If you’re like most Singaporeans, you probably hold most of your net worth in the flat you live in. You’re counting on it to be a good store of value for when you upgrade to your dream home – or when you finally retire.

So it can come as a shock when you get to the HDB Resale Completion Appointment only to find out you won’t get any cash – and in fact have to top up out of your own pocket.

Just how do you calculate the proceeds from the sale of your HDB flat? How much cash will you get, and in which cases will you have to top up out of your own pocket?

That’s what we’ll cover today.

Before we get into the nitty-gritty details, we’ll go over a straightforward scenario for calculating your sale proceeds.

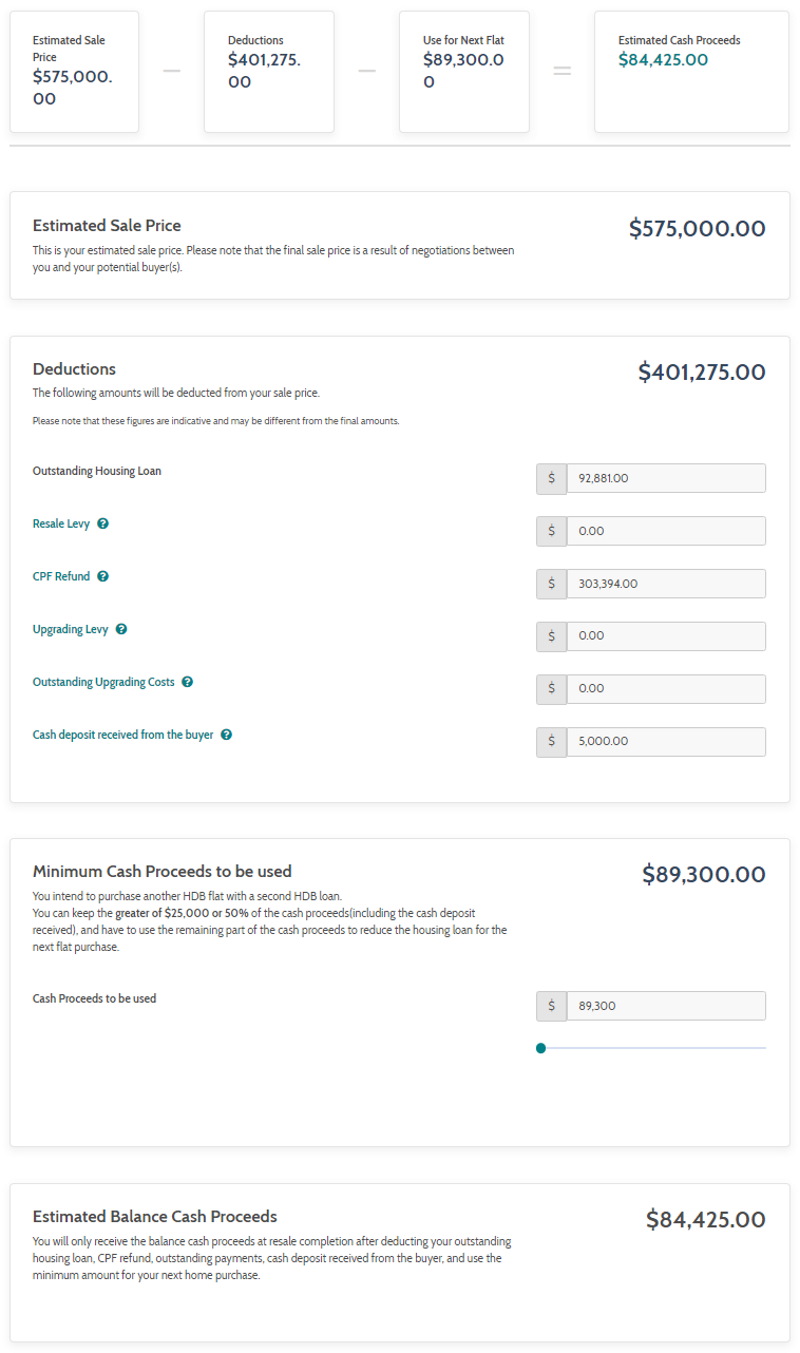

HDB’s calculator is a great guide for this. You begin with your Intended Selling Price, from which you’ll make deductions to end up with your final Balance Cash Proceeds.

