The Singapore property market is in a state of flux, influenced by factors such as interest rates, increased housing supply, and property cooling measures. In this article, we will delve deeper into these factors to help buyers and sellers understand the market dynamics and make informed decisions.

Interest rates in Singapore have seen significant hikes in recent times and buyers need to be mentally prepared for any potential rise in interest rates. It is important to know that The U.S. Federal Reserve’s interest rate decisions have a significant impact on global interest rate trends, including Singapore’s.

In recent times, the U.S. Federal Reserve has been gradually increasing interest rates to manage economic growth and maintain stability. However, the pace of rate hikes has been slowing down since Feb 2023. From the Fed Reserve table below we can observe that during Sep-Nov 2022, the interest rate hike peaked at +0.75% compared to recent period Feb-Jun 2023 where the interest rate hike averaged to only +0.25%.

Image credit: tradingeconomics

The outlook for interest rates suggests that we may be approaching a potential plateau or inflection point, indicating a potential stabilization or slower pace of increase in the near future.

Buyers need to be cognizant of this shift in interest rates and understand that the current level may become the new norm for a while. It is crucial to evaluate the affordability of mortgage rates based on this expectation. Consulting with financial advisors and mortgage specialists will provide buyers with insights into the potential impact of interest rate increases on their financial planning.

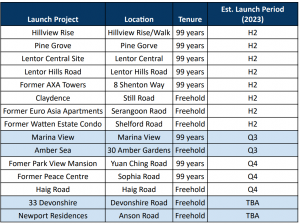

To meet the strong demand for private housing, the government of Singapore has decided to increase the supply of new private housing units. In the second half of 2023, there will be 5,160 units available, which is a significant increase compared to the previous year. In total, there will be about 9,250 units available in 2023, the highest level since 2013. Additionally, developers have the option to initiate the development of an extra 3,430 units if they see market demand.

This increase in supply is part of a larger plan to address housing needs. In total, around 63,500 private housing units (including Executive Condominiums) are expected to be available. Between 2023 and 2025, approximately 40,400 units will be completed, more than double the number completed in the previous years. This is part of a larger plan to complete about 100,000 public and private housing units between 2023 and 2025, ensuring there are enough homes for the population.

The abundance of housing options provides buyers with a broader range of choices. This increased supply empowers buyers to take their time, conduct thorough research, and make informed decisions. Buyers can explore various property types, locations, and price ranges, enabling them to find properties that align with their preferences and budget.

For sellers, the higher supply means heightened competition. To attract buyers in this dynamic market, sellers should set realistic prices that align with current market conditions and property valuations. Collaborating with experienced real estate agents who possess in-depth market knowledge and pricing strategies is crucial for sellers to achieve successful transactions.

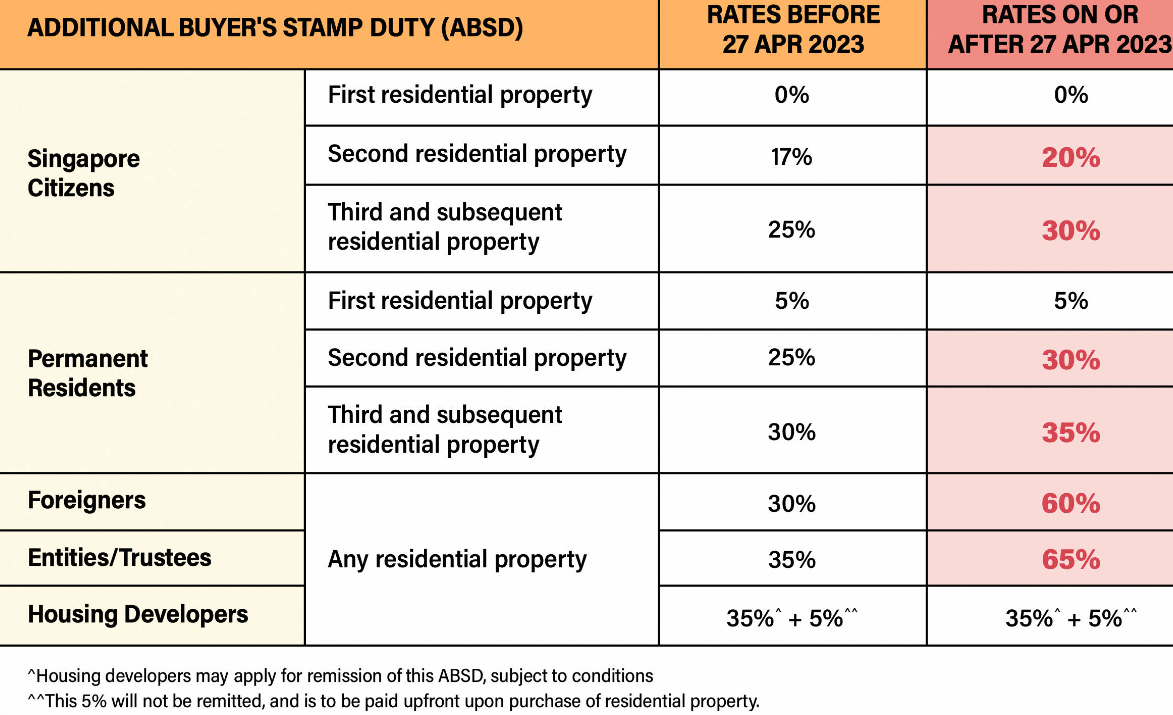

On April 27th, 2023, the Singaporean government announced of the raise in the Additional Buyer’s Stamp Duty (ABSD) rates for certain types of property transactions. That was the third round of cooling measures since December 2021. The aim of this move is to promote a sustainable property market and prioritize housing for owner-occupation, while managing investment demand.

Image credit: MND Singapore. Read more about the increase in ABSD here

Image credit: MND Singapore. Read more about the increase in ABSD here

Coupled with the 15-month wait-out period for individuals downgrading from private properties, industry experts have expressed agreement that these cooling measures have been somewhat effective in curbing the rapid rise in property prices and values.

These cooling measures have been calibrated to moderate housing demand while prioritizing owner-occupation. Property seekers who are looking to buy for their own stay or HDB buyers will not be affected by these measures and will be provided with options for new flats. The government will continue to adjust its policies as necessary to ensure they remain relevant and promote a sustainable property market.

Navigating the Singapore property market requires a comprehensive understanding of the prevailing conditions and factors at play. Buyers should be mentally prepared for potential interest rate increases, factoring them into long-term affordability calculations. The increased housing supply offers buyers more choices but also intensifies competition among sellers, necessitating realistic pricing strategies.

Property cooling measures remain an integral part of the Singapore property market. Buyers and sellers should stay informed about the latest measures, such as ABSD, LTV limits, SSD, and TDSR, and consider their impact on transactions and market dynamics.

By staying informed, conducting thorough research, and seeking professional advice, buyers and sellers can make confident decisions in the ever-evolving Singapore property market. Remember that real estate transactions are long-term investments, and careful consideration!

Jeff, the co-founder and CEO of Bluenest Pte Ltd. With his real estate career spanning from 2011, he has acquired deep knowledge and understanding of the Singapore Real Estate industry. In addition to his involvement in real estate, Jeff is a venture builder with a keen interest in tech startups, showcasing his passion for innovation.