Singapore property prices are set to keep climbing in 2022 and as a property owner you might be wondering if now is a good time to sell your private property. Some might have qualms about the selling process but in reality, to sell private property isn’t nearly as complicated as selling an HDB flat.

For one, there aren’t as many regulatory requirements you have to follow. You also won’t be hit with all the miscellaneous costs, like the resale levy and HDB administration fees.

But since agent commissions can be exorbitant when you sell a private property, it’s no wonder that more and more sellers are opting for the DIY route.

(Read also: Is It Worth it to Engage a Property Agent?)

That said, when you sell your private property in Singapore without an agent, there’s a fair bit more learning involved. Obviously, as a diligent seller, you’ll want to make sure you haven’t missed out on any key aspects of the resale condo procedure.

And that’s exactly we’ve prepared this comprehensive guide for you.

The Private Property Resale Process

Step 1: Check Your Eligibility

Step 2: Calculate Your Finances

Step 3: Chart Out Your Timeline

Step 4: Decide Whether to Hire an Agent or DIY

Step 5: Get a Home Valuation & Set a Price

Step 6: Market Your Property

Step 7: Conduct House Viewings

Step 8: Issue an Option to Purchase (OTP) to Your Buyer

Step 9: Wait for Buyer to Exercise OTP

Step 10: Pay Seller’s Stamp Duty If Necessary

Step 11: Invite Buyer to Inspect the Unit

Step 12: Complete the Sale at the Lawyer’s Office

Step 1: Check Your Eligibility

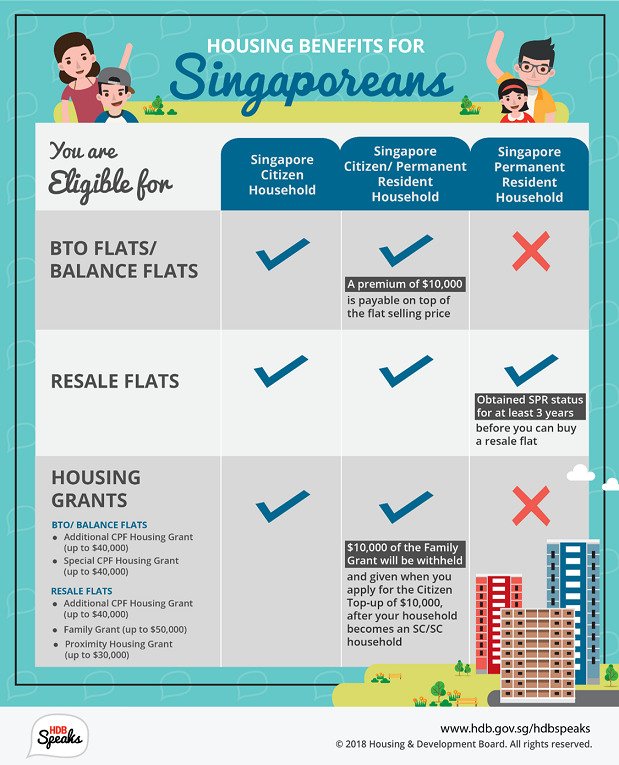

Unlike with an HDB resale flat, there isn’t a Minimum Occupation Period (MOP) to fulfill before you can sell your private property.

Technically, you can rent out or sell your condo immediately after you purchase it. It’s just that you might be hit with the Seller’s Stamp Duty (SSD) if you sell too soon. (Read also: How to Calculate and Avoid Paying Seller Stamp Duty)

We’d recommend holding your property for at least 3 years if you’re not in a hurry to sell.

Back to Top

Step 2: Calculate Your Finances

If you’re looking to sell your current private property and upgrading (or downgrading) to another place, then it’s relatively straightforward. You can check out this article to get a breakdown of all the costs you’ll incur.