The main deductions are as follows:

After making the requisite deductions, you’ll be left with your cash proceeds.

Here’s a sample from HDB’s Sale Proceeds Calculator:

So what eats into your sale proceeds? Here’s what people often miss in their calculations:

If you used CPF savings to pay for your flat, you’ll need to return this to the account along with the 2.6% annual interest that would have accumulated if you’d left the funds there. And if you’ve been using CPF to pay off your home loan every month, that amount gets much larger.

Let’s take a typical 25-year HDB mortgage of $250,000. After 18 years of paying off your loan, you’d have made a total repayment of ~$234,000 (including about $80,000 in interest payments on the loan). If you used your CPF to make these payments every month, you need to refund the CPF along with accrued interest.

Basically, you’re paying interest on your interest payments – a double whammy.

In this example, the total amount that you’d need to refund to CPF for mortgage payments is:

~S$234,000 (CPF you withdrew for payments)

+ ~S$69,000 (Accrued Interest at 2.6%)

Total: ~$303,000.

If you took any housing grants, you also need to return these funds along with accrued interest to your CPF account. You don’t have to return it to the government, but you won’t get the proceeds in cash either.

Say you bought your flat 18 years ago, taking $30,000 from CPF housing grants on top of the $250,000 home loan. The grant amount you’d refund to CPF would then include about $16,789 in accrued interest. That means another $46,789 out of your sale proceeds to refund to CPF.

Next you’ll have to deduct all the costs associated with selling a home, including

(We cover all the payments in our guide on HDB Resale Payment Timeline: How to Plan Your Cashflow.)

If you sell your flat below market value and the sale proceeds aren’t enough to fully refund your CPF, you may need to top up the difference in cash.

But as long as you sell your flat at or above market value, you won’t have to pay out of your own pocket even if the proceeds aren’t sufficient. That’s why even if you’re in a rush, it’s worth doing the prepwork and engaging a good agent for the sale.

Read also: How to Sell HDB – 5 Lessons We Learned From Record-Breaking Flat Sales

You can find out the amount you need to refund to your CPF account here.

HDB Resale Levy

The HDB resale levy is an additional amount you need to pay if you’re selling a subsidised flat and subsequently buying another subsidised flat. You won’t need to pay it if you buy the next flat without any housing grants.

HDB defines a subsidised house as:

When and how you’ll pay the resale levy depends on when you book your second subsidised flat. HDB will either deduct it directly from your sale proceeds or ask you to pay it in cash when you collect the key to your second flat. For more details, check out HDB’s website.

HDB Upgrading Levy

This is rare, but it’s applicable if you’re selling a flat that has gone through at least two rounds of subsidised MUP upgrading programs. To check if you need to pay the upgrading levy, you can submit a query with HDB here.

If you’re planning on buying a new flat with an HDB loan, you’ll have to use the greater amount of either $25,000 or 50% of the cash proceeds (including the $5,000 cash deposit) to reduce the loan amount.

E.g. If your cash proceeds come to $48,000, you’ll need to use $25,000 to offset the HDB loan amount.

Putting all the numbers together, let’s use an example.

Say you and your spouse bought a $285,000 4-room BTO 18 years ago. You were both first-timer applicants and you got $30,000 from HDB housing grants. You paid $5,000 in cash, $30,000 in CPF, and took a $250,000 HDB loan. You also chose to make your monthly mortgage repayments using CPF.

You’ve decided to sell your flat and found a buyer who offered $575,000.

* P (Principal), I (Accrued Interest)

And unless you’ve already got your next home in move-in ready condition, you’ll probably need to save some of this for costs like a downpayment, renovations, buyer stamp duty, and any applicable levies. If you’re buying your next place while selling your current flat at the same time, you’ll need to manage your finances accordingly.

Still need help figuring out your cashflow for the purchase of your next home? Get in touch with one of our agents.

Kenneth is Co-founder of Bluenest and helps to manage the real estate side of the business. He carries over 10 years of experience and was ranked top 10 in Singapore for the number of HDB properties transacted in 2019. Kenneth was featured in the news multiple times for his record-breaking transactions.