Mortgage Stamp Duty (If Applicable): Also known as Mortgage Duty, you’ll pay a maximum duty of $500 on the loan for the new place. (Read more from IRAS here.)

Buyer’s Stamp Duty: You’ll get approval for your Resale Application about a month before the completion of the sale. You’ll have to pay Buyer Stamp Duty within 14 days of the approval letter, either in CPF (if you have enough) or in cash. If you don’t have enough CPF at the time, you can pay in cash first and apply for a reimbursement from CPF later.

Here’s how to calculate BSD:

| Purchase Price or Market Value of Property | Buyer Stamp Duty Rate |

| First $180,000 | 1% |

| Next $180,000 | 2% |

| Next $640,000 | 3% |

| Remaining Amount | 4% |

For example, if you’re buying a resale flat for S$620,000. You would pay:

$1,800 (1% x $180,000) + $3,600 (2% x $180,000) + $7,800 (3% x $260,000) = $13,200 total.

You can use IRAS’ Stamp Duty Calculator here.

Private Conveyancing Lawyer Fees: $1,800 – 2,500. Settled either in CPF or cash with a trip down to the lawyer’s office before the completion of the purchase.

Conveyancing Fees (HDB): If you chose to use HDB’s conveyancing instead of private lawyers, you’ll need to pay legal fees to HDB. You can use HDB’s Legal Fee Calculator to find out how much you need to pay. (Bear in mind that HDB conveyancing officers can usually only process your Resale Application after your CPF funds are back in your account, so this will extend your home purchasing journey considerably.)

Cash Balance of Purchase Price: If any part of the purchase is not covered by the home loan or CPF, you’ll need to top up the balance in cash. Take out a cashier’s order at least a week before the Resale Completion Appointment and bring it with you on the day of.

Renovation Costs (If Applicable): Congrats on your new place! Now you’ll have to do it up nicely…

Fire Insurance: Max of $8.10 for a 5-year Premium. This is mandatory if you’re taking a loan from HDB.

Home Protection Scheme: Amount Varies. You’ll need this if you’re using CPF to pay off your home loan, but it’s optional if you have private life insurance or mortgage-reducing insurance that can cover the oustanding home loan. Premiums are automatically deducted from your CPF OA.

Service and Conservancy Charges (S&CC): ~$20 – $110. You won’t have to pay this at the Resale Completion Appointment, but you do need to state how you’ll pay the first month’s fees.

Apportioned Property Tax: At the Resale Appointment, you’ll pay the seller an apportioned amount of property tax (pro-rated based on when during the year you’re buying the property).

Still need help figuring out your cashflow with the HDB selling and buying timeline? Get in touch with us.

Kenneth is Co-founder of Bluenest and helps to manage the real estate side of the business. He carries over 10 years of experience and was ranked top 10 in Singapore for the number of HDB properties transacted in 2019. Kenneth was featured in the news multiple times for his record-breaking transactions.