As a freelancer or self-employed individual, it can feel a little lonely when you’re applying for a home loan. After all, these processes were designed to serve the majority of the local populace – and to date, 92% of the workforce still have traditional office jobs.

The good news is that the self-employed population has since grown to a size of 200,000 and is increasing every year. As a result, more housing policies now include the interests of freelancers and self-employed folks.

That makes this an opportune time to share with you the latest considerations and how to secure a larger housing loan if you’re a freelancer or self-employed.

Here’s what you’ll learn:

As long as you work for yourself and aren’t employed by a company, you’re considered as self-employed.

Common examples include insurance agents, real estate agents, tuition teachers, freelancers, and so on.

Money talks. Your income is how the relevant authorities evaluate the amount they can give you. As a freelancer/self-employed individual, your income can vary depending on your business. Banks/HDB may feel uneasy unless they know that you can pay them back. For this reason, they require more concrete evidence that justifies your income over time. This brings us to point 2.

Many freelancers skip their CPF contributions to retain more spending income. In the long run, this can hinder family planning if you fail to obtain a larger housing loan.

You should have a record of CPF contributions for at least the past 2 years, or your latest IRAS Notice of Assessment. Tax filings are good support documents to support your loan applications.

Stable employment means a steady income stream. It’s vital for those freelancing or self-employed to note this. To justify your loan applications, you must provide evidence to show that you’ve been working consistently for the past 2 years. Other forms of verification can be through your bank statements from the past 6 months.

This is applicable if you’re getting a bank loan. Based on how well you’ve managed your credit in the past, banks determine your creditworthiness for the future. As home loans generally come with long-term tenure, credit score is a huge deciding factor.

To determine your credit score, banks look at the frequency of defaults or late payments. That means if you’re self-employed, it’s best to pay your bills punctually even when you’re low on income!

And on a more obvious (and grim) note, if you’ve ever declared bankruptcy, this puts a major dent in your credit score.

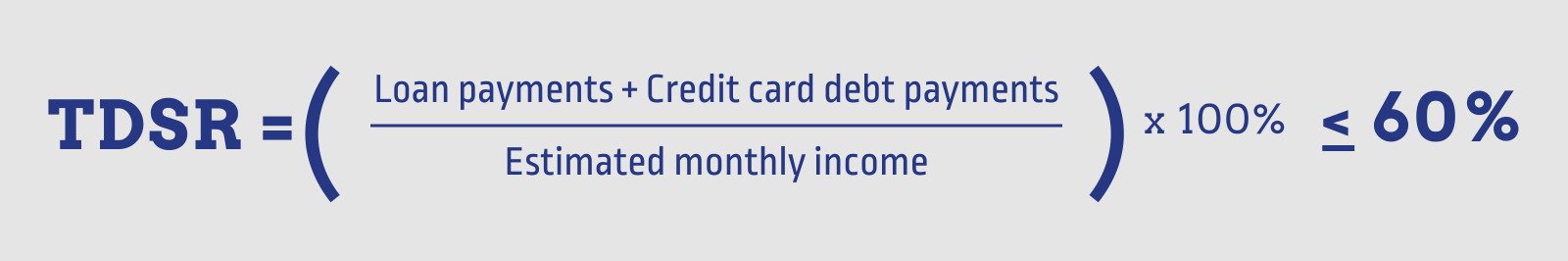

TDSR determines the maximum amount you can borrow. To ensure that you don’t overextend yourself, TDSR takes into account the repayments of all your existing credit expenses (e.g. car loan, study loan, credit card debts, etc.). Your total credit expenses should not exceed 60% of your monthly salary.

