Everyone loves the idea of passive income, and one of the easiest ways to generate a steady stream of it is to rent out your home.

There’s one caveat, though… not everyone is eligible to rent out their property.

Everyone loves the idea of passive income, and one of the easiest ways to generate a steady stream of it is to rent out your home.

There’s one caveat, though… not everyone is eligible to rent out their property.

Decided that you want to rent out your HDB flat, but don’t know where to start? You’re at the right place!

In this guide, we walk you through the step-by-step process of renting out your flat.

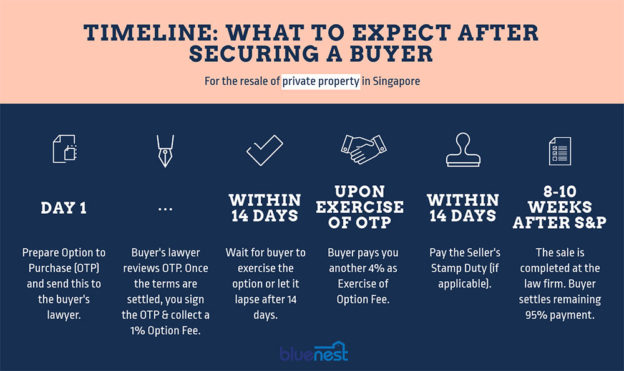

Congratulations! You’ve managed to find a buyer for your resale HDB or private property. You’ve gotten through the hardest part – but until the sale has been officially completed, you can’t rest easy just yet.

Now that you’ve gotten to this point, you may be wondering: “what else do I need to do in the meantime? How long does the whole process take?”

We’re here to give you the rundown of the private property or HDB resale process so you know exactly what to expect.

Maybe you’ve been living in that BTO flat for a while now & “coincidentally” you have been hearing that HDB flats are fetching over a million dollars today. You’re doing well financially, and you’re wondering if it’s the right time to sell your resale HDB and upgrade to a private property.

Maybe you’ve outgrown your home and need more space for your family.

Whatever your reason to sell your HDB flat up on the resale market, you want to make sure you’ve dotted all the i’s and crossed all the t’s.

In land-scarce Singapore, selling your property is a huge step. But it’s challenging to figure out if you should sell your house – let alone when to do so.

Should you sell your HDB after 5 years and upgrade to a condo? Or is it better to keep it and buy that private property as an investment?

When should you sell your condo, and what do you have to consider before listing the unit?

Maybe you’ve read the news articles on HDB resale flats going at sky high prices – some even fetching over a million dollars. You’re wondering if your own home could net such a lofty value.

Or perhaps you’ve decided to sell your home for some extra liquidity, and are wondering how to get the best possible value and price for it.

Regardless of your reasons, you’re probably wondering if there are ways to increase the value of your home without spending a small fortune in the process.

A lot goes into pricing your property for sale in Singapore. You don’t want to shortchange yourself by listing at too low a price, of course. But you also don’t want to quote too high a starting price, lest your property be unsold for many months. You must be thinking how to accurately retrieve your property valuation.

Recent transactions give you an initial gauge, but then there are other questions to consider.

For instance, what if you’ve recently renovated your home?

What if you have one of the rarer property types – and there are no other comparable units for sale in your area?