This year, 58 BTO’s will be delayed by at least 6 months. That’s on top of the 3-5 years buyers have already waited for their new homes to be ready, not to mention time for renovations.

This puts many young couples in a bind. Do they still register for a BTO and wait anywhere from 5-6 years, or should they opt for a resale flat and pay the additional Cash Over Valuation (COV)?

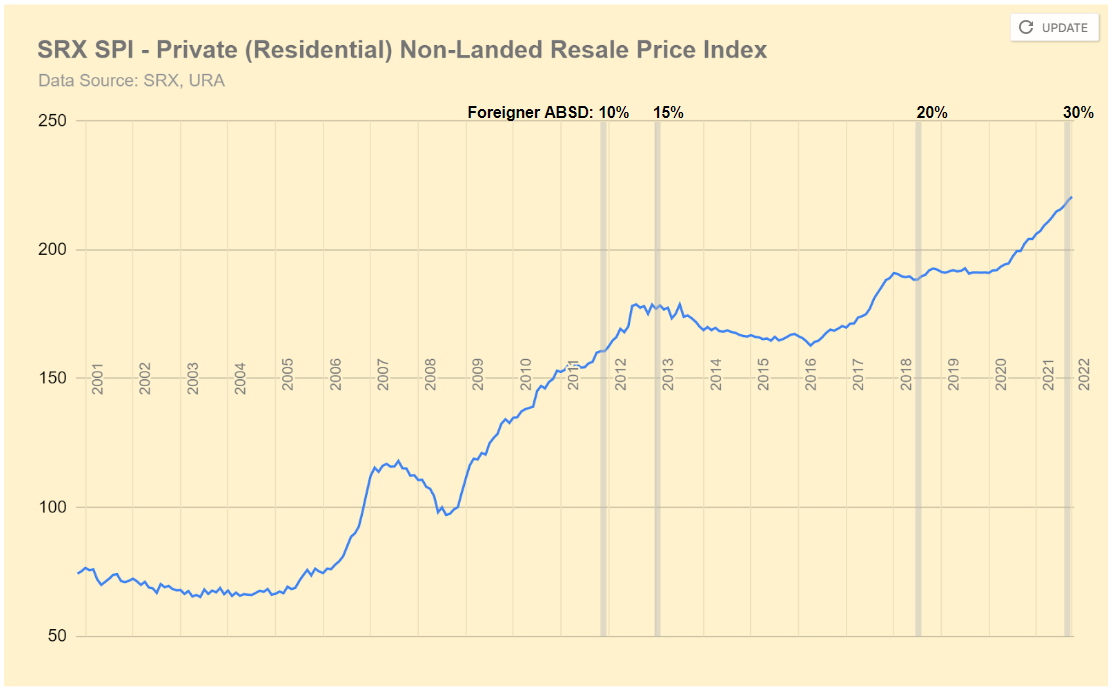

Many, it seems, are opting to buy resale. And with resale prices hitting new records for the first half of 2022, we’ve compiled a list of more affordable resale flats that have just completed their Minimum Occupancy Period (MOP) of 5 years.

Read also: Singapore Property Market Outlook 2022: 6 Trends to Watch

You can move in almost immediately, yet still enjoy a relatively new flat with modern fittings. Here’s our list:

- Woodlands Pasture I & II

- Boon Lay View

- Spring Haven @ Jurong

- Keat Hong Crest

- Fern Grove @ Yishun

- Saraca Breeze

- Angsana Breeze

- EastWave @ Canberra

- Matilda Edge

- The Verandah

- Waterway Brooks

- Anchorvale Parkview

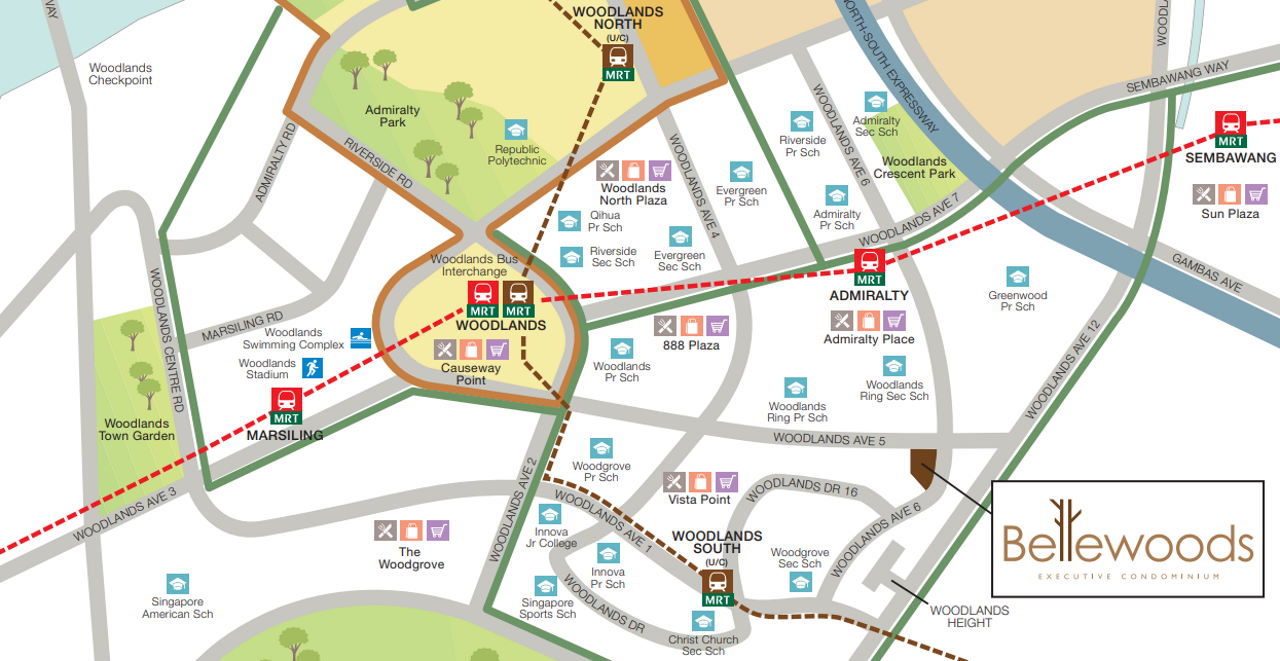

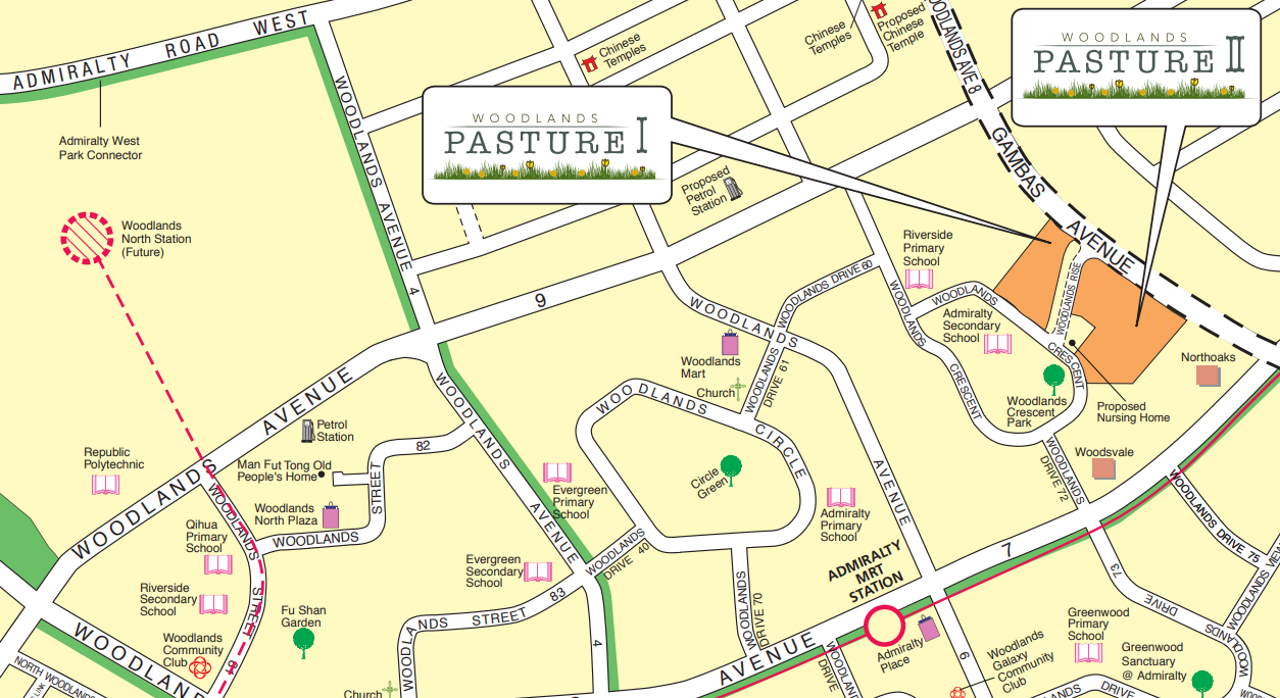

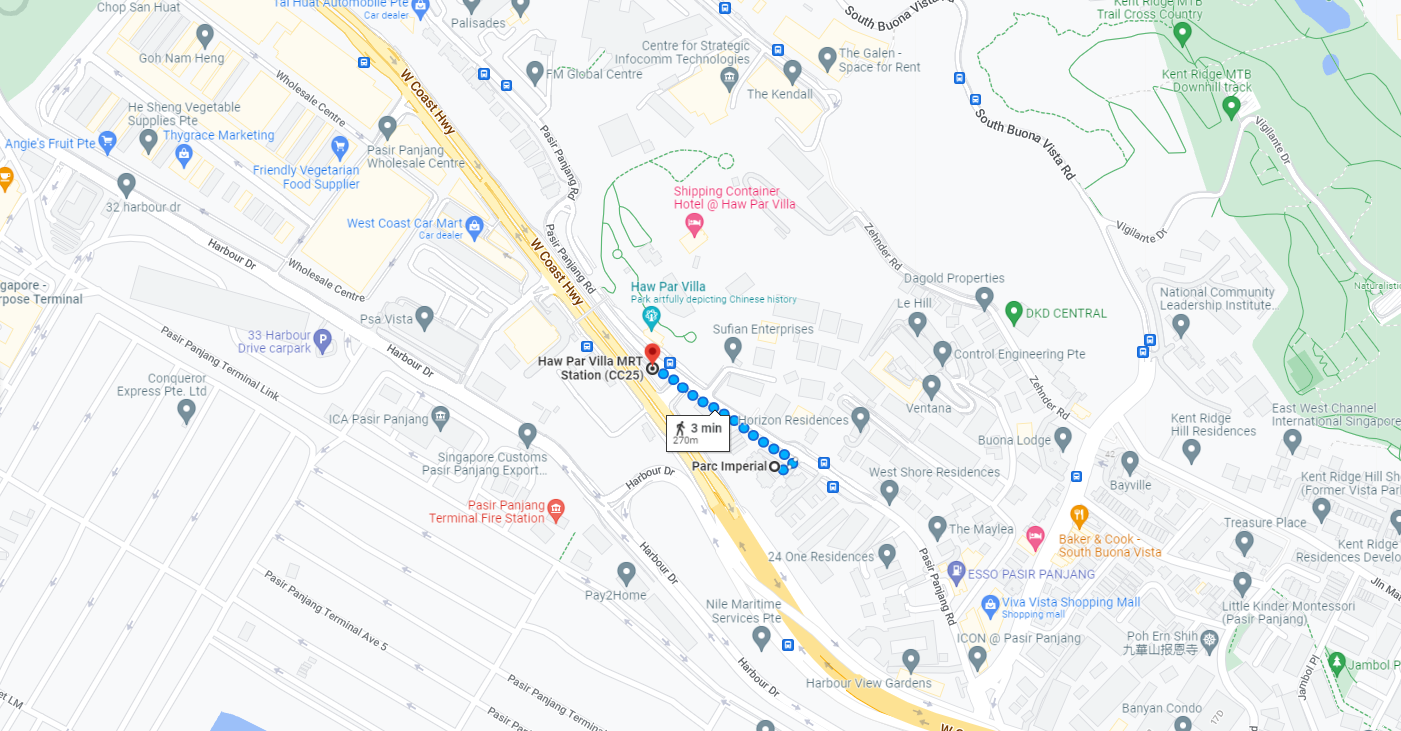

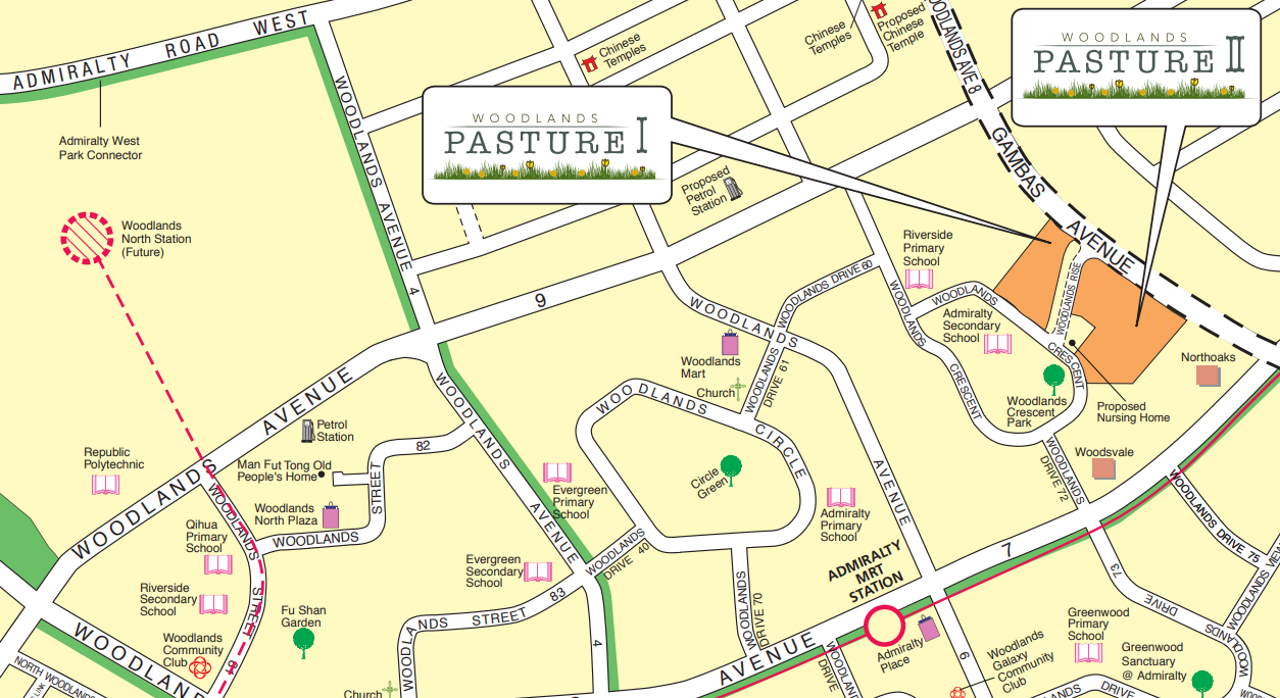

1. Woodlands Pasture I & II (Woodlands)

We begin our list with a double feature: two newly-constructed developments across the street from each other. At the time of writing we found 4 listings of 4-room flats for sale, priced around S$550,000.

Location & Accessibility

Pasture I & II are within 1km of Riverside, Greenwood, Evergreen, and Admiralty Primary Schools.

Woodlands Pasture I is right next to Admiralty Secondary School, so depending on your facing there may be the occasional tolling of assembly bells and other noises from students coming out of classes.

On the other hand, Woodlands Pasture II is closer to Gambas Ave, so there may be concerns of traffic noises.

If available, you may opt for a unit that faces the quieter Woodlands Rise or Woodlands Crescent Park.

The HDB estate is a 12 to 14-min walk (1-1.2km) from Admiralty MRT (NS10).