Read also: The Real Costs of Selling a Property in Singapore

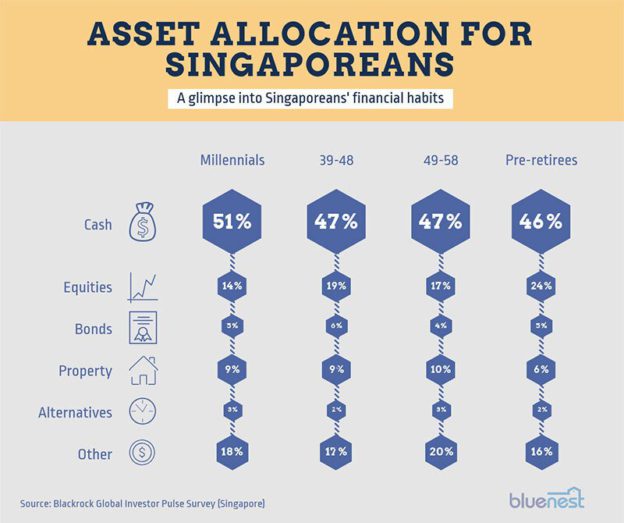

But if you’re selling an investment property and buying another one afterwards, bear in mind that you might run into a few extra hurdles with bank loans, Additional Buyer’s Stamp Duty (ABSD), CPF usage, and the larger cash down payment required. (Read also: 3 Steps to Determine If You’re Ready to Sell Your House)

By the way, if you used CPF to purchase your current property, you’ll also have to refund your CPF account with accrued interest and pay off your home loan (if any) in its entirety.

This means you might not get much in cash from the proceeds of the sale, so do ensure you have enough liquidity to cover the cash down payment for your new place.

Back to Top

Step 3: Chart Out Your Timeline

In contrast to the 8-week period HDB takes to process a Resale Application, the sale of a private property typically takes 3 months once you’ve found a buyer.

This gives you a little more time to move out, but you’ll still want to have a rough timeline in your head before you list your property for sale.

For instance, have you got your eye on a new condo? Check out how quickly units are being snapped up in that development so you don’t miss out on your dream home.

Are you looking to sell your private property first so you have the money to purchase that grand new condo? Survey the prevailing market conditions to make sure you’re selling at your preferred rates. (Read also: 2 Easy Steps to Get a Precise Valuation On Your Next Property)

Or are you buying first so you don’t miss out on that great deal? Make sure your finances can carry the load of two properties – particularly if your previous home doesn’t get sold as quickly as you’d hoped.

You might also want to consider the best time of year to start selling your property. For instance, there are usually more houses sold in between school terms, as buyers don’t want to uproot their families in the middle of the term.

Back to Top

Step 4: Decide Whether to Hire an Agent or DIY

Compared to the rather tedious HDB process, the procedure to sell a private property in Singapore without an agent is easy.

That said, it definitely has its own share of hiccups, so you may still want to consider getting an agent. (Read also: 7 Myths About Property Agents Everyone Thinks Are True)

Some of the snags you might hit during the resale condo procedure include:

- Buyer fails to get Approval in Principle (AIP) from their bank before signing the OTP. They then find out the loan isn’t sufficient and back out.

- Not accurately pricing your property (and then seeing your property listing grow stale from remaining on the market too long).

- Not making your home attractive enough for property listings / house viewings.

- Not knowing the right channels to market your property (or not having access to certain listing websites).

If you’re not administratively inclined, you might also need help with the previous two steps (planning your finances and timeline).

Typically, agent commissions for the sale of private property are about 2%. PropNex, for example, charges a “minimum 2 per cent or up to a maximum of 4 per cent as sales commission.” (Source: TODAYonline)

Depending on the property, some agencies might even charge as high as 5%. On a million-dollar property, that’s a whopping $50,000 in commission fees. In contrast, Bluenest offers full-service agent packages at half the market rate of only 1% .

This gets you everything that a professional real estate agent can offer, but saves you tens of thousands in commission fees. For instance, you’ll get:

- Thorough financial planning, especially if you’re selling and buying property at the same time

- Premium marketing services with regular optimization to get your property maximum exposure

- Professional photography services and guided home viewings

- A skilled negotiator working on your behalf, leading to faster sales and higher prices

Back to Top

Step 5: Get a Home Valuation & Set a Price

The best way to start pricing your home is to get a CMA for your property. Essentially, this is a deep dive into the specifics of your property versus comparable properties in the surrounding neighbourhood – floor area, facing, orientation, layout, and so on.

