Given its stability and foreigner-friendly tax policies, Singapore has always held an appeal for those looking to buy property.

But with the surging domestic demand for property during the pandemic, the government saw fit to put in place cooling measures in December 2021 – including a higher ABSD for foreigners.

So what are the rates now, and what implications has ABSD historically had on property prices?

We’ll explore that today, covering:

The Singapore government first introduced ABSD in 2011 as part of a broader set of property cooling measures to reduce speculative purchases. ABSD is a tool meant not to depress housing prices, but to encourage price stability and sustainability.

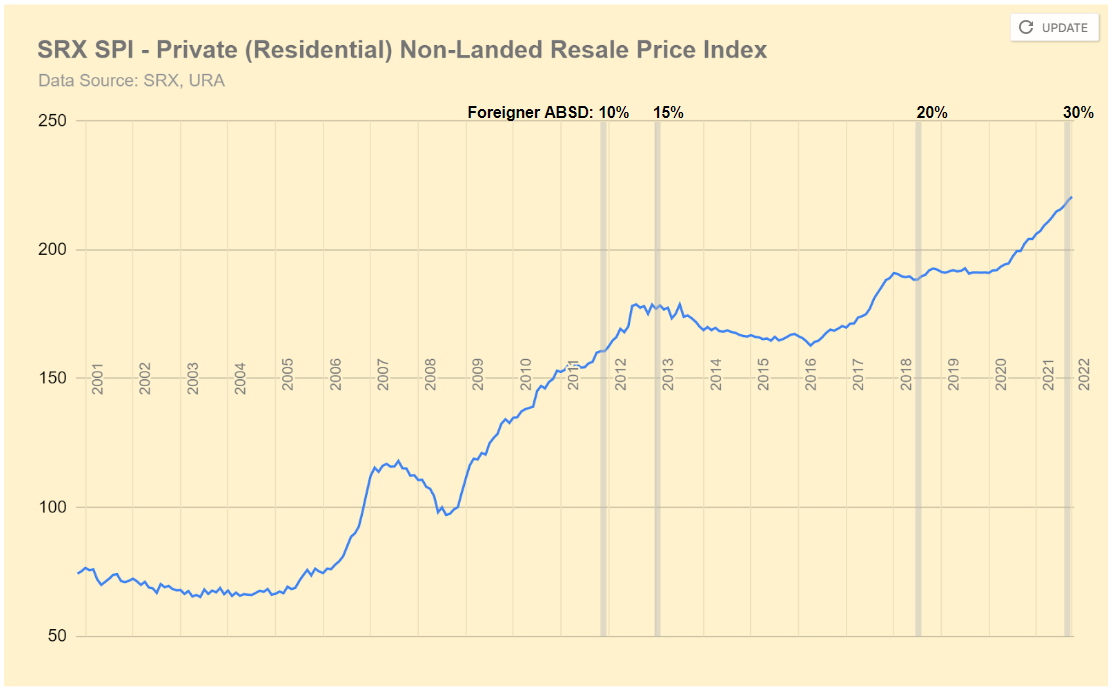

Since its introduction in 2011, ABSD for foreigners has increased three times – in 2013, 2018, and at the end of 2021. It started at 10% and subsequently increased to 15%, 20%, and now 30% respectively.

As long as you’re either a foreigner or PR buying property in Singapore, you’ll have to pay ABSD on top of Buyer Stamp Duty (BSD). The tax also applies to locals buying more than one property.

There are two exceptions:

Yes. For foreigners buying property in Singapore, the same 30% ABSD rate applies regardless of whether you own zero or three properties (locally or overseas).

For foreigners buying any residential property, the ABSD rate as of 16 December 2021 is 30%.

Here’s the full table of rates:

| Profile of Buyer | ABSD Rates on or after 16 Dec 2021 |

| Foreigners (FR) buying any residential property | 30% |

| Singapore Citizen (SC) buying first residential property | Not Applicable |

| SC buying second residential property | 17% |

| SC buying third and subsequent residential property | 25% |

| Singapore Permanent Resident (SPR) buying first residential property | 5% |

| SPR buying second residential property | 25% |

| SPR buying third and subsequent residential property | 30% |

For most foreigners, 30% is the only rate you should be concerned with. It’s only if your home country has a Free Trade Agreement with Singapore that the other rates come into play. (More on that next.)

You can apply for an ABSD remission if you fulfil either of two conditions:

The following countries have FTAs with Singapore:

For tax purposes, Nationals or Permanent Residents of these countries are treated the same as Singapore Citizens. (See above table for the ABSD rate you’ll have to pay.)

If the property in question is purchased only under both your names, you’re eligible to apply for a full ABSD remission as long as you both do not own any other residential property within Singapore. (ABSD only counts residential property within Singapore.)

If you’re planning to sell off your current property to buy another, you may also apply for an ABSD refund as long as you sell your current (and only) residence within 6 months of the date of purchase/TOP/CSC, whichever is applicable.

You can find a complete table for ABSD Rates and Remission for Married Couples at IRAS.

Nope. Starting from 9 May 2022, transferring any residential property into a living trust will incur an ABSD rate of 35%. Likewise, purchasing one under a living trust will incur an ABSD rate of 35%.

Sure, but you’ll still have to pay ABSD – at a higher rate than as an individual foreigner, even. If you buy a property as an individual, you’ll pay a 30% ABSD rate. But if you buy it under a company, the law thinks of the purchaser as an “entity” and subjects you to a 35% tax rate.

Remember that the intent of ABSD is to curb property speculation, not depress property prices. Historically, property prices have continued to rise in spite of ABSD, but there are several factors you need to consider alongside the stamp duty.

For context, here’s a chart depicting Singapore’s property price index. Grey lines mark the introduction of ABSD and the three subsequent hikes:

Three things to note here:

If the government believes that one round of cooling measures isn’t working, they may go with another round not long after – whatever it takes to reduce the speculative fervour.

That was what we saw in 2013. The introduction of ABSD in 2011 failed to slow the speculative flurry. Two years later, an ABSD hike followed.

The 2013 ABSD hike was followed by four and a half years of little to no property price appreciation. The 2018 hike was followed by almost two years of suppressed property price growth.

There are other forces at play, such as interest rates and the overall money supply in the global system.

The introduction of ABSD in 2011 and subsequent hike in 2013 followed a property market boom that started in late 2008. Back then, the market was buoyed by tax concessions, quantitative easing, and government stimulus as the world recovered from the 2008 Global Financial Crisis.

Similarly, the ABSD hike in Dec 2021 followed surging property prices from high domestic demand, supply crunches, low interest rates, and a massive amount of liquidity flooding the system from economic stimulus during the pandemic.

In short:

It’s too early to tell if the ABSD hike in Dec 2021 will have a definitive effect on property prices, though we’re already seeing a slowdown in property purchases.

At the time of writing, the property price index has continued to increase for the first half of 2022. It’s hard to say what ABSD will do this year given that we’re still dealing with record levels of inflation, geopolitical tensions, and supply chain disruptions.

We’re also seeing the highest recorded net capital inflows into Singapore, which means many foreign investors still see the island-state as a safe haven.

Is property in Singapore still a good investment decision? It depends on your financial situation and your outlook on Singapore in the midst of all the market volatility. Ultimately, you need a holistic view of the global market and how it influences the local property market to make an informed decision.