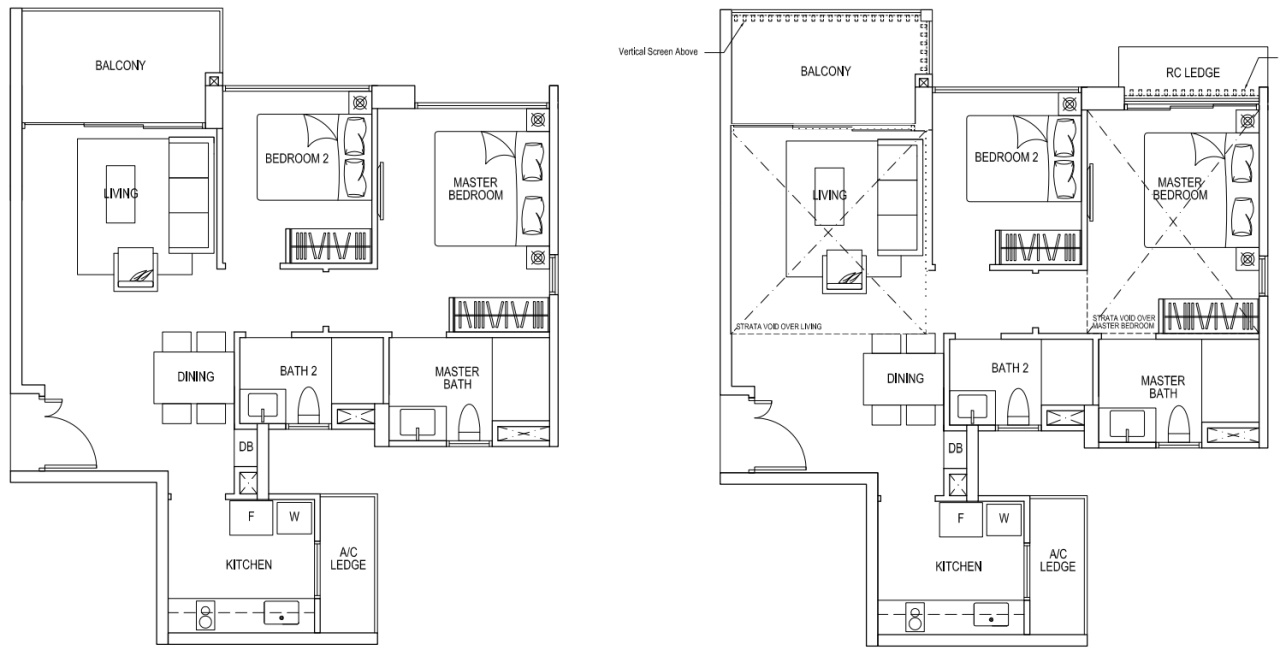

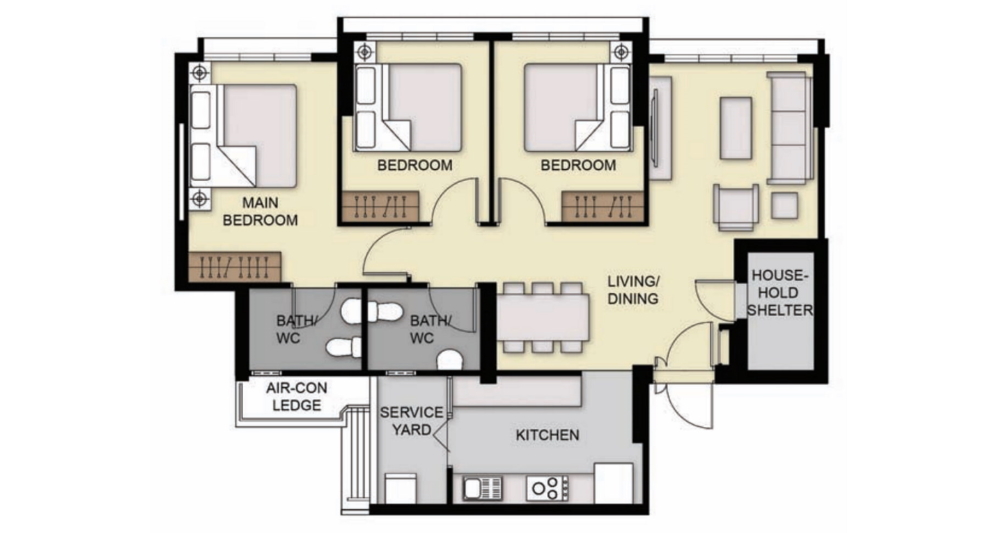

Size & Layout

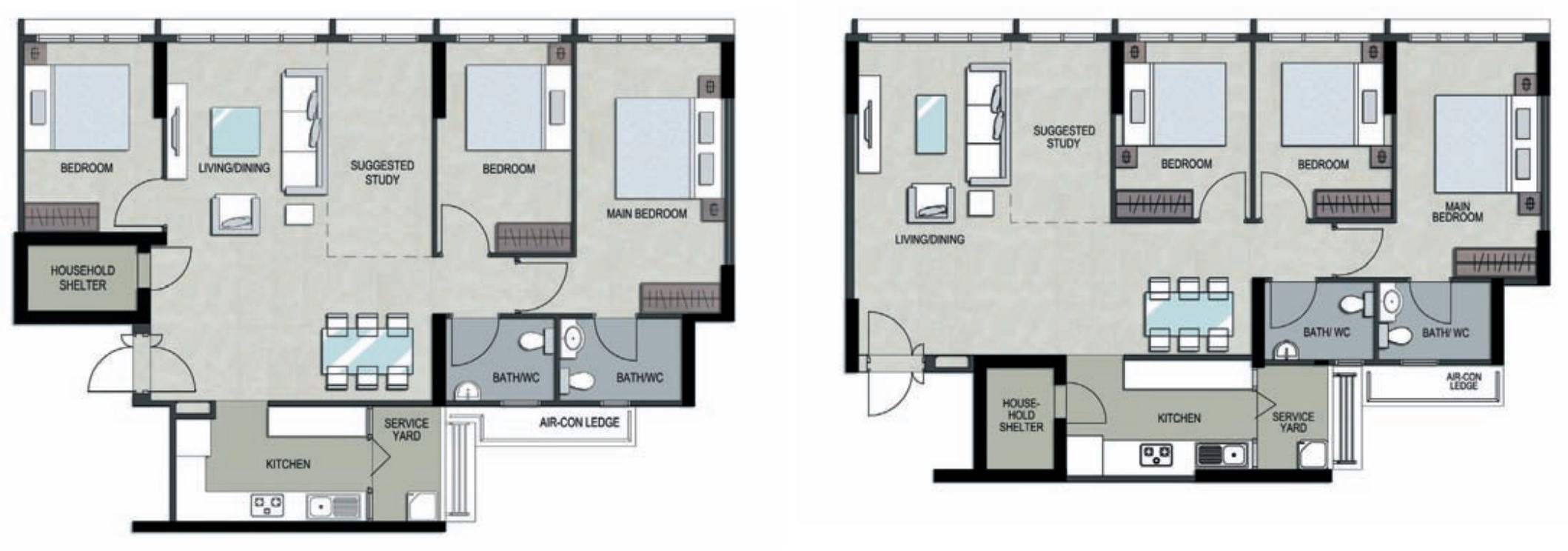

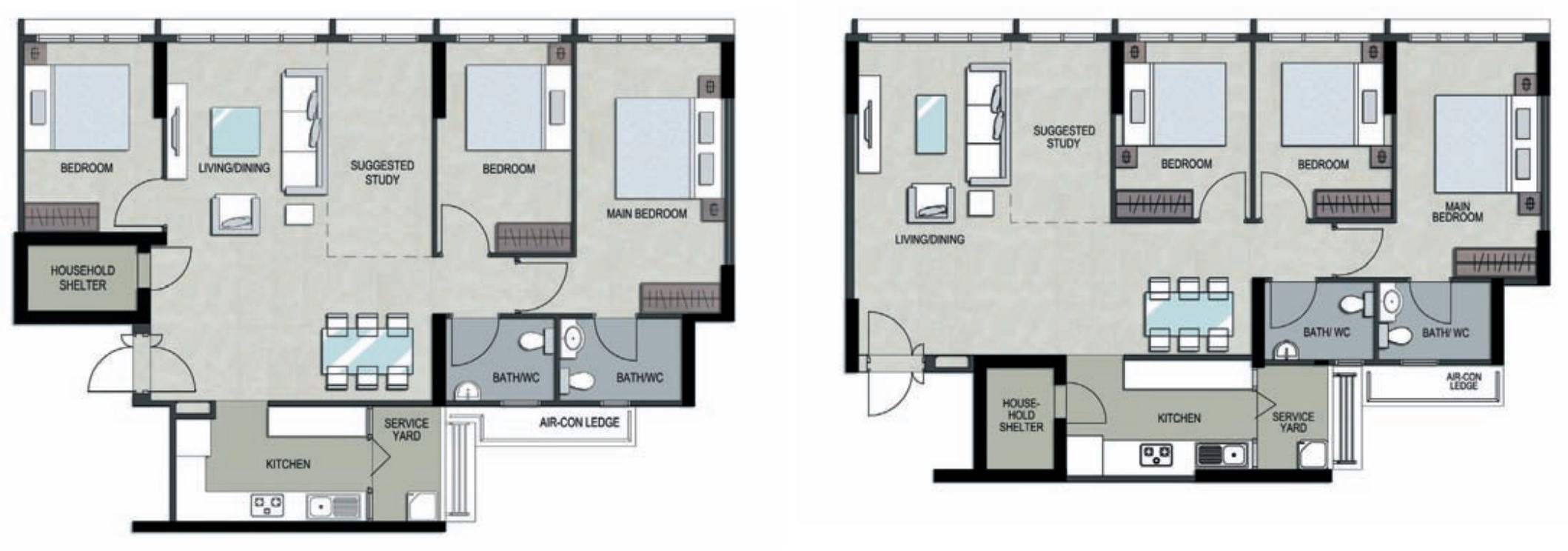

The 4-room flat configurations here are 1,001 sqft. As with many of the new generation of 4-room flats, the layouts are very functional with rectangular rooms and reduced dead space. The units also come with a service yard that’s accessible from the kitchen.

In Woodlands Pasture I & II, the household shelter is located just next to the main entrance. This creates a smaller living area – we much prefer layouts where the HHS is next to the kitchen, as it can easily be repurposed into a dry goods pantry.

The living areas here have 3/4-height windows, while the bedrooms have half-height windows. If natural light is a concern, this may be something to watch out for as you arrange your viewings.

Most of the developments in Pasture I and II are either South-West or North-East facing.

Amenities

Just across from Woodlands Pasture I is Woodlands Crescent Park, where you’ll find a big playground, basketball court, football field, and various other family-friendly amenities. There are also supermarkets, eateries, and other retail stores along Gambas Ave to the east.

Pricing

In the last 6 months, 4-room units in this HDB estate have transacted for 490 – 531k.

Units in this estate currently list for $493 – 575 psf. In comparison, units in the surrounding neighbourhood have transacted for an average of $414 – 515 psf in the last 6 months.

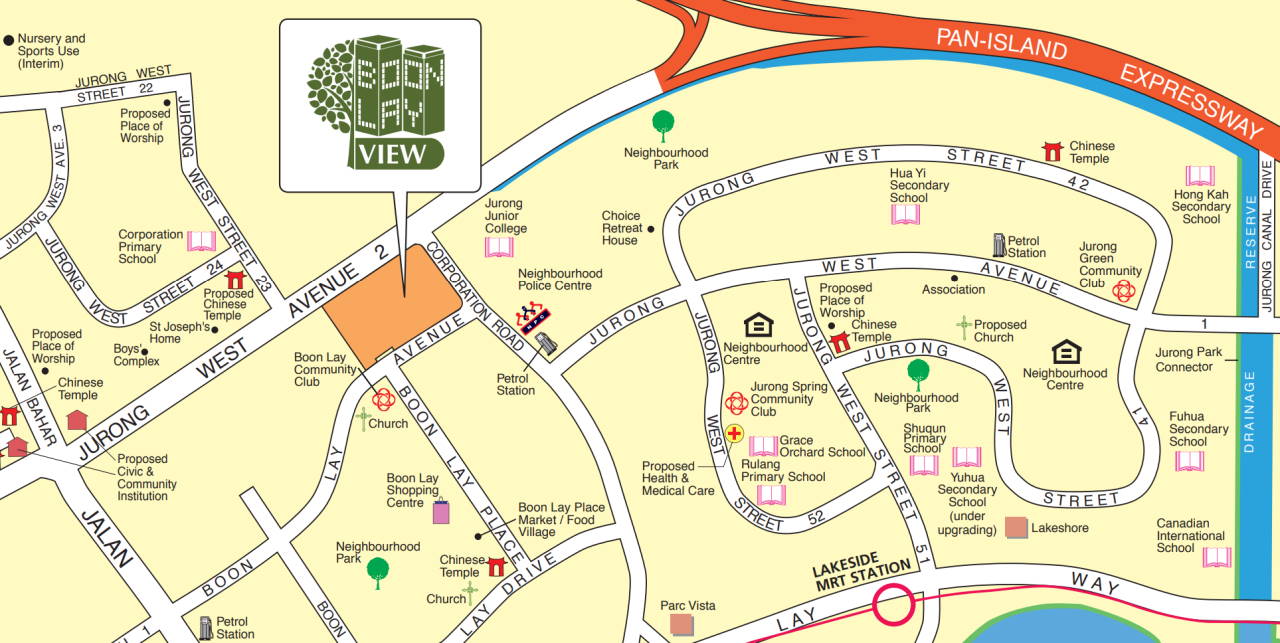

2. Boon Lay View (Jurong West)

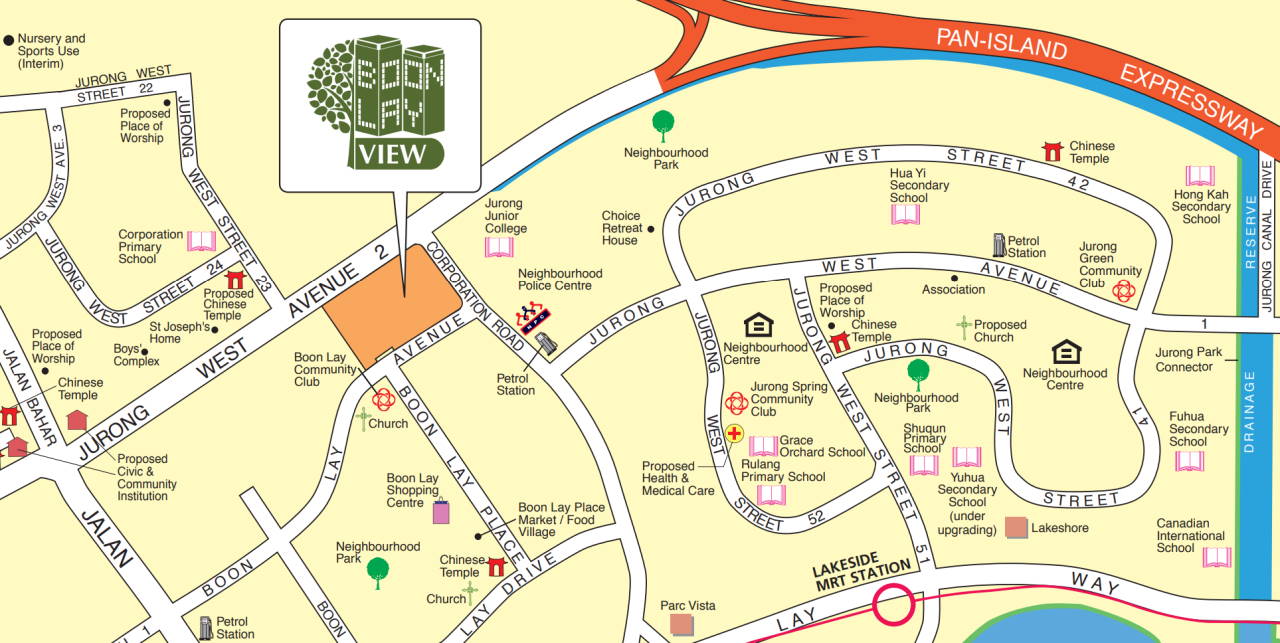

Location & Accessibility

Boon Lay View is a little community of its own, with its HDB blocks marking the border and enclosing the playground, Residents’ Corner, and other amenities within. The North-West facing blocks may get quite a bit of traffic noise from Jurong West Ave 2, so we’d recommend a South-East or South-West facing if available.

