As we know, the Covid-19 pandemic had impacted the Singapore property market.

The government restricted viewings during circuit breaker and resale prices dropped rapidly.

Looking back at 2020, the HDB resales volume fell by 41.9 per cent, which translates to 5,893 flats sold in the first quarter of 2020 to 3,426 flats in the second quarter. However, as the government eased restrictions and allowed viewings, we see resales volume increasing again in the third quarter.

Photo credits: The StraitsTimes

Coming into 2021, with Singapore importing vaccines and the fear of social interaction dropping, the property market may have new trends hopping on and may present more opportunities for investors, depending on circumstances.

Why are all these happening? Here’s is an overview of Singapore property market now!

1. Demand for Singapore property : Public vs Private Residential

2. Supply of Singapore Property : Public vs Private Residential

3. Singapore Rental Market

4. Singapore Landed Property Market

As of February 2021, the HDB resale market has sold a worth of 23 million-dollar flats being sold while overall prices have risen for the eighth consecutive month. There have been predictions that the demand will remain consistent with the introduction of the Enhanced Housing Grant where close to $500 million has been disbursed to about 15,600 flat buyers.

As buyers are paying cash over valuations for flats in popular locations such as Yishun or Bukit Panjang, several resale flats are transacting above valuation. The weak job market and delay in construction may have contributed to the demand too. Hence, it is normal for private sellers to downgrade to HDB. Thus, with the buying interest and appealing flats, the HDB property market may continue increasing or remain stagnant in 2021.

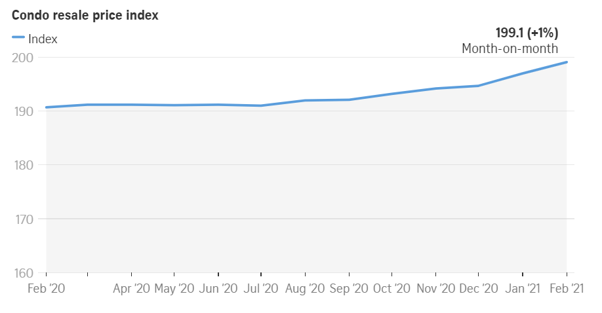

On the other hand, private properties has had a healthy growth even with the pandemic. Statistics from URA have shown that the private property prices increased by 2.2 per cent overall for the whole of 2020. According to PropertyGuru, demand for housing is expected to continue staying strong overall hence there might be strong interest for affordable private properties. In January 2021, the condo resale prices rose for the sixth straight month with the resales market termed more affordable than new unit prices. It is possible that with the ongoing demand, resales prices might continue increasing as compared to new launches.

Besides that, generally private home prices are rising for the fourth consecutive times, by another 2.9 percent. According to URA, the prices have increased by 2.1 percent in the fourth quarter last year. With comparisons annually, prices increased by 6.2 percent.

With the demand for residential properties seemingly increasing, what is happening to the supply?

For 2021, we expect to see more flats expecting to MOP , hence increasing the HDB resales. An estimated 20,000 houses from year 2020 to 2021 would have reached the five-year Minimum Occupation Period and are able to enter the resale market. In addition, we see more sellers jumping into the HDB resale market with delays in the BTO construction.

Meanwhile on the private housing side, there are an estimated 30 residential projects which comprises 7940 units for sale in 2021, with CBRE stating that “buying sentiment is expected to remain strong and help support demand for upcoming new launches”. The Core Central Region (CCR) comprises of 39.4% while the Rest of Central Region (RCR) takes up 38.4% units.

Furthermore, with Singapore’s impressive capability in managing the pandemic, we might see foreign investors returning for opportunities.

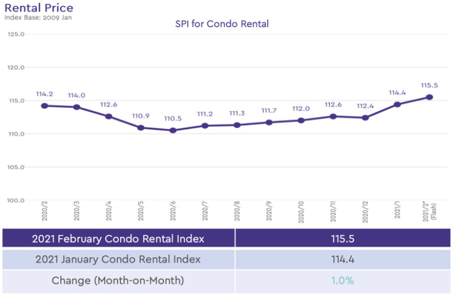

According to statistics from SRX, the condo rental market has seen rent increasing by 1.0% in February 2021 from January 2021. We see an estimated 4,013 units rented out in February 2021 as compared to 4,456 units in January 2021.

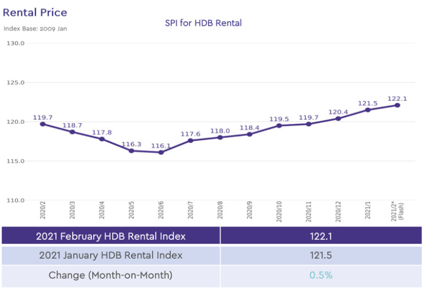

On the other hand, HDB rent prices increased by 0.5% overall from January 2021 to February 2021. The mature and non-mature estates increasing by 0.6% and 0.4% respectively. This could be due to the facilities development for the more mature estates over the years. We also see an estimated 1,497 HDB flats rented in February 2021 versus 1,819 units in January 2021.

From the above statistics, we see the rental market dipping slightly during the circuit breaker period. This could be due to Singapore imposing travel restrictions. Hence, there are fewer foreigners to push the market. Currently, the market seemingly resumes back to where it was.

The prices of landed properties have increased 5.6 percent which is a contrast to the 1.6 percent fall last quarter. The significant interest in Good Class Bungalows (GCB) also contributed to it with individuals with extremely high net worth playing a big role. Additionally, landed home supply is expected to increase at a slow rate.

Since prices are expected to stay robust in 2021, now is the perfect time to sell your house for a little switch up in the environment!

Did we mention that our best record was selling a HDB within 3 hours and a condo within 2 days? All at a satisfactory price! Moreover, we transacted over 100 properties in the last 4 months!

With only 1% commission, we sell faster, better and more efficient than the normal traditional agents! From the latest technology to a personalized marketing strategy with top-notch agents, we are defined by service and expertise!

Speak to us at https://www.bluenest.sg/

Check out our success stories:

1. HDB SOLD IN 6 DAYS DESPITE ETHNIC QUOTA

2. SOLD HDB RESALE FLAT AT RECORD PRICE

Jonathan is our Real Estate Specialist and has 7 years of real estate experience under his belt. Prior to joining Bluenest, he worked for Keppel Land, one of the biggest and most reputable property developers here in Singapore. Jon is always on the look out for the latest property market trends and to share with his fellow peers!