30 Sept 2022–

Measures to Promote Sustainable Conditions in the Property Market by Ensuring Prudent Borrowing and Moderating Demand

Due to a substantial increase in market interest rates, there is a growing likelihood of further increases in the future. And as such these measures aim to regulate the amount of money that can be borrowed for property purchases, ensuring that borrowers do not overextend themselves financially. By setting stricter limits on loan quantum, the government intends to protect home buyers from potential difficulties that may arise as a result of uncertain economic conditions and the anticipated rise in interest rates.

It is essential for property buyers and owners to carefully evaluate their financial circumstances and take into account the potential impact of rising interest rates on their borrowing costs. Engaging with financial institutions and seeking professional advice will be crucial to navigating these changes effectively.

If you are unsure of the entire resale process, do read: HDB resale payment timeline: How to plan your cashflow

Very simple- the government wants to maintain affordable housing options, particularly for first-time home buyers. This measure aims to moderate demand and prevent private property owners, who generally have greater financial means, from outbidding other potential buyers.

Before 30 Sept 2022– PPOs and ex-PPOs are currently allowed to buy a non-subsidised HDB resale flat on the open market, with the requirement that they dispose of their private properties within six months of the HDB flat purchase.

The recent round of cooling measures, aims to address signs of overheating in both the HDB resale and private home markets. By reviewing and adapting measures in response to market dynamics, the government aims to maintain a stable and sustainable property market that aligns with economic fundamentals.

The measures are likely to make it challenging for potential home buyers to obtain loans or afford properties. As a result, individuals who are unable to meet the stricter criteria or afford the higher costs of purchasing a property may shift their focus towards the rental market. This increase in demand for rental properties can lead to a surge in rental prices and a decrease in rental vacancy rates. Landlords and property investors may benefit from this shift in demand, capitalizing on the growing number of tenants seeking rental accommodations.

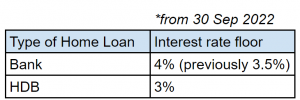

The increase in interest rate floors for Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR) calculations, along with the reduction in the Housing Development Board (HDB) loan-to-value (LTV) limit, will limit the amount of money borrowers can access for property purchases.

These measures aim to prevent over-borrowing and speculative activities, ensuring a more sustainable and stable property market. As a result, potential buyers may be deterred from entering the market or may need more time to accumulate sufficient funds for a purchase. This decrease in demand for properties can lead to a stabilization or even a decrease in property prices. Overall, the cooling measures aim to create a balanced and sustainable property market in the long run.

Jeff, the co-founder and CEO of Bluenest Pte Ltd. With his real estate career spanning from 2011, he has acquired deep knowledge and understanding of the Singapore Real Estate industry. In addition to his involvement in real estate, Jeff is a venture builder with a keen interest in tech startups, showcasing his passion for innovation.