The major malls are a little farther. Jurong Point is a 15-min bus ride, but there’s the smaller Boon Lay Shopping Centre just three blocks away for all your day-to-day needs.

EW26 Lakeside MRT is a 1.9km walk from Boon Lay View, but there are 3 regular buses that will take you to the MRT within 5 to 7-min.

Corporation Primary School is also within walking distance.

Size & Layout

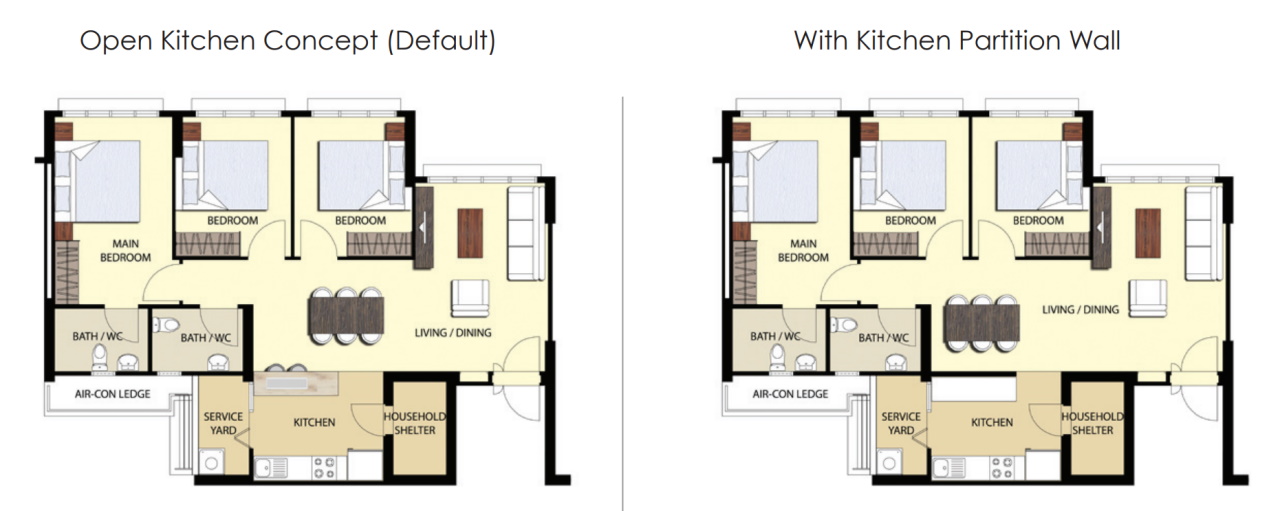

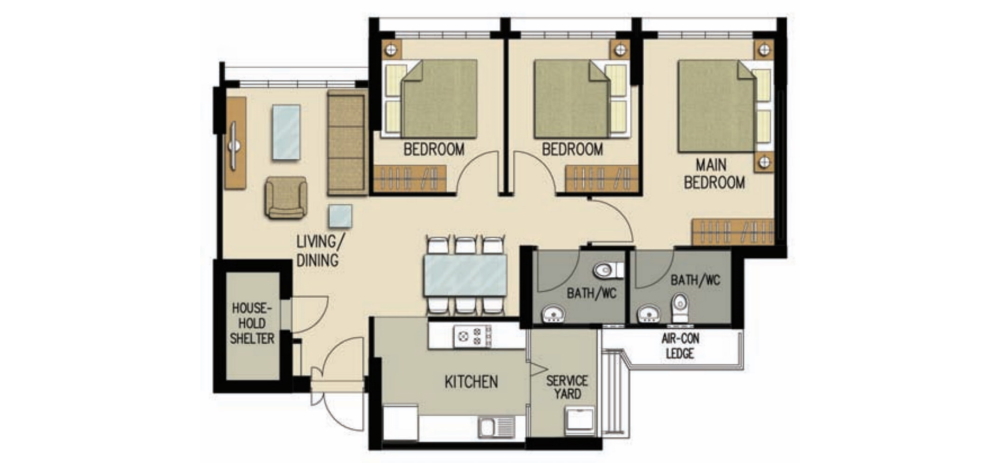

Boon Lay View also comes in both 4-room and 5-room configurations, approximately 1,012 and 1,227 sqft respectively.

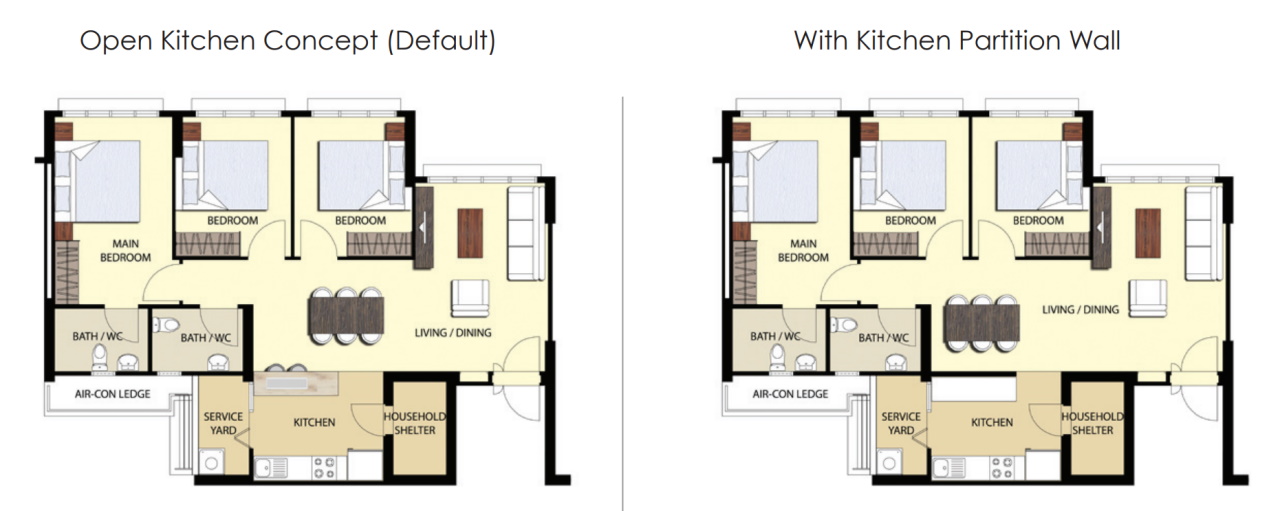

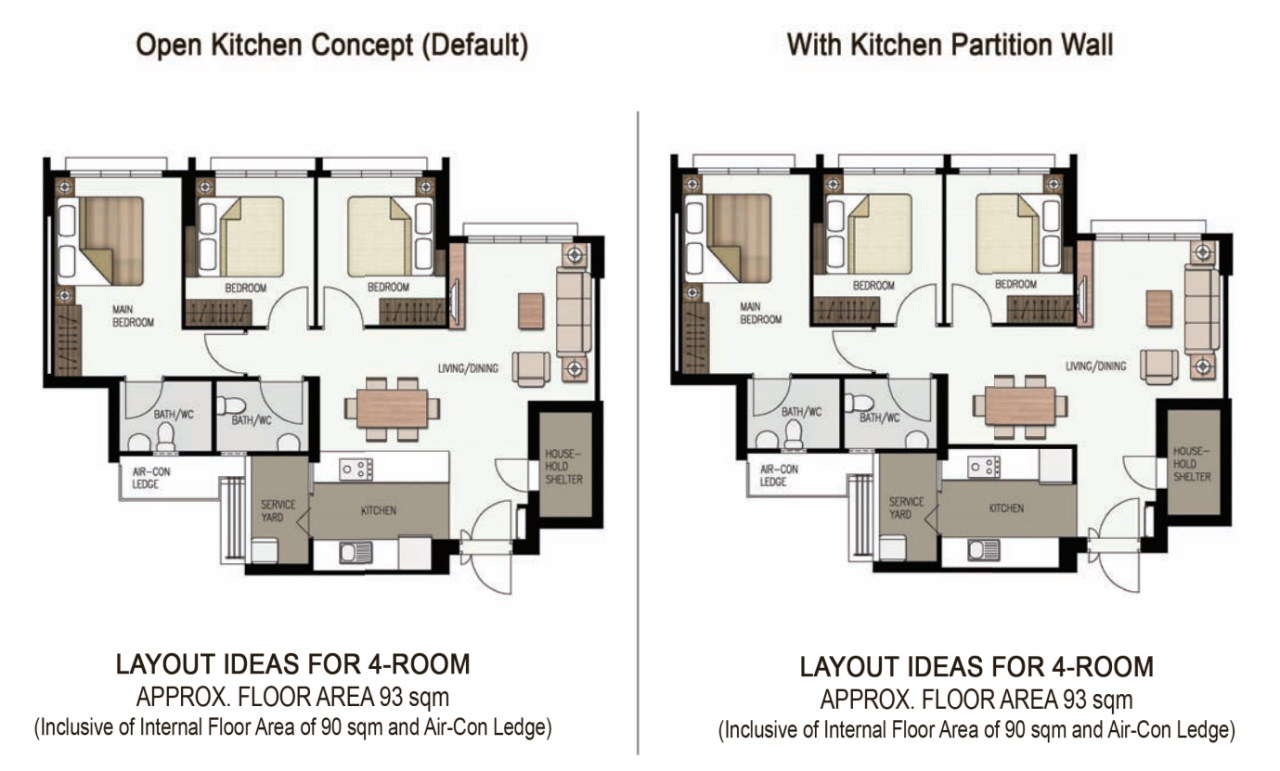

With the 4-room layout, each bedroom has good natural light. However, note that the kitchen will only have natural light from the service yard. For this reason, we highly recommend looking for units with an open kitchen concept. If you do heavy cooking, you still have the option of using glass or clear acrylic panels to close off the kitchen while still allowing more natural light into the dining area.

Amenities

You won’t lack for food or recreational activities here: if you decide to leave the relative comforts of the HDB community, there are three parks along with two wet markets and hawker centres, all within walking distance.

Pricing

In the last 6 months, 4-room units in this HDB estate have transacted for 515 – 556k.

Units in this estate currently list for $544 – 653 psf. In comparison, units in the surrounding neighbourhood have transacted for an average of $486 – 550 psf in the last 6 months.

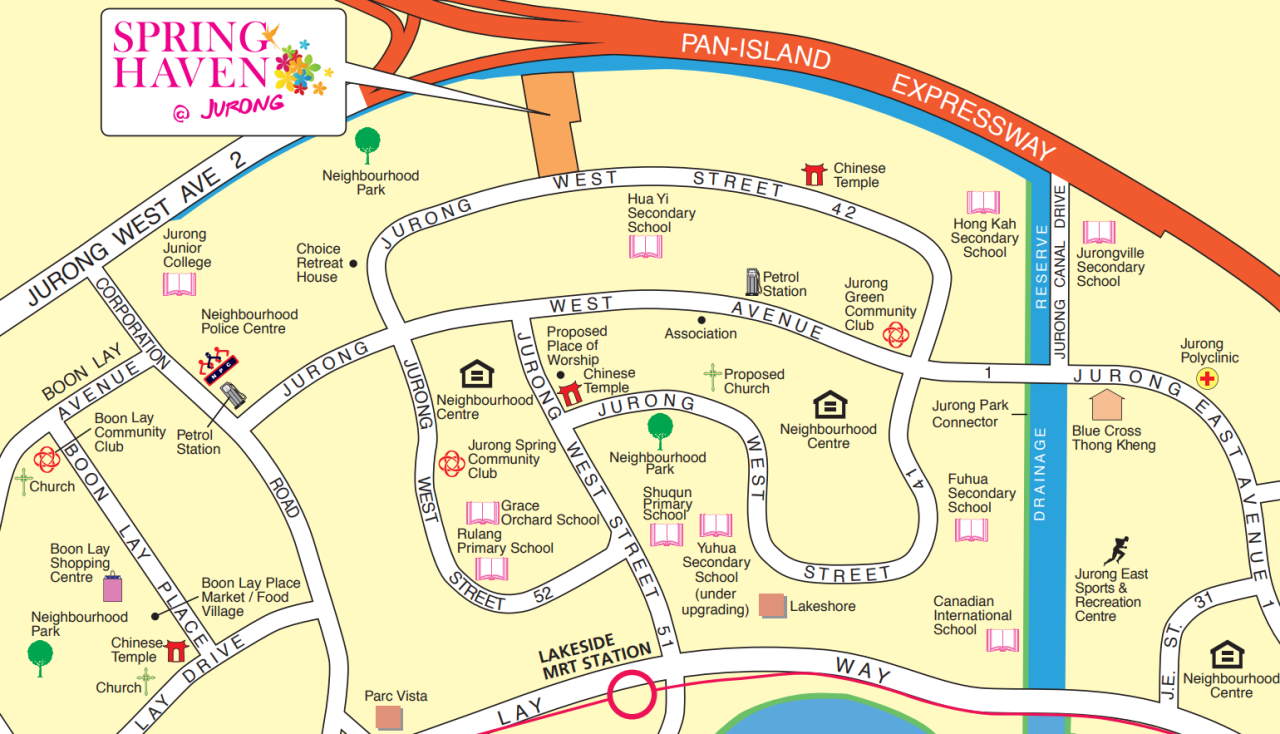

3. Spring Haven @ Jurong (Jurong West)

Location & Accessibility

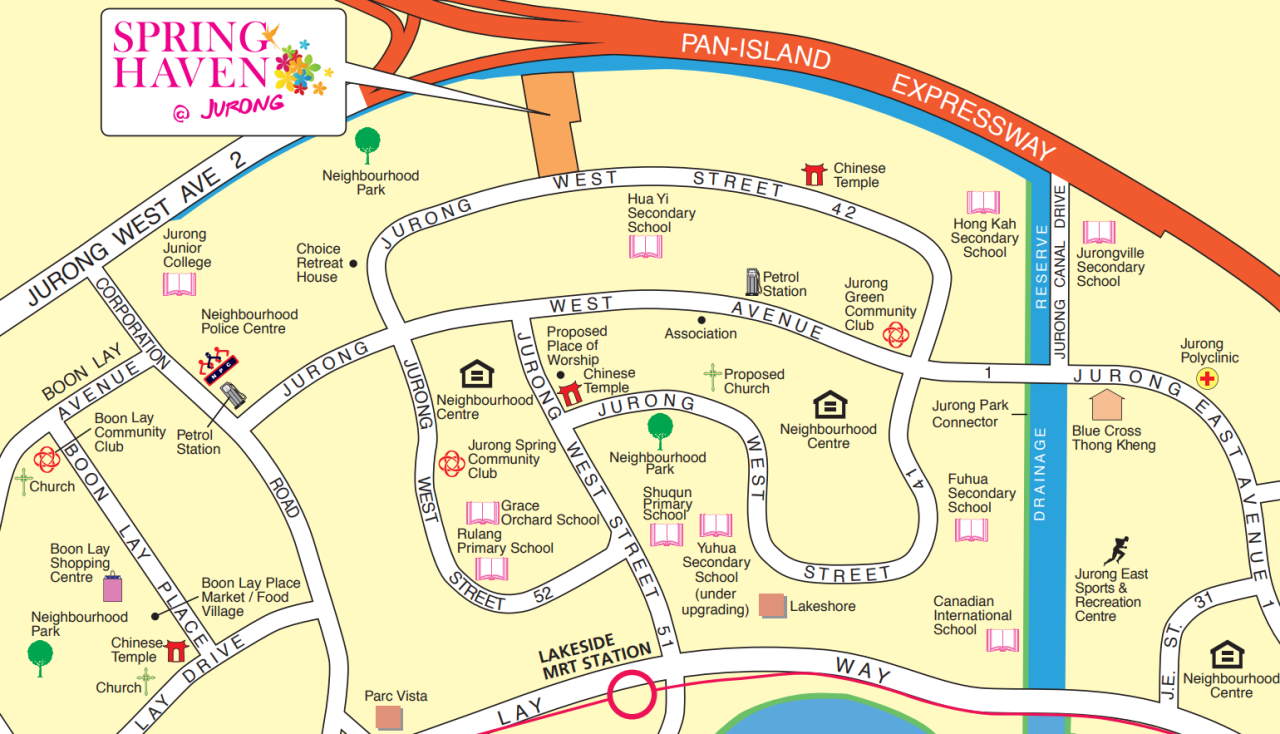

Roughly 1.5km northeast of Boon Lay View is Spring Haven, one of the smaller BTOs on this list. What’s nice about this estate is that it’s in between two older HDB estates, so you see a contrast between its new design and the more “traditional” HDB designs.