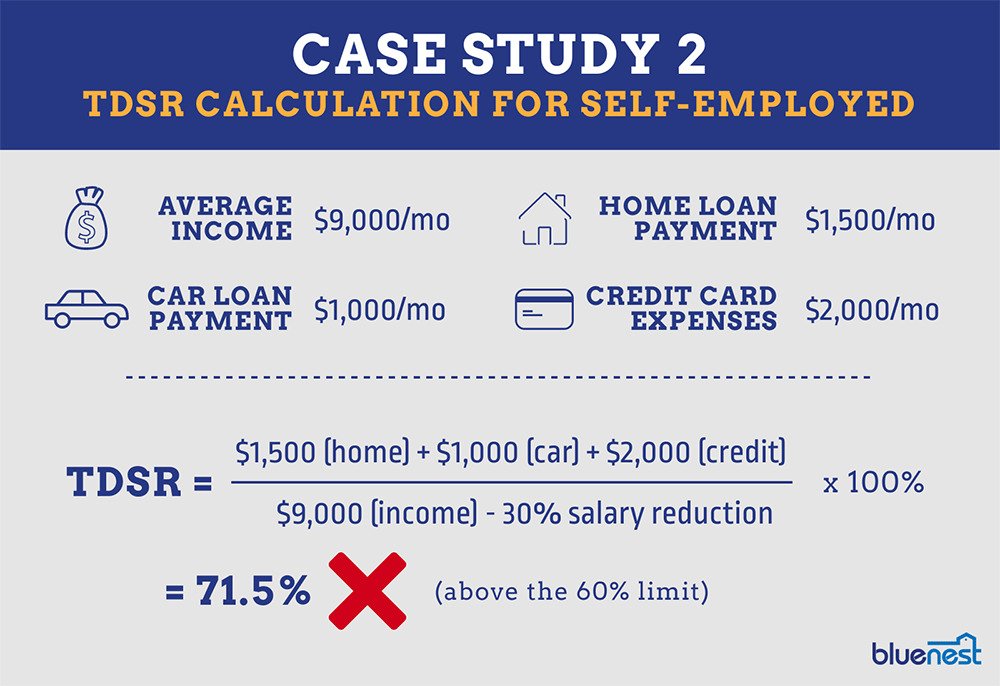

The conditions are even more stringent when you apply for a home loan on freelance income. Financial institutions generally assume your income is unstable, so they’ll reduce your stated monthly income by 30% when calculating your TDSR. (Read also: 3 Easy Keys to Deciding Between HDB vs Bank Loan)

