In land-scarce Singapore, selling your property is a huge step. But it’s challenging to figure out if you should sell your house – let alone when to do so.

Should you sell your HDB after 5 years and upgrade to a condo? Or is it better to keep it and buy that private property as an investment?

When should you sell your condo, and what do you have to consider before listing the unit?

Timing is everything. Sell your house too soon and you might be facing a ton of headaches for years down the road.

In this article, we’ll guide you through everything you need to consider to make sure you’re ready to sell your house.

HDB flats have a Minimum Occupation Period (MOP) of 5 years. This means you’ve got to actually be living in the flat for that length of time. Any periods of non-occupation (e.g. working overseas) don’t count.

For the most part that is. If you’ve got a 1-room resale flat that you bought off the open market without a grant, there’s no such MOP. (Source: HDB) Executive Condominiums (EC) purchased from the resale market also don’t need to adhere to the 5-year MOP.

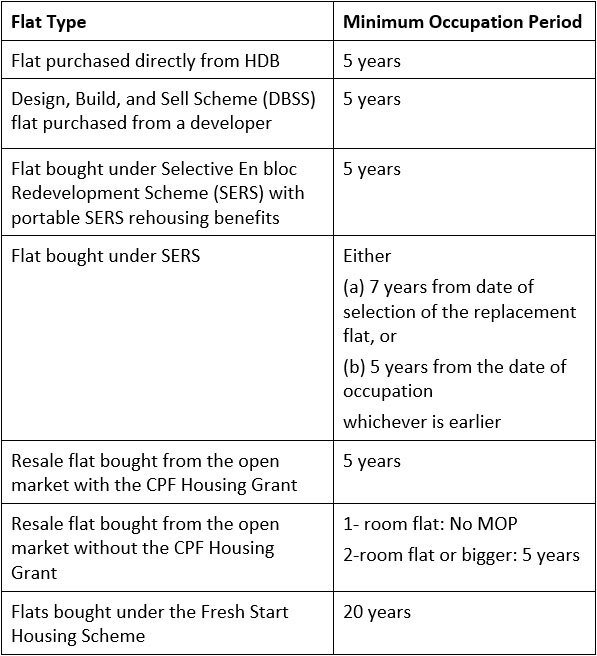

The table below details the MOP for each flat type:

Alternatively, you can visit the HDB resale portal to check whether you’re eligible to sell your HDB.

What if you’ve got extenuating circumstances (such as divorce, or you need to move to be closer to elderly relatives) and you want to sell your house before the MOP is up?

It’s possible – but only in very rare cases. You’ll also have to appeal directly to HDB (and you may also have to pay a visit to your MP).

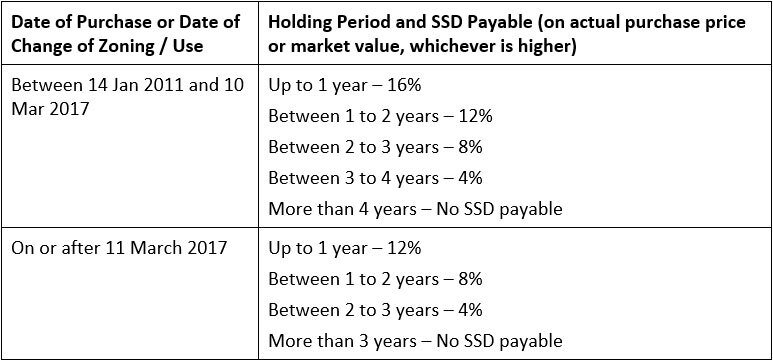

There’s no Minimum Occupation Period for private property. However, you’ll have to keep that property for at least 3 years if you want to avoid paying the Seller’s Stamp Duty (SSD).

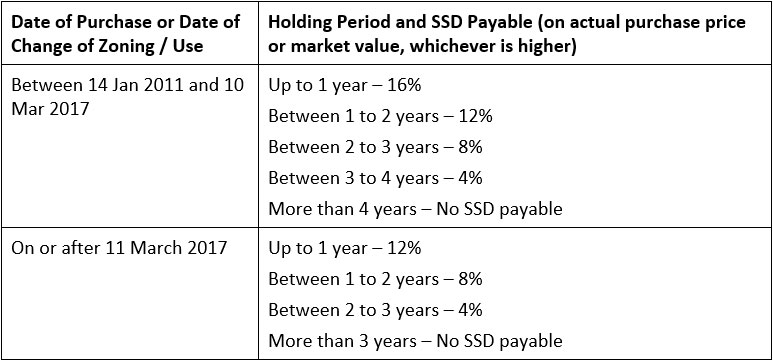

The amount of SSD payable depends on how long you’ve kept your private property and when you purchased it. The table below outlines the SSD payable:

You can check out the IRAS website for more details.

According to DBS Bank, Singaporeans have an impressive savings rate of 55%.

That said, it’s still wise to make sure you’re financially solvent before upgrading to that bigger unit. You don’t want most of your paycheck to be eaten up by housing loan payments. (Read also: The Costs of Selling Your Property in Singapore)

Bluenest’s agents can help with a thorough analysis of your finances and current property’s value, which will be crucial especially if you’re planning to buy another place.

First, grab that loan statement and figure out exactly how much you have left to pay.

Next, you’ll have to find out the current market rate of your property. Our consultants can help by doing a Comparative Market Analysis (CMA) of your property. Alternatively, you can attempt to tackle this by reading through our guide on how to value & price your property for sale.

Once you’ve subtracted your outstanding loan amount from your property price estimate, you’ll know how much you have in home equity.

Don’t forget to factor in the principal amount and accrued interest you’ll have to refund to CPF. You won’t get the entire sale proceeds in cash!