The PIE is adjacent to the North-facing units, with the new Tengah HDB town on the other side of the expressway. Homebuyers may want to look for South-facing units for a quieter residence.

It’s a 1.4km walk away from EW26 Lakeside MRT, but there are 3 buses that will make the trip in around 10 to 15 minutes.

Both Rulang and Shuqun Primary Schools are within 1km of Spring Haven.

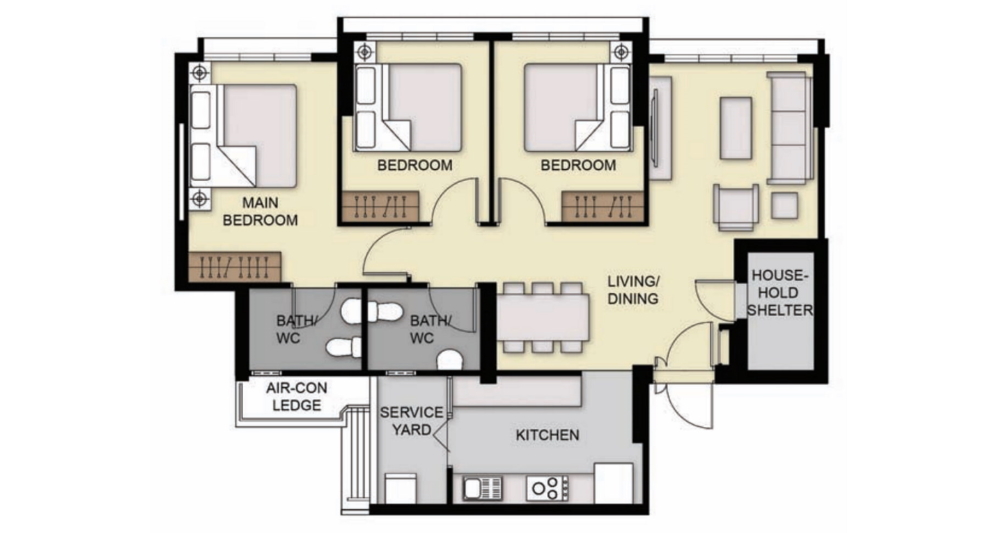

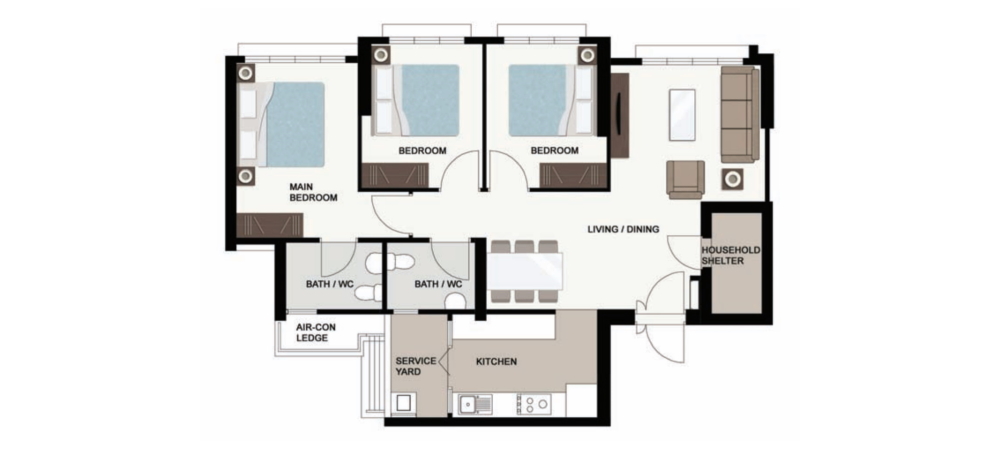

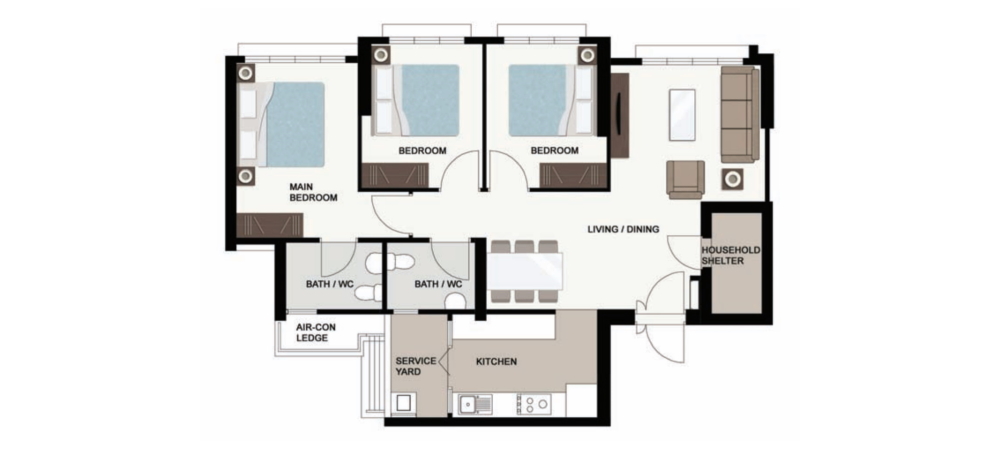

Size & Layout

The 4-room flats are sized at 990 sqft and have a very functional rectangular layout. The units here have 3/4-height windows in every room, so there’s a good amount of natural light streaming in.

Amenities

The Jurong West 505 Market and Food Centre is a 10-min walk (700m) and houses various eateries, retail outlets, and the Jurong Spring Community Club. You have access to the more established coffeeshops in the neighbouring HDB estates as well.

Pricing

In the last 6 months, 4-room units in this HDB estate have transacted for 487 – 595k.

Units in this estate currently list for $525 – 587 psf. In comparison, units in the surrounding neighbourhood have transacted for an average of $345 – 594 psf in the last 6 months.

4. Keat Hong Crest (Choa Chu Kang)

Location & Accessibility

On the other side of the new Tengah HDB town you’ll find Keat Hong Crest: a quiet and calm living area that contrasts with the hustle and bustle of industrial Jurong. The HDB estate is 1.1km away from Keat Hong LRT (BP3), 1.2km away from South View LRT (BP2), and 1.8km away from Choa Chu Kang MRT (NS4), which would take 15 to 20 minutes by bus depending on the time of day.

Chua Chu Kang, Concord, and South View Primary School are all within 1km.

Size & Layout

The 5-room flats for this estate are sized around 1,237 sqft, and the 4-room flats are around 990 sqft.

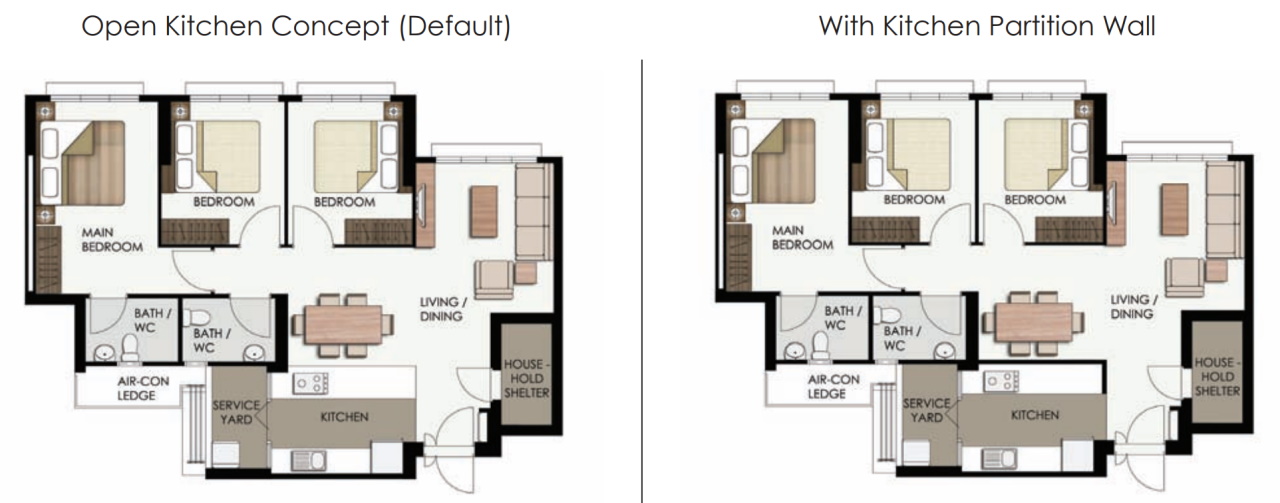

Of the new generation flats, we were pleasantly surprised to see that Keat Hong Crest has great layout options, especially in the positioning of the household shelter. Here there are two choices: either the HHS is out of the way and next to one of the bedrooms, or it’s next to the kitchen and can be used as a pantry.

Both these choices keep the living and dining space completely rectangular and free from dead space. This excellent layout is true for both the 5-room and 4-room units.

Amenities

Keat Hong Shopping Centre is nearby with many retail stores, eateries, and specialty stores. Sunshine Place Shopping Mall is also within 800m.

About a 10 to 12-min walk away is Keat Hong Garden, where you’ll find a tank (of all things), a fitness corner, and many play areas for children.

Pricing

In the last 6 months, 4-room and 5-room units in this HDB estate have transacted for 468 – 530k, and 558 – 590k respectively.

Units in this estate currently list for $484 – 583 psf. In comparison, units in the surrounding neighbourhood have transacted for an average of $404 – 565 psf in the last 6 months.

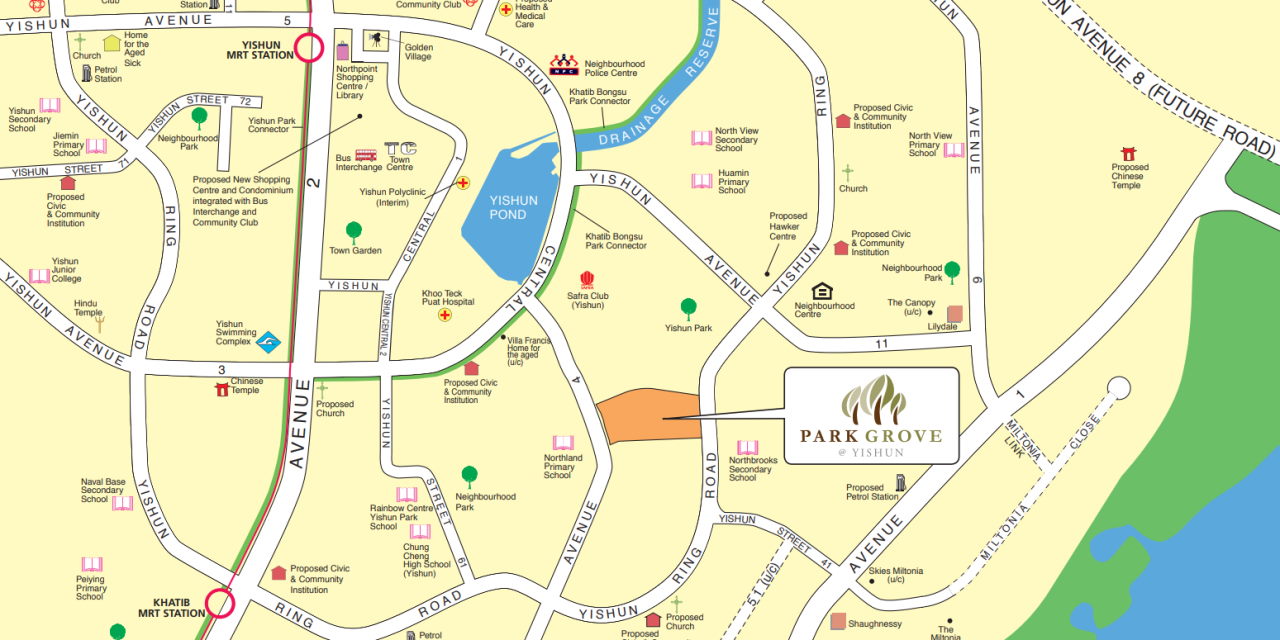

5. Fern Grove @ Yishun (Yishun)

Location & Accessibility

Fern Grove @ Yishun is actually located a bit closer to Khatib MRT (NS14) than Yishun MRT (NS13), which are 1.3km and 1.8km away respectively. It’s about a 12-min bus ride to Khatib MRT, with at least 3 bus services that regularly travel that route.

Huamin, Northview, Naval Base, and Northland Primary Schools are all within 1km.

Size & Layout

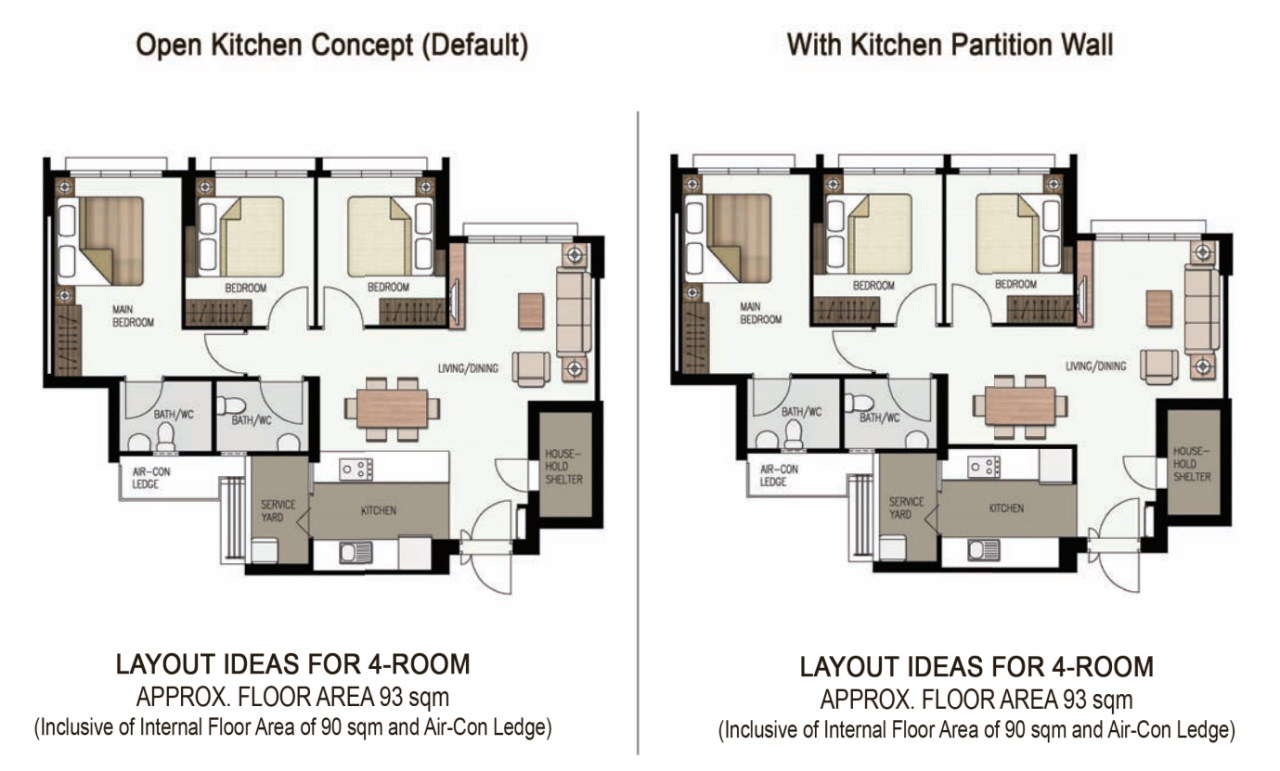

One of the features unique to the new generation of 4-room HDB flats is that the layout is conducive for open-concept kitchens. This feature is quite popular among young couples who don’t do heavy cooking and prefer a more interactive and spacious feeling to their kitchen and dining areas. Look out for listings that take advantage of the open kitchen concept.