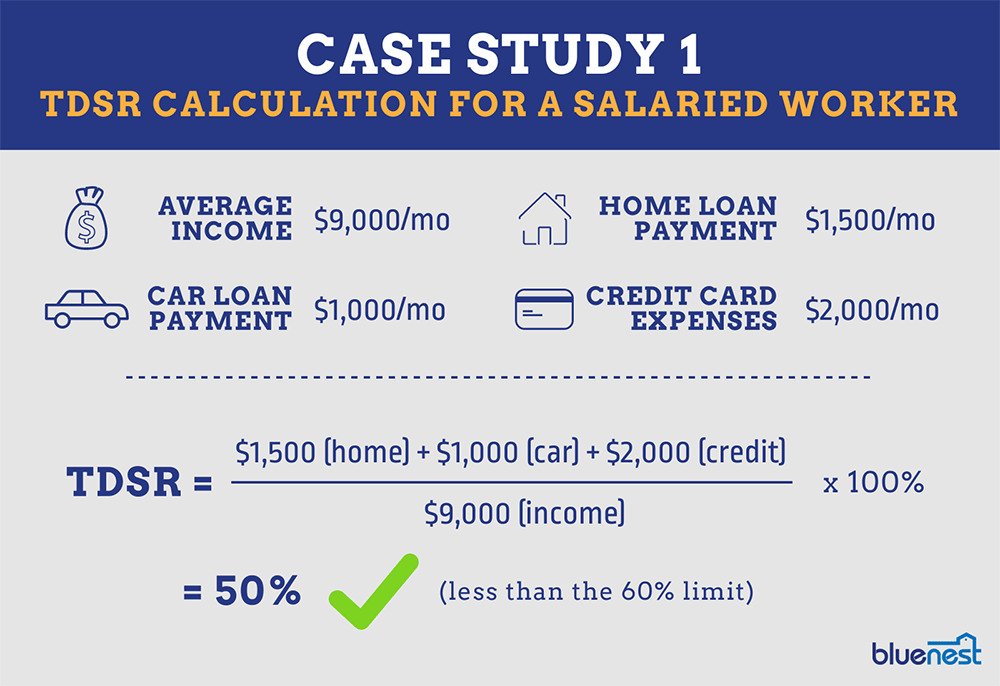

Sally is a regular civil servant who earns $9000 a month. She is currently servicing her car loan and credit card expenses. She is considering applying for a loan to finance her new home with a monthly repayment of $1500.

As Sally’s TDSR is less than the stipulated 60%, she would’ve gotten her loan approved.

Sally’s close friend, Nelly, is a freelance designer who similarly earns an average of $9000 per month. She has similar expenses compared to Sally and is currently considering taking up a home loan to buy a condo.

Unfortunately, as a freelancer, only 70% of Nelly’s $9,000 monthly income will be considered in the loan application. After factoring in her current loan obligations, a $1,500 home loan repayment would put her loans at 71.5% of her monthly income — way above the 60% TDSR limit. The bank rejects her loan application.

There are three main ways around it:

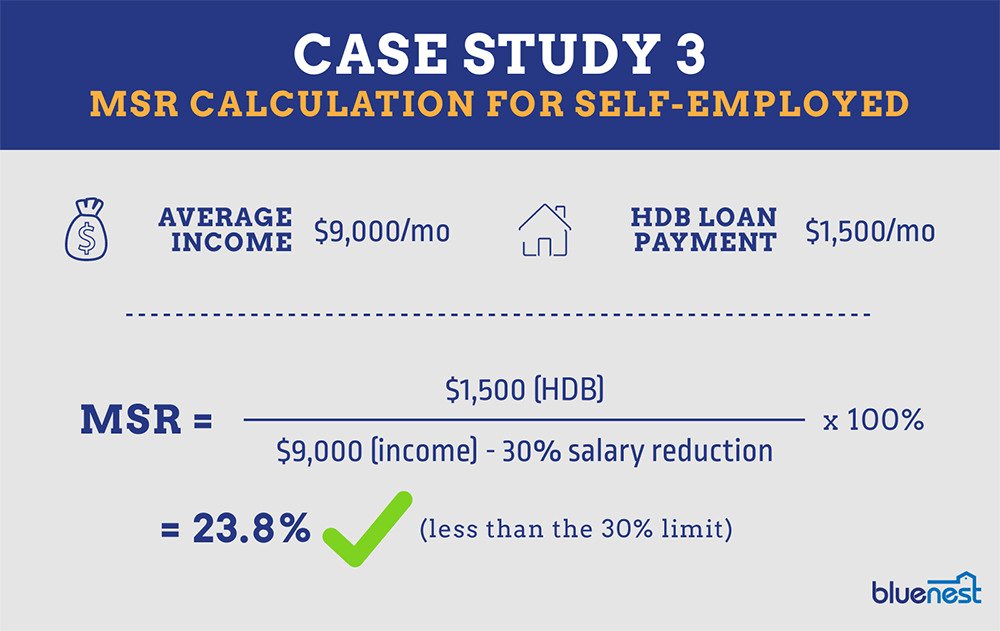

The MSR applies to those taking a loan to purchase an HDB flat or Executive Condo (EC). MSR limits your home loan repayments to 30% of your monthly income. Once again, there is a 30% reduction in your monthly salary if you’re self-employed.

Nelly decides to buy an HDB flat instead and is subjected to the MSR.

As Nelly’s MSR is lower than the regulated 30%, she can get her loan approved if it’s solely based on the MSR.

A year before applying for loans, you can take on more jobs (and therefore earn more income). The income value used for the loan calculations will be based on the higher amount you’ve earned for that whole year (as evidenced in your bank or CPF statements). After you’ve successfully secured a larger home loan, you can go back to working at your own preferred pace.

Was this article helpful? Good things must share!