In our conservative island-state, our housing regulations are skewed in favor of Singaporean citizens with a good dose of filial piety. Meaning the best way to take advantage of all the resale and BTO housing grants? Get married and buy a flat close to your parents. Better yet, buy the flat and live with your parents.

There are HDB grants for first-timers, second timers, or even first-timers marrying second-timers. But you might be wondering: are there HDB grants for single Singaporeans? And what if I marry a PR or a foreigner?

Article has been updated in July 2023

That’s why we’ll break down the various housing grants available by each demographic:

1. Single Citizen

1. Single CitizenAssuming you’re at least 35 years old and a first-timer applicant, great news! You may be eligible for these subsidies:

Under CPF’s new Enhanced CPF Housing Grant, you can get up to $40,000 as long as your income doesn’t exceed $4,500/mo.

There are also other requirements, like:

There are three grants to take note of:

These three combined entitle you to up to $95,000 for the purchase of a 2- to 4-room resale flat (excluding 3Gen flats) in any location

To qualify for all three though, you’ll need:

Applying with your best friend? You can do so under the Joint Singles Scheme. Under the Enhanced CPF Housing Grant, you can get up to $80,000 as long as your combined income isn’t more than $14,000 a month. (Read also: 8 Things to Know About the Enhanced CPF Grant)

Applying with your siblings? Under the Orphans Scheme, you can go as big as a new 5-room flat in a non-mature estate and get a grant of up to $80,000.

Or you can go for a resale HDB with one to three other single (Singaporean) friends or your (Singaporean or PR) siblings. The Singles Grant (capped at a combined monthly income of < $14,000) will then give you:

Lastly, if you buy a resale flat and live with or near your parents, you’re entitled to $15,000 or $10,000 respectively under the Proximity Housing Grant. By “near,” we mean within 4km.

As an incentive to convert, if your sibling becomes a Singaporean citizen later on, you can get an extra $10,000 as a “Citizen Top-Up.”

2. Citizen Marrying Citizen

2. Citizen Marrying CitizenIf you’re in this category, you’re in the best position to take advantage of all the CPF housing grants. The exact amount you’ll get depends on a few factors:

Here are the grants you may be eligible for:

HDB now has one single Enhanced CPF Grant for first-timer SC/SC couples. This gives you up to $80,000 for a new flat of any size and in any location (read: fewer restrictions, more grant money). Your monthly household income must not exceed $9,000, however.

(Read also: 8 Things to Know About the Enhanced CPF Grant)

Here’s the breakdown of how much you’ll get based on your income bracket:

(Source: HDB)

(Source: HDB)

But what if you’re getting married young – and you haven’t been employed for the 12 months prior to your flat application?

Fret not: HDB introduced the Deferred Income Assessment. This allows young couples to apply for their BTO flat first (which typically takes 3 long years before it’s actually built), then have their income assessed for the housing grant / HDB loan closer to the key collection date.

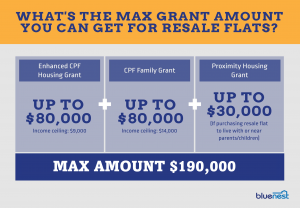

If you’re in this group, congrats! You stand as one of the biggest beneficiaries of the newly revised CPF grants. To push the first-time homebuyer market more towards resale HDBs, there are more subsidies (up to $160,000!) available to this demographic:

(Read also: 8 Things to Know About the Enhanced CPF Housing Grant)

The grant amount you’ll get depends on your income bracket. Also, to get the max grant amount for your income bracket, you’ll have to make sure the resale flat you buy can last you and your spouse until at least 95 years old. Otherwise, the EHG will be prorated.

Upgrading? You might be able to get up to $15,000 under the Step-Up CPF Housing Grant for your new flat.

This allows you to go for a 3-room flat in a non-mature estate, provided you have a max household income of $7,000 and at least one of you has been employed for the 12 months leading up to the flat application.

Very similar to the above, you might be eligible for $15,000 in subsidies under the Step-Up CPF Housing Grant.

Just note that the resale flat must be able to last until you and your spouse are at least 95 years old. Meaning if you’re 40 and your spouse is 50 years old, the resale flat must have at least 55 years left on its lease (calculated from your age, since you’re the younger buyer).

Also, since you’re buying a resale flat, you may be eligible for the Proximity Housing Grant if you live with or near your parents (provided you haven’t already received it before).

There’s one grant of note: the Enhanced CPF Housing Grant. This gets you up to $40,000 provided your household income is no more than $4,500/mo.

These grants calculate your eligibility by taking half of your average monthly household income for the last 12 months. Meaning if you earned $4,000 and your spouse earned $3,000, the figure they’ll use is $3,500.

There are three HDB grants available for you:

The Half-Housing Grant grants you $25,000 – essentially, half the amount you would’ve received from the Family Grant if you had applied as two first-timers. To qualify, you:

The Top-Up Grant is for those who have previously received Singles Grants but get married later on. This tops up the difference between what you would’ve received from the Family Grant and what you already received from the Singles Grant.

The PHG gives you another $20,000-$30,000 if you’re purchasing a resale flat to be closer to your parents.