Amenities

Just a 3-min walk (250m) will get you to Wisteria Mall, which has a plethora of amenities including a supermarket, gym, cafes, fast food restaurants, and other retail outlets.

If you love the outdoors, you’ll be glad to know that Yishun Park and Rockridge Park are to the north and south respectively. SAFRA Yishun is also at the Yishun Park site, so you’ll have no lack of recreational activities here.

Pricing

In the last 6 months, 4-room units in this HDB estate have transacted for 538 – 540k.

Units in this estate currently list for $556 – 589 psf. In comparison, units in the surrounding neighbourhood have transacted for an average of $436 – 589 psf in the last 6 months.

6. Saraca Breeze (Yishun)

Location & Accessibility

Sandwiched between Rockridge Park and Orchid Country Club Golf Range, Saraca Breeze probably has the best greenery view on our list. The trade-off is that it’s a good 20-min walk (1.5km) to Khatib MRT (NS14), but a 15-min bus ride will get you there as well.

Naval Base and Northland Primary School are both within 1 km.

Size & Layout

Amenities

Wisteria Mall is only an 8-min walk (650m), most of which is very pleasant as you can cut through Rockridge Park @ Yishun. A little farther and you’ll reach SAFRA Yishun and Yishun Park as well.

Pricing

In the last 6 months, 4-room units in this HDB estate have transacted for 478 – 540k.

Units in this estate currently list for $549 – 617 psf. In comparison, units in the surrounding neighbourhood have transacted for an average of $445 – 554 psf in the last 6 months.

7. Angsana Breeze (Yishun)

Location & Accessibility

Fair warning: residents refer to this place as “ulu but breezy,” which gives you a rough idea of what to expect. Still, at least it’s closer to Khatib MRT (NS14) with just a 10-min bus ride compared to Saraca Breeze’s 15 minutes.

The place has improved a bit since the BTO launched – you’ll find food courts, dental clinics, kindergartens, and childcare centres all nearby. Wisteria Mall is also about a 6-min walk away, so your day-to-day needs should be easily settled.

Schools within 1km include Naval Base and Northland Primary School.

Size & Layout

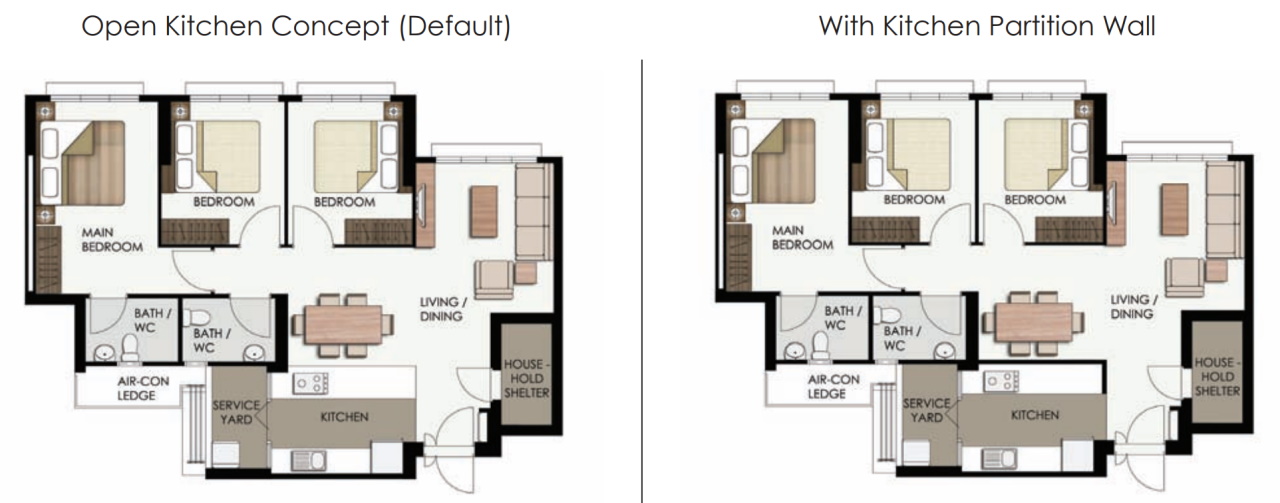

The 4-room flats here have the household shelter in the living/dining area, which can serve as a shoe or cleaning supply closet as needed. We’ve also seen some owners hack away the partition wall connecting the living and common bedroom to create a home office.

If you can, try to get a unit that faces Orchid Country Club for good views of the greenery and water – but expect to pay a premium for this.

Amenities

Rockridge Park is a 5-min walk away. The only other notable mention here is that SAFRA Yishun is just 1.2km away, so it might be worthwhile renewing your membership for your fitness and recreational needs.

Pricing

In the last 6 months, 4-room units in this HDB estate have transacted for 473 – 568k.

Units in this estate currently list for $533 – 588 psf. In comparison, units in the surrounding neighbourhood have transacted for an average of $445 – 554 psf in the last 6 months.

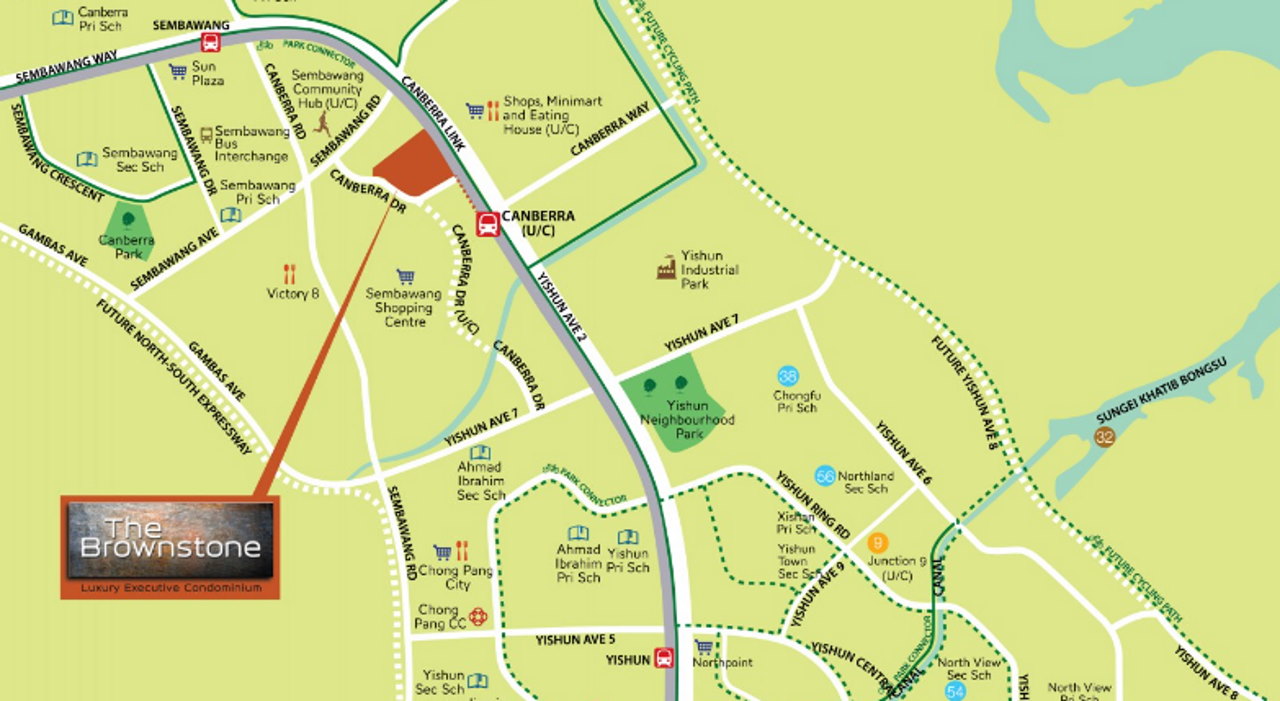

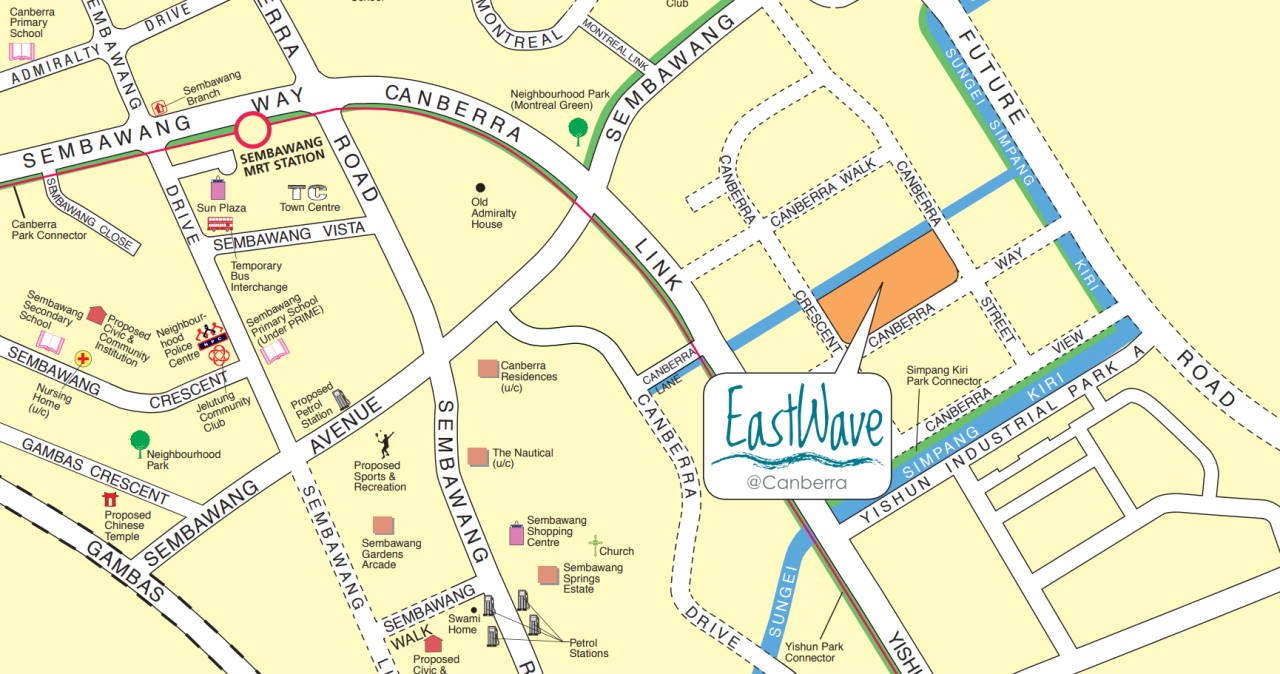

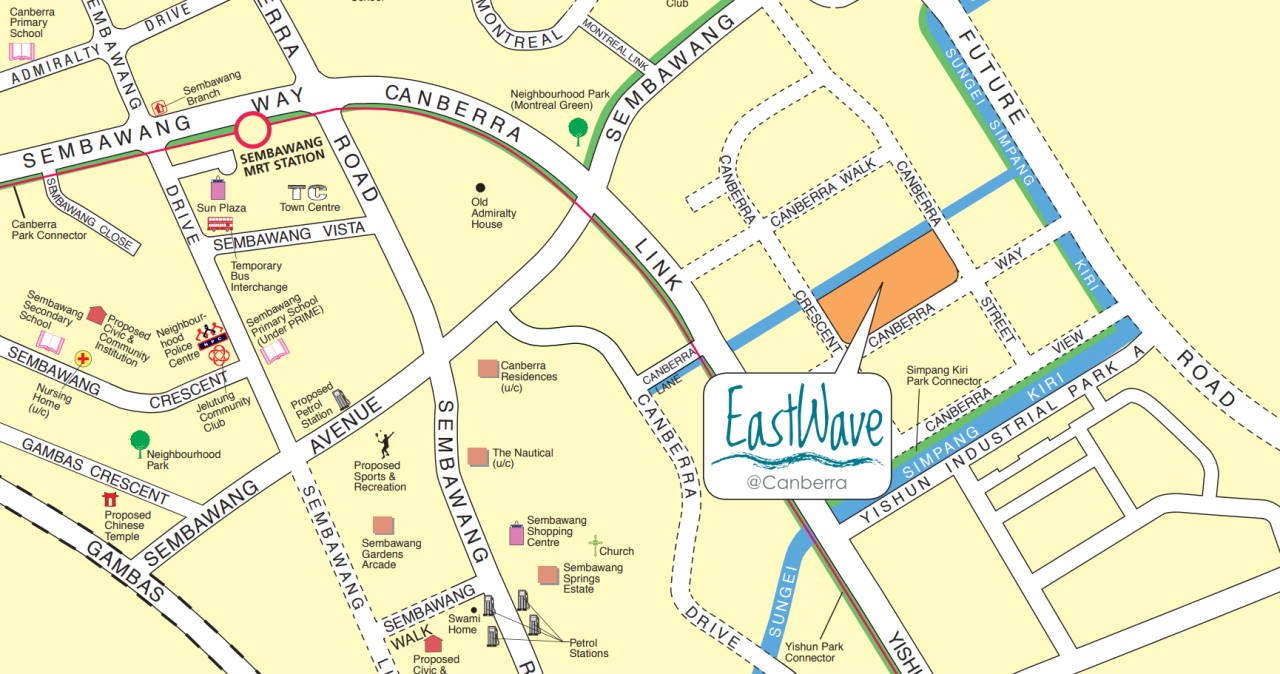

8. EastWave @ Canberra (Sembawang)

Location & Accessibility

About a 10-min walk away from the newly-opened Canberra MRT is EastWave @ Canberra. This is a peaceful, quiet area to live in – there aren’t many amenities around here, but that’s slowly changing.

The estate is a short bus ride away from Sun Plaza at Sembawang MRT Station, where you’ll find a range of shops, eateries, supermarkets, and a public library.

Schools within 1km of EastWave @ Canberra include Punggol Green, Valour, Springdale, and Compassvale Primary School.