HDB has a nifty tool for you to calculate your home equity. Private property owners will have to do the calculations manually though (or engage a Bluenest agent to help with this).

Ideally, you want the cash amount to at least be enough to pay off the loan balance AND cover the upfront costs for the new place.

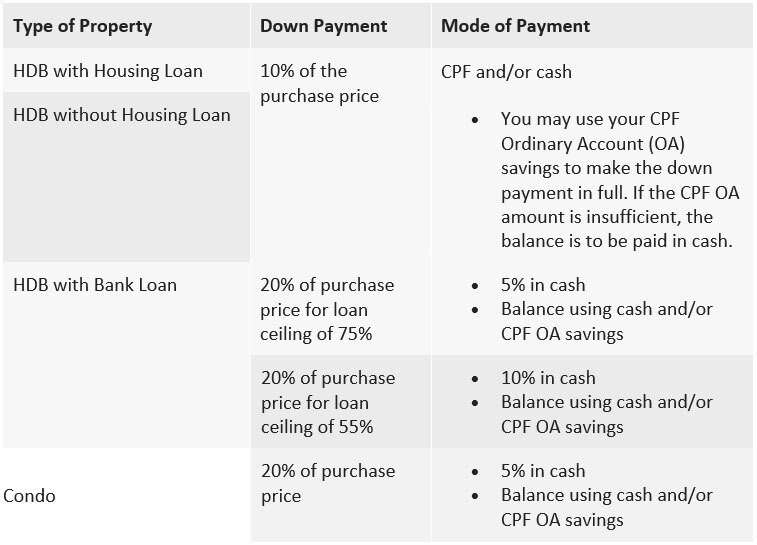

For instance, you’ll need to cover the down payment for HDBs and then a budget for stamp duty, moving costs, and perhaps renovation costs as well.

Source: HDB

Note that if you’re buying an additional property as an investment, the upfront costs are much higher.

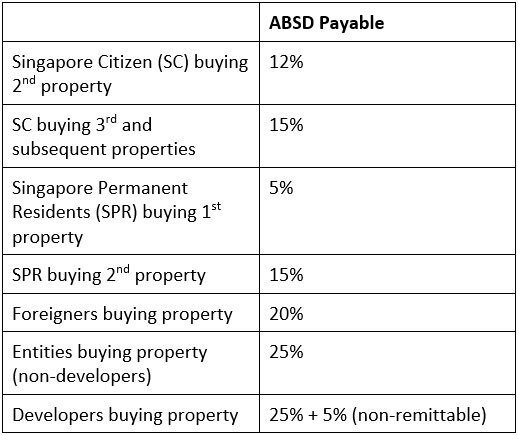

On top of a bigger cash down payment, you’ll also have to pay the Additional Buyer’s Stamp Duty (ABSD).

Source: IRAS

The Loan-to-Value (LTV) limits have also dropped as of the 6th of July, 2018. This means that you won’t be able to borrow as much from the bank for that 2nd property onwards – and you can’t use as much of your CPF to pay for it, either.

If you need to take out a loan to pay for the new place, calculate how much you’ll have to fork out in monthly payments.

You’ll also want to check whether there are any maintenance fees for the new place (and how much) along with the property taxes you’ll have to pay.

As a rule of thumb, the total amount of all these housing expenses shouldn’t exceed 30-40% of your gross monthly income.

Once you know you’re financially stable and eligible to sell your home, you also need to consider the timing and the emotional load of selling your home.

Will you sell your home first and then buy a new property later on? Where will you live in the meantime?

Or you could buy another HDB flat first, which means you won’t have to scramble to find new living arrangements. But then you’ll have to sell your old flat within 6 months of taking possession of the new one.

In a buyer’s market, this may be quite an obstacle. HDB does grant extensions on a case-by-case basis, but it leaves you open to considerable risk if your previous property remains unsold for a long time. (Read also: 10+ Tips to Increase Your Property’s Value – and Sell It FAST)

This route also means you’ll have to bear the costs (and stress!) of owning two properties at the same time. Specifically, there’s the Additional Buyer’s Stamp Duty and a bigger down payment required – both on a lower loan amount and higher interest rates. Singapore citizens get an ABSD remission automatically, but Singapore Permanent Residents will still have to pay the lower ABSD rate of 5%.

Alternatively, HDB’s Enhanced Contra Facility Scheme (ECF) allows you to sell your current HDB flat and purchase a resale flat simultaneously. This way, you won’t have to front all that cash for the new flat, since the sale proceeds will be used to buy the new flat and replenish your CPF account.

To apply for this scheme, simply indicate in the Resale Application Form that you’d like to opt for ECF. You may also fill out the Application for Enhanced Contra Facility Form and submit it to HDB.

If you’re thinking of selling your private property and replacing it with an HDB flat instead, there are two key things to take note of.

Firstly, if you’re going for a BTO or new Executive Condominium (EC), you’ll have to wait 30 months after the sale of your private property before you can apply for the new flat.

But if your goal is just to get a resale flat, the waiting period doesn’t apply. Go ahead with the purchase; just note that you’ll have to sell your private property within half a year of taking possession of the resale flat.

What other concerns do you have in deciding whether to sell your house? Let us know in the comments!

Meiling is an American-born Chinese living in Singapore. As a property owner herself, she enjoys doing research into the local real estate market and making highly technical topics easy to understand for readers. In her spare time, Meiling enjoys going for a long run or snuggling into her armchair with a good book.

I have a 4A flat at Sims Drive for sale

Hi, thanks for reaching out to us! We will reach out directly to you via email. Chat soon 🙂