We cover the valuation process in more detail in our guide on how to value and price your property for sale.

You can also call up the bank to get an indicative valuation of your property, though these estimates will vary from bank to bank.

By the way, if you’re not satisfied with the price your property is fetching, consider taking action on some of these tips to increase your property’s value.

Back to Top

Step 6: Market Your Property

After all that prep work, it’s time to actually advertise your property!

Putting ads out in the newspapers is one way to do this, but make sure you have professionally-taken photographs of your home to attract the best buyers.

Otherwise, you can try the free alternatives available for property listings. (You’ll still need decent photographs and a good write-up, though.)

Back to Top

Step 7: Conduct House Viewings

Have a few interested buyers? Great! It’s time to get your house ready for viewings.

Just as we’d want to look our best for a job interview, you want your property to be in the best condition possible beforehand.

(Read also: 10+ Tips to Increase Your Property’s Value — and Sell It FAST)

A few tips here:

- Declutter your house (3 simple things to do) and get rid of as much personalization as possible. This way, buyers can imagine building a home there. Yes, decluttering does affect your home sale and we have success studies to prove it.

- Eliminate any foul odors or cooking smells before the viewings. You might even want to spray a bit of air freshener – just make sure it isn’t too strong!

- Try to schedule viewings in the mornings or evenings, when it isn’t too hot. You don’t want buyers to feel like they’re walking into a giant oven.

- Open up the windows and let in some fresh air to make sure the place doesn’t feel stuffy.

If you can afford the time or money, you might even want to put up a fresh coat of paint and buff up the flooring. This will help your place look well-maintained and thus more attractive to buyers.

Back to Top

Step 8: Issue the Option to Purchase (OTP)

So you’ve found a buyer – congratulations! At this point, most of the legwork is done. Assuming your buyer has the means and commitment to follow through, it’s largely a waiting game until the sale is closed in 12 weeks. (Read also: So You’ve Found a Buyer — Now What?)

You can get a standard Option to Purchase (OTP) from a solicitor if you’ve already got one in mind. Some will even give out the OTP for free, since they want your business during conveyancing and all.

Alternatively, if you want to save a bit on the legal fees, all of Bluenest’s packages also include the OTP.

Sign this OTP and send it over to the buyer (or buyer’s lawyer). In exchange, they’ll give you 1% of the purchase price as the Option Fee.

Back to Top

Step 9: Wait for Buyer to Exercise OTP

The buyer now has 14 calendar days to decide whether they want to move forward with the sale. During this time, you can’t give an OTP to anyone else.

If they do, they give you another 4% as the Exercise of Option Fee. You can also engage a solicitor (if you haven’t already) to take care of the rest of the legalities.

If the buyer backs out, you get to keep the Option Fee, but you’ll have to put your house back on the market.

Back to Top

Step 10: Pay Seller’s Stamp Duty If Necessary

Once the buyer exercises the OTP, you have a 14-day deadline to pay IRAS your Seller’s Stamp Duty (if you need to).

Head over to the IRAS e-Stamping Portal here to do so.

Back to Top

Step 11: Invite Buyer to Inspect the Unit

In the remaining time before the sale closes, you’ll obviously have to move out.

You’re still under obligation to maintain the place in the same condition, but other than that there shouldn’t be any more hurdles to jump over.

Once you’ve moved all your stuff out, invite the buyer over to conduct a final inspection to confirm vacant possession before the close of the sale.

Back to Top

Step 12: Complete the Sale at the Lawyer’s Office

It’s the day you’ve long been waiting for: you get to collect the other 95% of the payment!

Head down to the lawyer’s office to hand over the keys, sign those documents, and get all the bank loan and CPF stuff sorted out.

This is also when you’ll have to settle those conveyancing fees, agent commissions, and bank early repayment/legal fees. The lawyers will settle the official transfer of the title deeds, so you’re all good to go!

Back to Top

Was this article helpful? Good things must share!