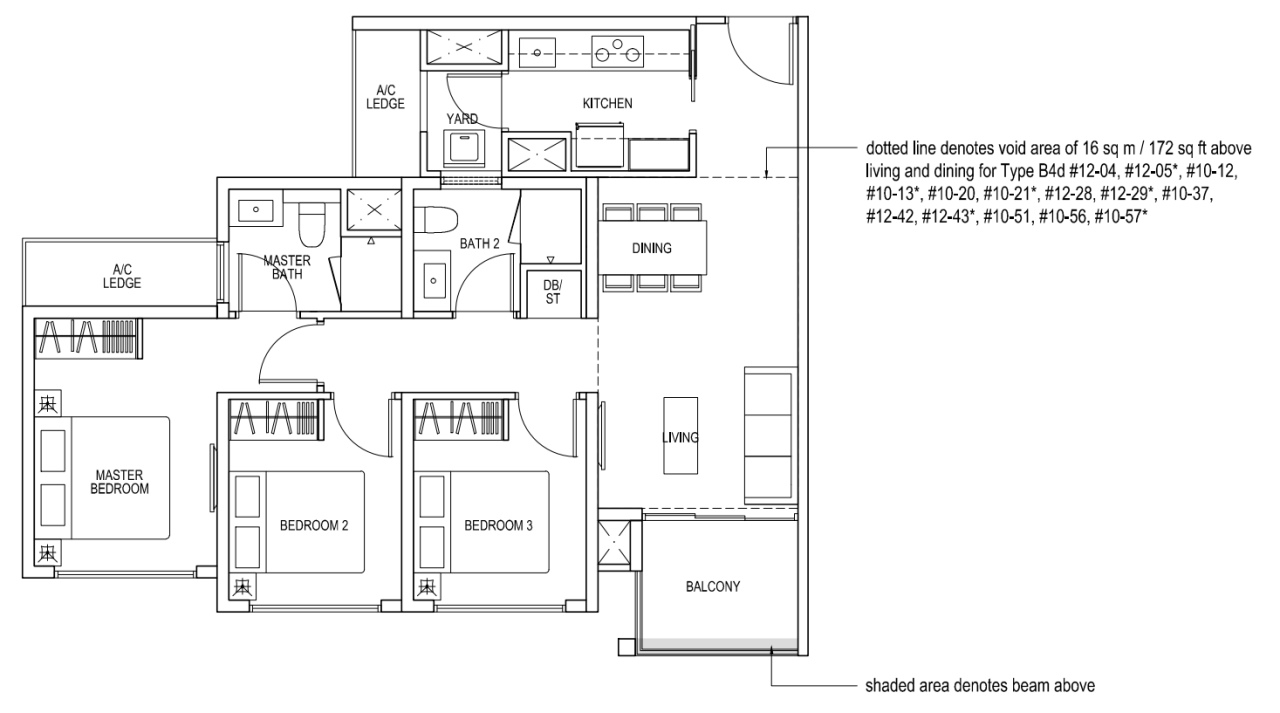

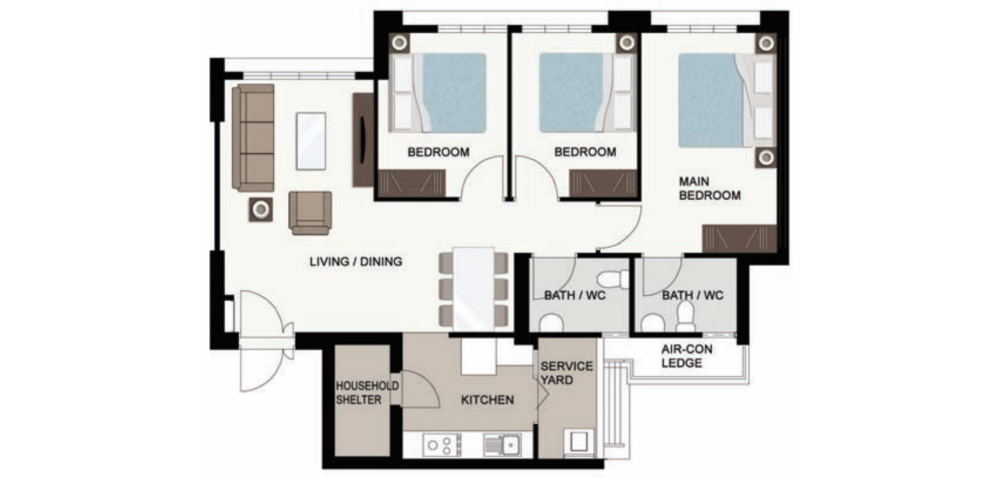

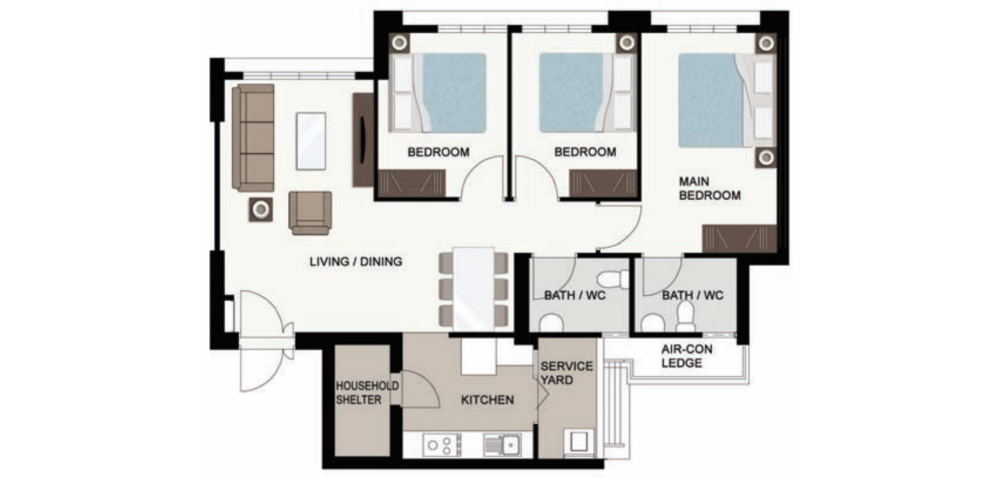

Size & Layout

There are two prominent 4- and 5-room flat layouts here: some units position the household shelter in the living/dining area, while others have the HHS in the kitchen. The layout you choose will depend on what you’d use it for.

Note that kitchens here are smaller, so this may not be a great choice if you and your partner cook a lot. Otherwise, we like that there’s minimal dead space and a larger living/dining area with these layouts.

Amenities

Since it’s a newly-built estate, there aren’t as many amenities (or shops, for that matter) in the area. The good news is that EastWave @ Canberra gives you direct access to the Canberra Park Connector and the PCN, which takes you all the way to the beach.

Pricing

In the last 6 months, 4-room units in this HDB estate have transacted for 510 – 580k.

Units in this estate currently list for $583 – 627 psf. In comparison, units in the surrounding neighbourhood have transacted for an average of $599 – 624 psf in the last 6 months.

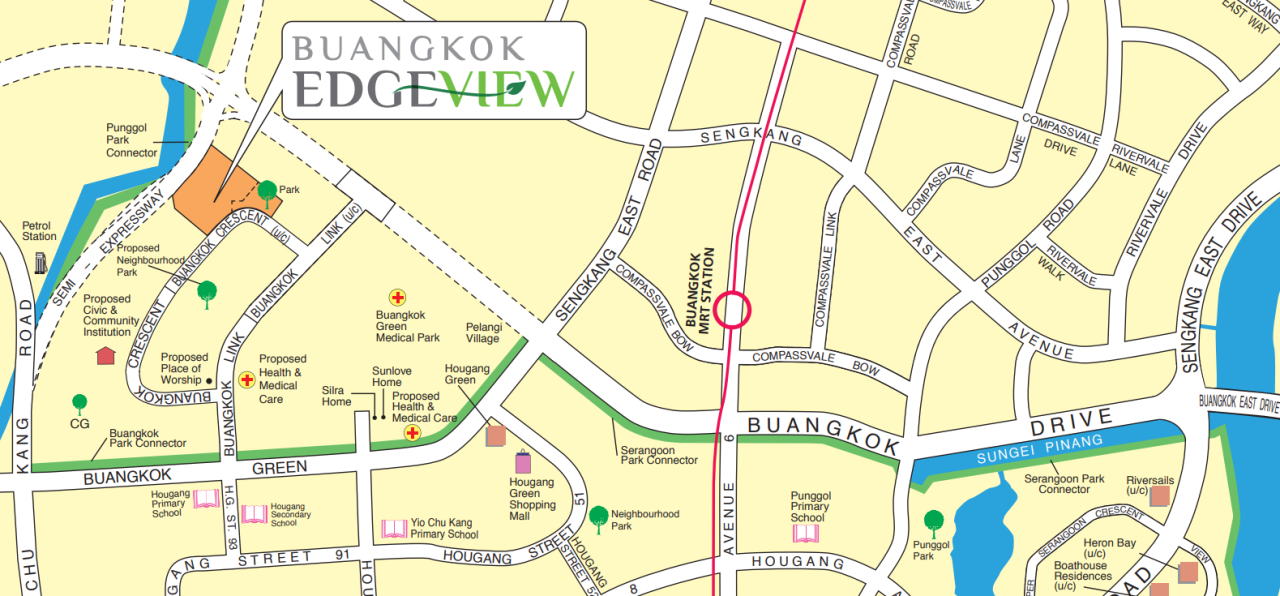

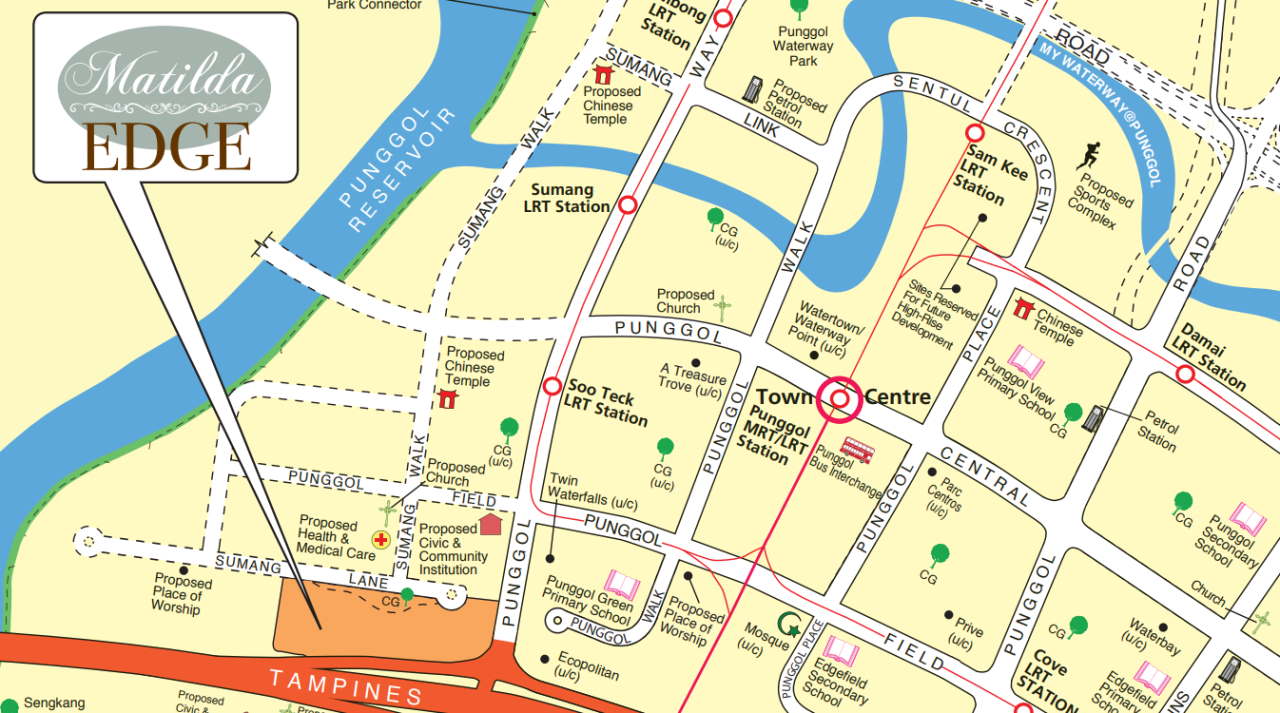

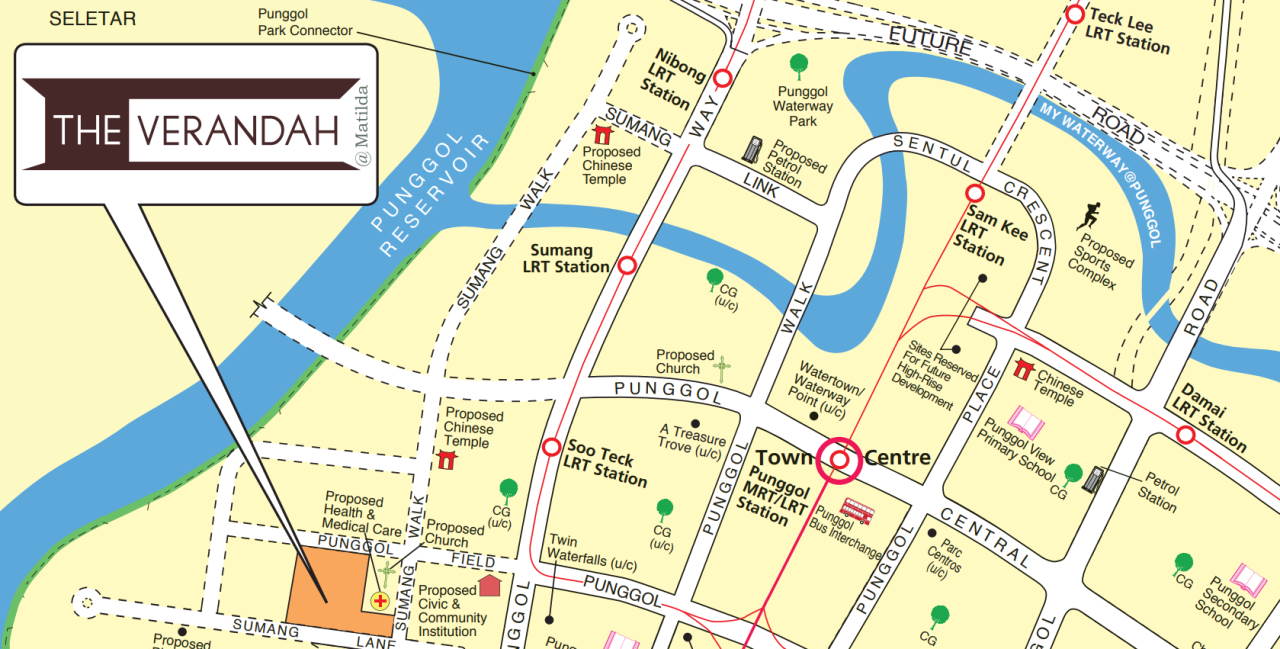

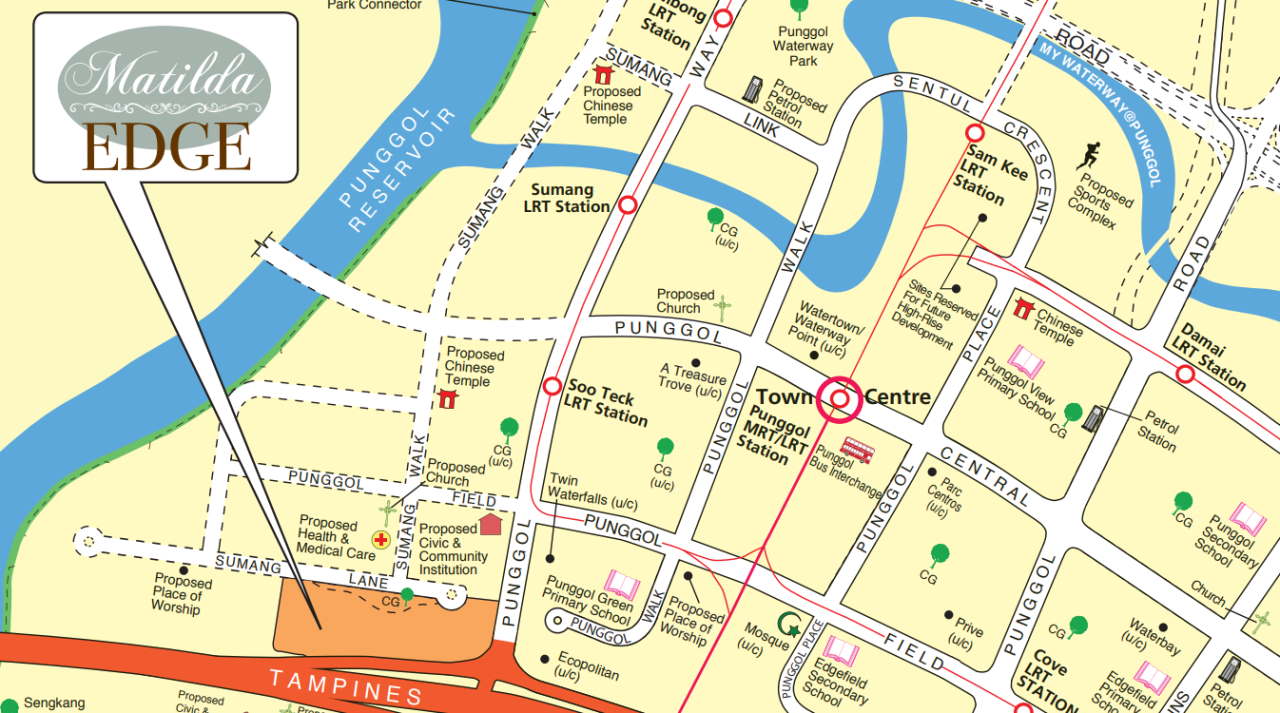

9. Matilda Edge (Punggol)

Location & Accessibility

First up with our Punggol BTOs is Matilda Edge, situated just next to the TPE. The nearest station is Soo Teck (PW7), a roughly 11-min walk away and one stop from Punggol MRT Station.