3. Citizen Marrying PR

3. Citizen Marrying PRThe grants here are similar to those of citizens marrying other citizens, with one main difference: PRs are heavily incentivized to convert to Singaporean citizenship.

HDB does this in three main ways:

With that in mind, here are the grants SC/PR couples may be eligible for:

There are two grants of interest to you:

Like the scenario of the SC/SC couple buying a BTO, the amount you’ll get depends on your income (capped at $9,000/mo).

Just note that you’ll have to pay a premium of $10,000 on top of the purchase price for that BTO flat. You’ll get it back later on, but only if the PR spouse converts to Singapore citizenship (Citizen Top-Up).

If you’re going for a resale HDB, there are four possible grants:

You won’t have to pay an extra 10k premium for a resale flat, but $10,000 of the Family Grant will be withheld. (SC/SC couples get $50,000.) Again, you’ll get this back if you convert to Singapore Citizenship later on.

Resale flats are also eligible for the Proximity Housing Grant, which gives you $30,000 if you live with your parents/adult children or $20,000 if you live within 4km of them.

I hate to break it to you, but you’ve maxed out your available government subsidies as an SC/PR couple. Unless the PR spouse converts to SC, there are no more grants for you!

The only grant you’re eligible for is the Proximity Housing Grant, provided you live with or near your parents/adult children (and assuming you haven’t received the PHG before, of course).

That, and the Citizen Top-Up.

Like the first- and second-timer SC/SC couple buying a new flat, there’s just one grant available to you: the Enhanced CPF Housing Grant (Singles).

The main difference is that the subsidies will be credited to the SC spouse’s CPF Ordinary Account, even if the first-timer is the PR.

This scenario assumes that one person (the SC spouse) previously received a Singles Grant, but gets married later on.

The Half-Housing & Top-Up Grant is the equivalent of the Family Grant. It gives you $40,000 (2- to 4-room flat) or $30,000 (5-room flat or bigger) minus the Singles Grant the second-timer SC spouse already received.

Of course, the PHG also applies if you’re buying a flat near your parents/adult children, and you can apply for the Citizen Top-Up if you convert to Singaporean citizenship later on.

(Read also: What Kind of Property Can You Buy in Singapore?)

4. Citizen Marrying Foreigner

4. Citizen Marrying ForeignerUnder HDB’s newly-revised Non-Citizen Spouse Scheme, you may be eligible for three grants:

Best of all, CPF recently revised the age requirement for the EHG to 21 years old — meaning citizens who marry foreigners will now get more financial aid earlier on. (Previously, you had to wait until you were 35 years old to qualify for the EHG.)

The EHG (Singles) has an income ceiling of $4,500/mo for HALF the combined household income. That means if you earn $5,000 and your non-citizen spouse earns $3,500, your calculable income is $4,250.

| New Flat | Resale Flat | |

| EHG (Singles) | Up to $40,000, provided that half your average household income does not exceed $4,500/mo | Up to $40,000, provided that half your average household income does not exceed $4,500/mo.

The remaining flat lease must cover the youngest buyer until the age of 95. |

| Singles Grant | Not applicable |

|

| Proximity Housing Grant | Not applicable | Up to $15,000 provided you live with or near (within 4km) your parents |

5. PR Marrying PR

5. PR Marrying PRSadly, if there aren’t any Singapore citizens in your household, you can’t apply for a housing grant.

You can still buy a resale flat if both of you have been PRs for at least 3 years, but you’ll have to cover the entire cost on your own.

6. PR Marrying Foreigner

6. PR Marrying ForeignerUnfortunately, under Singapore housing laws, marrying a foreigner is the equivalent of being single when you apply for an HDB flat.

And there isn’t any HDB grant for a single PR.

There’s only one way around this. You can apply for a resale flat with parents, siblings, or children who are Singapore Citizens / PRs (Public Scheme). If you’re considering this, check out the section above on Applying with Siblings / One to Three Other Single Friends.

That, or convert to Singaporean citizenship 😉

Was this article helpful? Good things must share!

Joreen is the Sales Director at Bluenest and a seasoned property agent who's transacted over 600 properties since 2008. She specialises in residential properties and is adept at resolving complex queries for clients. Remarkably, Joreen was ranked top 20 in Singapore for the number of HDB properties transacted for the first half of 2019.

Comments are closed.

I bought a resales HDB using non-citizen spouse scheme (I am SC and my wife long term pass) being me as the owner and she as occupier 2 years ago and she have converted to SPR recently.

Do you know if we are considered as first and second timer or as second timer if we were to purchase another resales HDB together upon MOP of my current HDB>

Hello Joe! You would be considered a 2nd timer if you have utilized any housing grant(s) for your current flat. Hope that helps!

Hi,

Is there any other ways to purchase or secure a house if my gf (Foreigner) and I (SC) are not married yet?

Eg: Any scheme that allow us to get a house first and just have to make sure we get married before we collect keys etc.

Hi Mr Lim, you can actually purchase a HDB flat if your partner is a non-resident. However the choices of flats will be limited, you could only purchase 2-room Flexi flat in non-mature estates only. Do hope this helps!