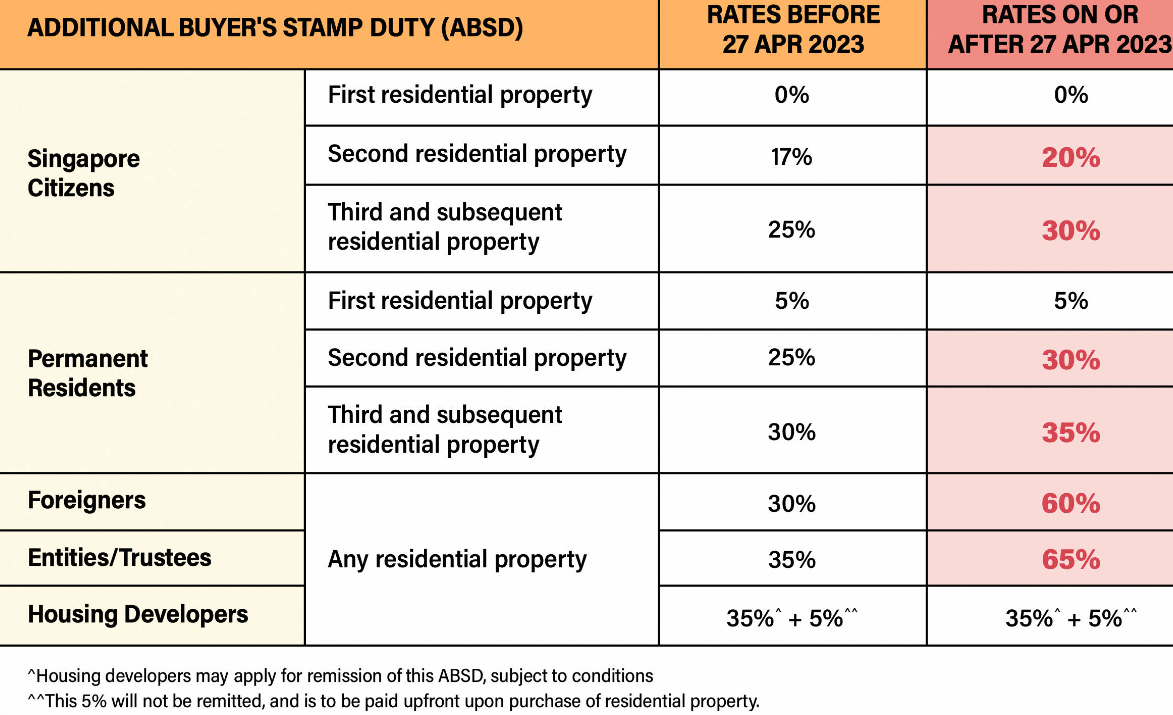

On April 27th, 2023, the Singaporean government announced that it would be raising the Additional Buyer’s Stamp Duty (ABSD) rates for certain types of property transactions. This is the third round of cooling measures since December 2021. The aim of this move is to promote a sustainable property market and prioritize housing for owner-occupation, while managing investment demand.

The revised rates will take effect from 27 April 2023.

The ABSD rates are a tax levied on certain property transactions in addition to the existing Buyer’s Stamp Duty (BSD). These rates apply to Singaporean citizens, Singapore Permanent Residents, foreigners, and entities or trusts that are purchasing residential property.

Image credit: MND Singapore

Based on 2022 data, the above ABSD rate increases will affect about 10% of residential property transactions. If you are looking to avoid ABSD and maximise your loan for the 2nd property- look no further and read our article on Deferred Payment Schemes.

Good thing is the ABSD rates for SCs and SPRs purchasing their first residential property will remain at 0% and 5%, respectively. These measures will not affect those buying an HDB flat or Executive Condominium unit from housing developers with an upfront remission, as long as any of the joint acquirers/purchasers is a Singaporean citizen.

Married couples with at least one SC spouse who jointly purchase a second residential property can continue to apply for a refund of ABSD, subject to certain conditions. These conditions include selling their first residential property within six months after the date of purchase of the second residential property if it’s completed, or the issue date of the Temporary Occupation Permit (TOP) or Certificate of Statutory Completion (CSC) of the second residential property, whichever is earlier, if the second property is not completed at the time of purchase.

It’s important to note that these measures will also help to stabilize private property prices and curb potential foreign investments. The government’s plan to increase housing supply on the Confirmed List to 4,100 units for the 1H2023 Government Land Sales (GLS) program from 3,500 units for 2H2022, and the launch of up to 23,000 flats in 2023, are part of this strategy. The government is also prepared to launch up to 100,000 new flats in total between 2021 to 2025, to cater to growing housing demand.

These measures have been calibrated to moderate housing demand while prioritizing owner-occupation and providing sufficient housing supply. Property seekers who are looking to buy for their own stay or HDB buyers will not be affected by these measures and will be provided with options for new flats. The government will continue to adjust its policies as necessary to ensure they remain relevant and promote a sustainable property market.

Joreen is the Sales Director at Bluenest and a seasoned property agent who's transacted over 600 properties since 2008. She specialises in residential properties and is adept at resolving complex queries for clients. Remarkably, Joreen was ranked top 20 in Singapore for the number of HDB properties transacted for the first half of 2019.