With 1,330 total units, this is the largest BTO on our list. Fortunately, blocks are spaced a good distance apart, so the development doesn’t feel cramped so much as it feels like a sprawling eco-conscious landscape.

Schools within 1km include Nan Chiau, Punggol Green, Compassvale, Springdale, and Valour Primary.

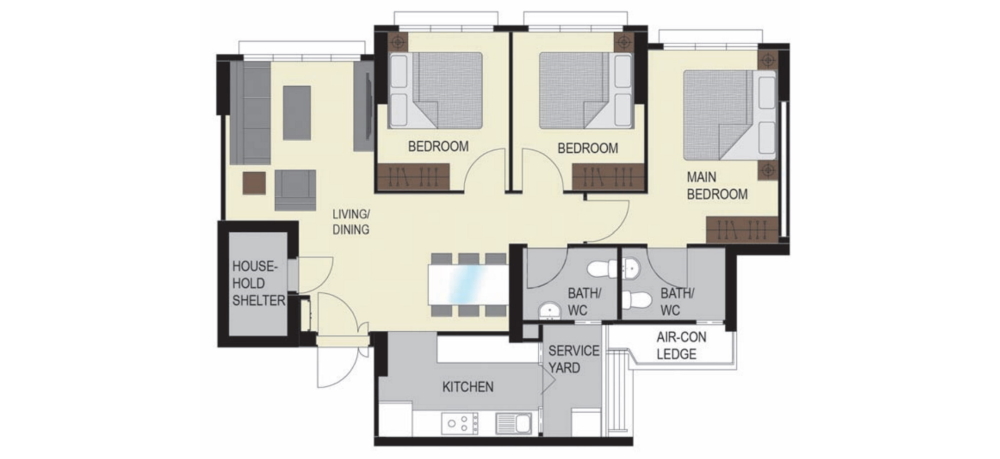

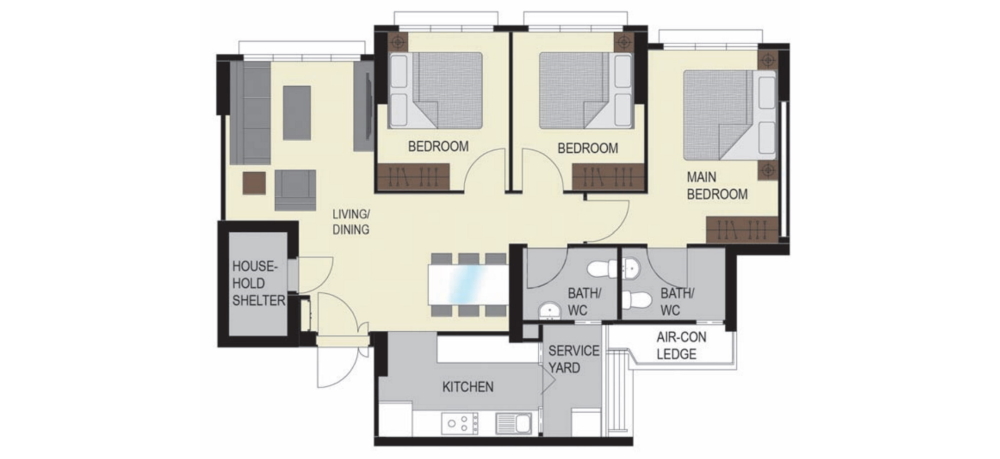

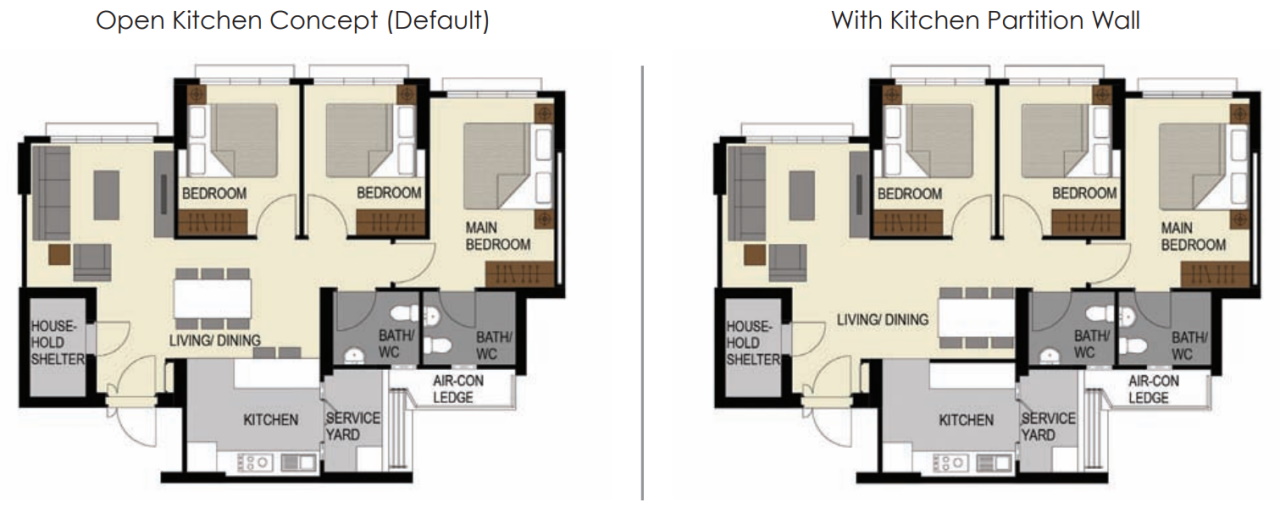

Size & Layout

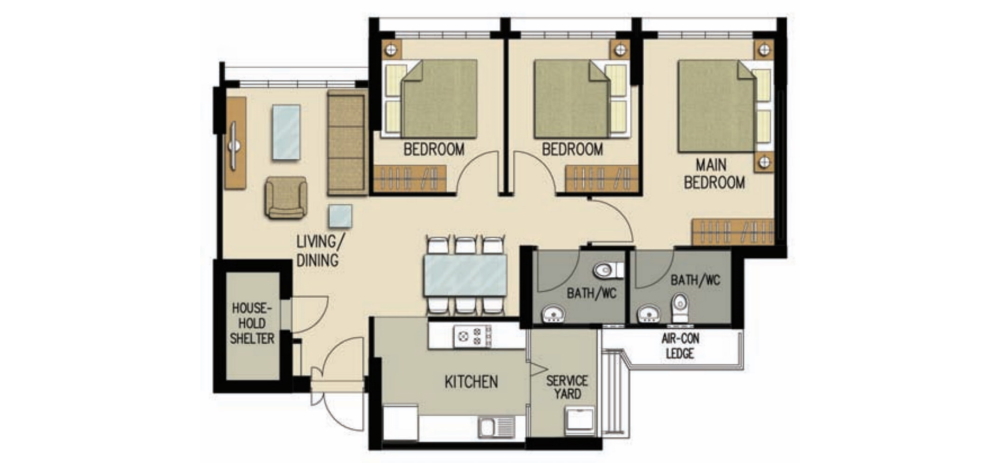

Like many other 4-room layouts on this list, Matilda Edge has its household shelters in the living / dining area. This makes the living area feel a little smaller, though we’ve seen homeowners turn it into a point of visual separation. This gives you the leeway to section off parts of the flat for family members with different routines.

You can knock down a wall to convert one of the common bedrooms into part of the living area, for example, or replace it with a glass partition to transform the space into a home office.

Here, you also have the option of either an open-concept kitchen or a closed kitchen. Bear in mind that Matilda Edge uses half- and 3/4-height windows, so you may need to find ways to let more light in.

Amenities

In line with Punggol’s vision of becoming an eco-town, Matilda Edge’s design features elements like a rooftop garden on the multi-storey carpark, plenty of greenery and flowers, rainwater harvesting, motion-sensor lights, and dedicated chutes for recycling.

You’ll find bicycle rentals and car sharing services conveniently located here, with easy access to Sengkang Riverside Park via the Park Connector Network along Punggol Reservoir.

The nearest major mall is Waterway Point at Punggol MRT (NE17).

Pricing

In the last 6 months, there’s only been one recorded sale of a 4-room unit, which transacted for 472.5k.

Units in this estate currently list for $524 – 628 psf. In comparison, units in the surrounding neighbourhood have transacted for an average of $459 – 639 psf in the last 6 months.

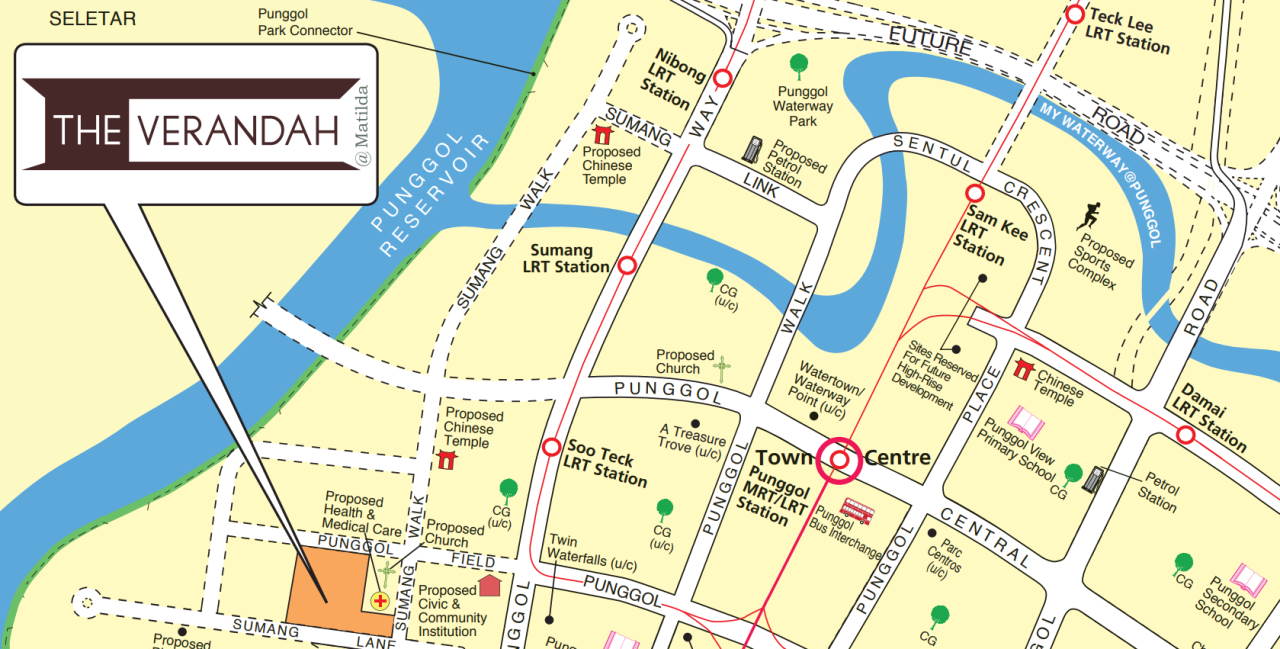

10. The Verandah @ Matilda (Punggol)

Location & Accessibility

Next to Matilda Edge is The Verandah @ Matilda, which is slightly nearer to the Soo Teck LRT station (PW7).

Bicycle rentals and car sharing services like BlueSG and Car Club are options just as accessible to residents of The Verandah.

If you have (or will have) school-aged children, you may want to note that unlike Matilda Edge, The Verandah @ Matilda is just out of range (but still within 2km) of Nan Chiau Primary. However, it’s still within 1km of Punggol Green, Valour, Springdale, and Compassvale Primary School.

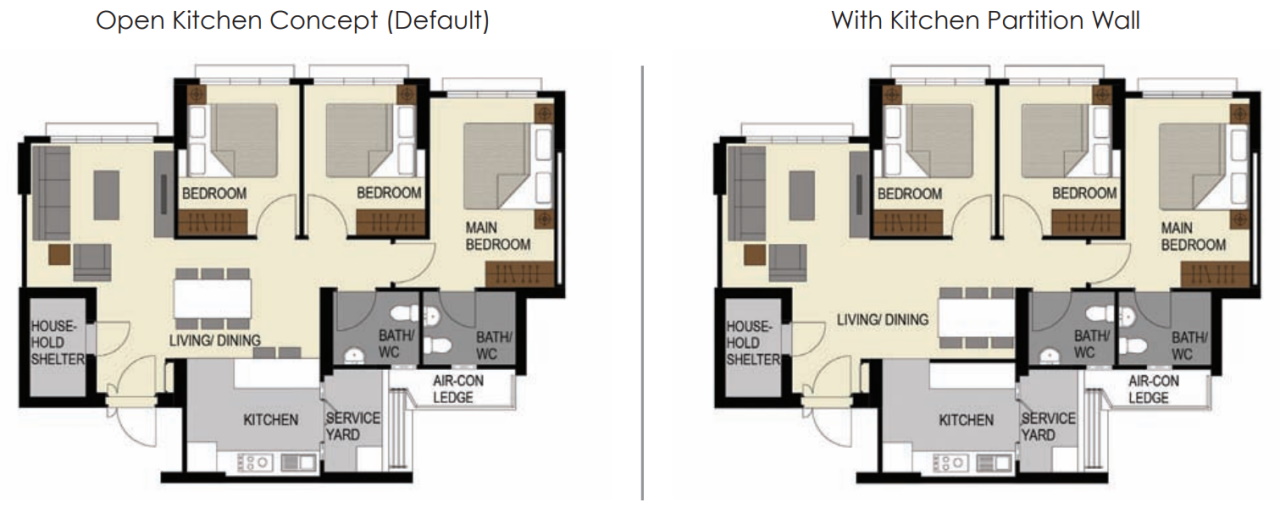

Size & Layout

If you think of the bedroom as your sanctuary, you’ll be glad to know that the 4-room layouts here favour a larger master bedroom. This can easily fit a king-sized bed with plenty of walking room to spare.

However, this comes at the expense of the living / dining areas. The household shelter is also right by the front door, which in our opinion creates some wasted space in the form of a narrow walkway.

Units here have a rare combination of full-height windows in the living area and 3/4-height windows in the bedrooms, so you’ll have plenty of natural light streaming in.

Amenities

From the outside, The Verandah @ Matilda doesn’t look like a typical HDB. In fact, it won the BCA Universal Design Mark Award (GoldPLUS) in 2018 for going above and beyond in its eco-conscious and user-centric design.

For starters, the estate is surrounded by lush greenery, with common amenities elevated on a landscape deck so that children and seniors can enjoy them without fear of vehicular traffic.

Like Matilda Edge, there are green features woven into every aspect of its design, from centralised recycling chutes and solar photovoltaic systems to rainwater harvesting and energy-efficient lights.

Pricing

In the last 6 months, 4-room units in this HDB estate have transacted for 495 – 585k.

Units in this estate currently list for $575 – 620 psf. In comparison, units in the surrounding neighbourhood have transacted for an average of $459 – 639 psf in the last 6 months.

11. Waterway Brooks (Punggol)

Location & Accessibility

Waterway Brooks is just south of the Punggol Waterway, which isn’t a particularly accessible area. It’s at least a 10-min drive southwest to get on the TPE via Punggol Road. However, it’s just southwest of Coney Island and about as near as you can live to Pulau Ubin without leaving the island.

The nearest station is Damai LRT (PE7), which is just a minute’s walk along Punggol Drive. It’s also about a 13-min walk from Punggol MRT station at Waterway Point.

Punggol Digital District is also slated to open from 2024 onwards.

Waterway Brooks is within 1km of Oasis, Horizon, Punggol View, Edgefield, and Valour Primary School. Punggol Secondary School is just 500m to the south, along Edgefield Plains.

Size & Layout

The 4-room is 1,001 sqft, with all the bedrooms and the living / dining area a good size. The downside here is the smaller kitchen. Not so great if you’re a Top Chef enthusiast, but great if you like entertaining guests or if you need a larger space to WFH.

This also puts the kitchen and service yard on the other side of the unit – a good layout for those who prefer to not have any of their bedrooms open up directly into the living or dining area.

Amenities

The HDB estate overlooks the Punggol Waterway. Running trails along both shores connect the Waterway Ridges Rain Garden in the east to the Punggol Regional Sports Centre in the west – a great location for those who prize an active lifestyle outdoors. Punggol SAFRA and Punggol Waterway Park are also just a 5-minute drive to the west.

There aren’t many amenities directly below the blocks, but if you cross the road using the LRT connection, you’ll find numerous eateries, cafes, a set of ATMs and an NTUC Fairprice.

Waterway Point is the nearest shopping centre – a 15-min walk or short bus ride to the west.

Pricing

In the last 6 months, 4-room units in this HDB estate have transacted for 498 – 628k.

Units in this estate currently list for $535 – 667 psf. In comparison, units in the surrounding neighbourhood have transacted for an average of $447 – 631 psf in the last 6 months.

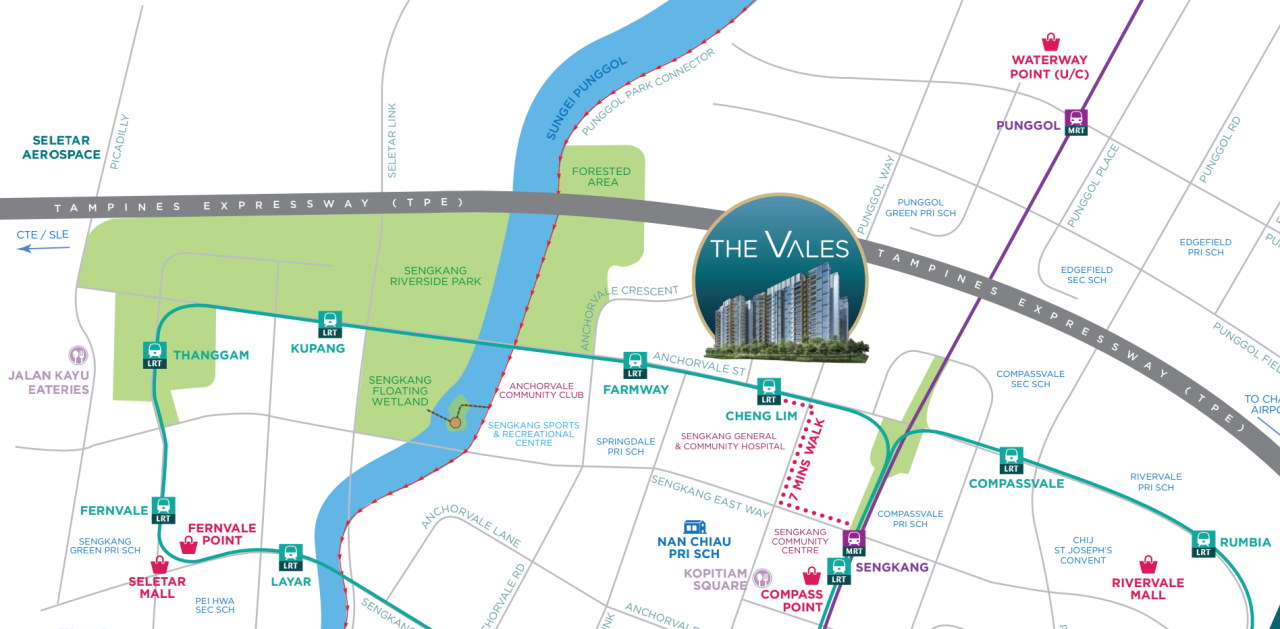

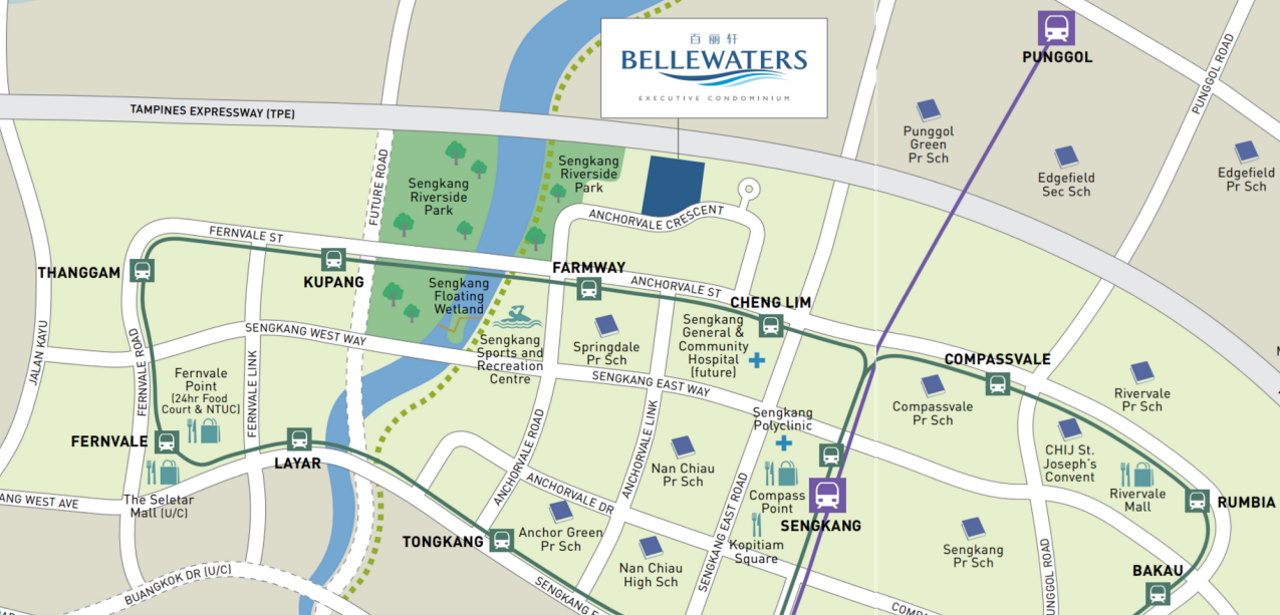

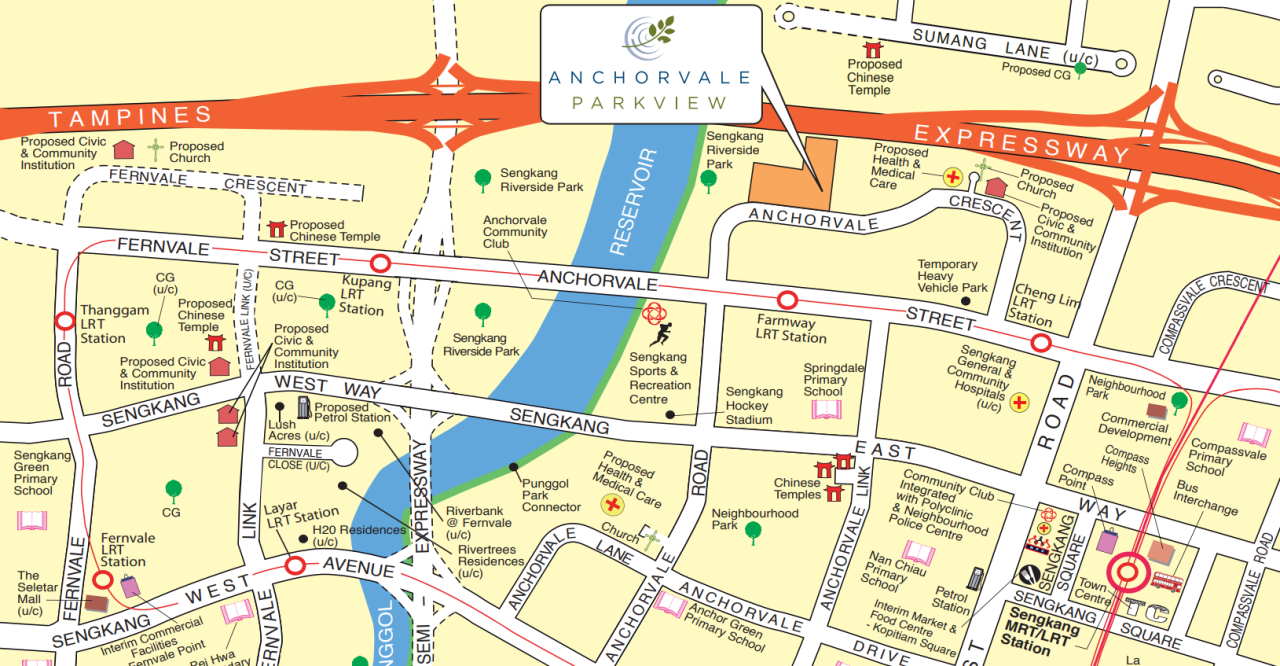

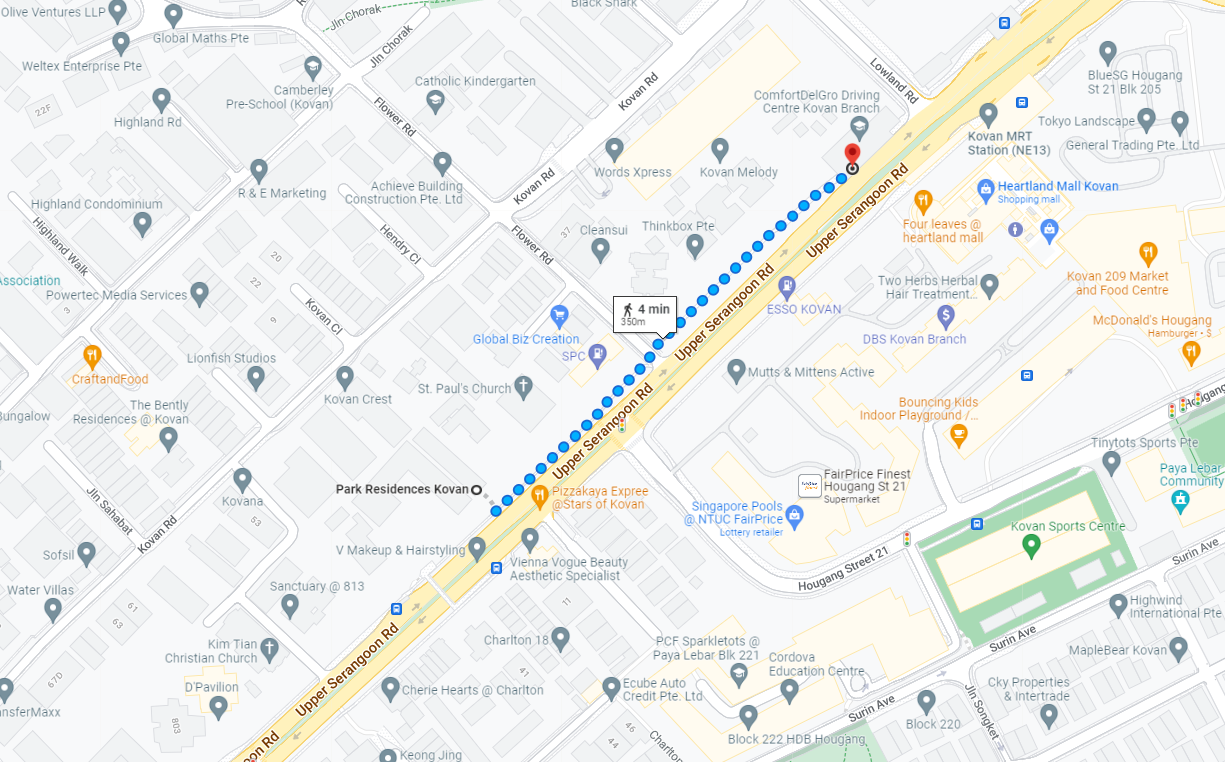

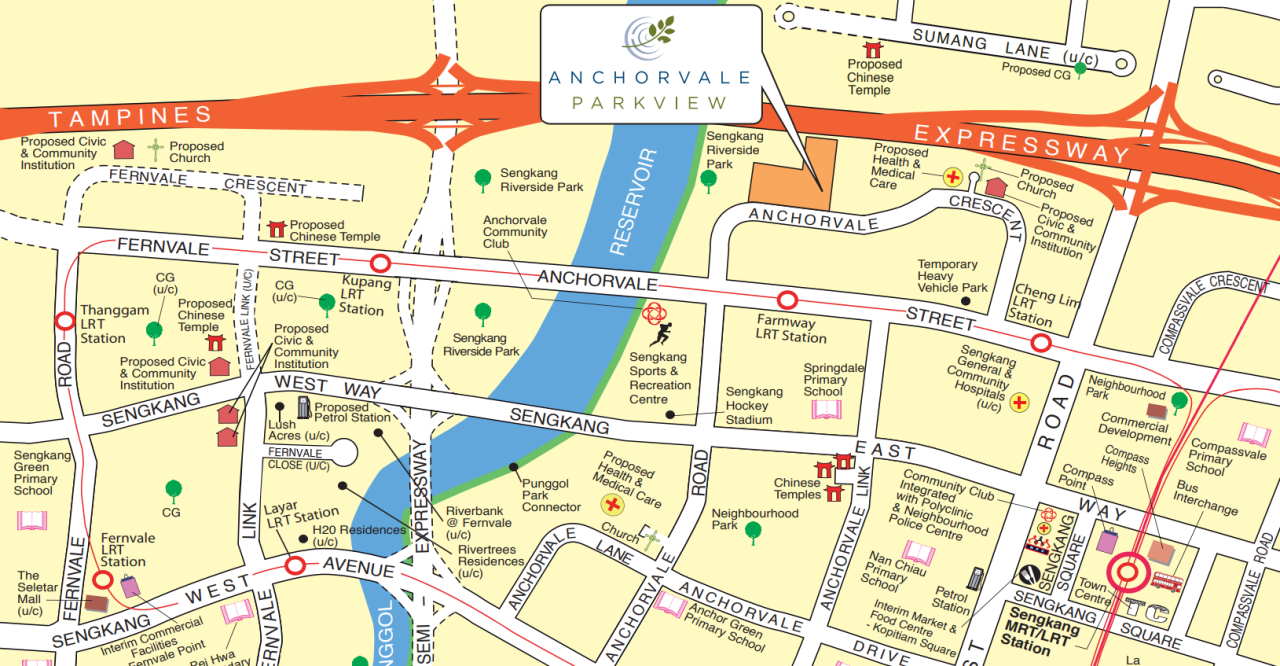

12. Anchorvale Parkview (Sengkang)

Location & Accessibility

Anchorvale Parkview is only a 5-mins walk from the Farmway LRT (SW2), and a few minutes’ drive from the nearest TPE entrance along Sengkang East Road.

The development is within 1km of Nan Chiau, Springdale, Punggol Green, and Fern Green Primary School, so there’s no lack of early education institutions to choose from.

Size & Layout

The 4-room units come in 1,001 sqft with the household shelter positioned in the living room. Since all 3 bedrooms are next to each other, you have the leeway to knock down a wall to make a larger master bedroom, if you’d prefer.

Amenities

The best part about Anchorvale Parkview is its proximity to Sengkang Riverside Park, a 21-hectare riverine park with constructed wetlands, open lawns, and trails that extend to both sides of the Punggol Reservoir. This keeps the area cool and breezy.

If your budget allows for it, you can even go for one of the 5-room flats with a facing that overlooks the park. But blocks here are spaced out, so even the ones farther from the park have a view of the water.

Other than that, the HDB estate conveniently houses a Sheng Siong and eateries on the ground level of the multi-storey carpark. There are also preschools and a few small businesses along the void deck on the ground floor.

The nearest mall, Compass One, is at Sengkang MRT (1.6km away).

Pricing

In the last 6 months, 4-room units in this HDB estate have transacted for 508 – 575k.

Units in this estate currently list for $527 – 615 psf. In comparison, units in the surrounding neighbourhood have transacted for an average of $494 – 594 psf in the last 6 months.