47%. That’s almost half the Singaporean population who will be 65 and above by 2050. It may seem a little far-fetched to you now, but a bit of quick math and you’ll realize your retirement years aren’t as far off as you think. As Singapore heads towards an aging population, the government has implemented elderly-friendly housing regulations like the Lease Buyback Scheme.

For most of us, the lengths of our HDB leases tend to outlast our lifespans — even though Singaporeans have one of the longest life expectancies (at 84.8 years). Even if you were to live ‘til the ripe old age of 95, you may still have another 30 years left on your lease.

This is why the Lease Buyback Scheme was introduced. Discover what this HDB scheme is all about and how practical it is for you or your parents.

Simply put, the Lease Buyback Scheme helps elderly homeowners monetize the remainder of their flat leases by selling it back to HDB. This helps supplement their retirement funds.

For example, if you bought a brand-new BTO with your fiancé in your late 20’s, that HDB flat would easily be able to cover you until the age of 95. But even after that point, the flat would still have over 30 years left on the lease. Since your children (and other buyers) aren’t likely to want it, you can sell it back to HDB instead.

You qualify for the Lease Buyback Scheme if you:

There are four things you ought to know about the scheme:

To make sure your flat can last for your entire lifetime, HDB requires that you keep a certain number of years on the lease (depending on the age of the youngest owner). As long as that minimum requirement is met, the excess determines the net proceeds you can unlock.

Table 1: Lease Buyback Options

| Age of Youngest Owner | Min. Lease Retained (Years) | Other Options (Years) |

| 65-69 | 30 | 35 |

| 70-74 | 25 | 30, 35 |

| 75-79 | 20 | 25, 30, 35 |

| >80 | 15 | 20, 25, 30, 35 |

Unfortunately, you won’t get the entire sum in cash up front. The main purpose of the Lease Buyback Scheme is to ensure security in your retirement years, so the proceeds will first go towards topping up your CPF Retirement Account (RA).

Table 2: CPF RA Top-up Requirement for Flat Owners

| Flat Owner’s Age | Top-Up Requirement for 1 Owner | Top-Up Requirement for > 2 owners |

| 65-69 | $176,000 | $88,000 |

| 70-79 | $166,000 | $83,000 |

| >80 | $156,000 | $78,000 |

Once you have at least $60,000 in your CPF RA, these funds will be used to buy a CPF LIFE plan. This guarantees you a regular payout which you can calculate here. The downside is that you don’t really have any say in the matter unless you’re 80 years old or above (in which case you won’t be automatically included in CPF LIFE).

After the top-up, you’ll get the remainder in cash: up to $100,000 per household. Anything beyond that $100,000 and you’ll have to top up your RA even further (to the prevailing Full Retirement Sum) before you can get more cash.

If you top up your CPF RA with at least $60,000 from the Lease Buyback Scheme, you’re entitled to a Lease Buyback Bonus (LBB). But don’t worry if you didn’t manage to hit this amount, as you’ll still get a prorated LBB.

Table 3: Lease Buyback Scheme Bonus Allocation

| Type of Flat | Fixed Lease Buyback Bonus | Pro-rated Bonus |

| 3-room Flat | $20,000 | $1 for every $3 CPF top-up |

| 4-room Flat | $10,000 | $1 for every $6 CPF top-up |

| 5-room Flat | $5,000 | $1 for every $12 CPF top-up |

If you pass away before the expiry of the remaining lease, it’s up to your family members to decide what they want to do with the inherited flat. They can either stay in the flat for the remaining period or terminate it early. In the latter case, HDB will refund them a prorated amount based on the remaining value of the flat’s lease.

In return for the buyback proceeds, you can no longer sell your flat in the open market. Neither will you be able to rent out the entire flat even if the offer is generous.

And what if you happen to outlive the remaining lease after participating in the scheme? The gahmen has made assurances that you won’t be left homeless, but there’s no clear indication of the housing arrangements you’ll have.

And since the amount mainly goes into your CPF RA, CPF controls your pursestrings. You’ll get regular monthly CPF payouts for retirement expenses, but that won’t help much if you happen to have big-ticket expenses (like large medical bills).

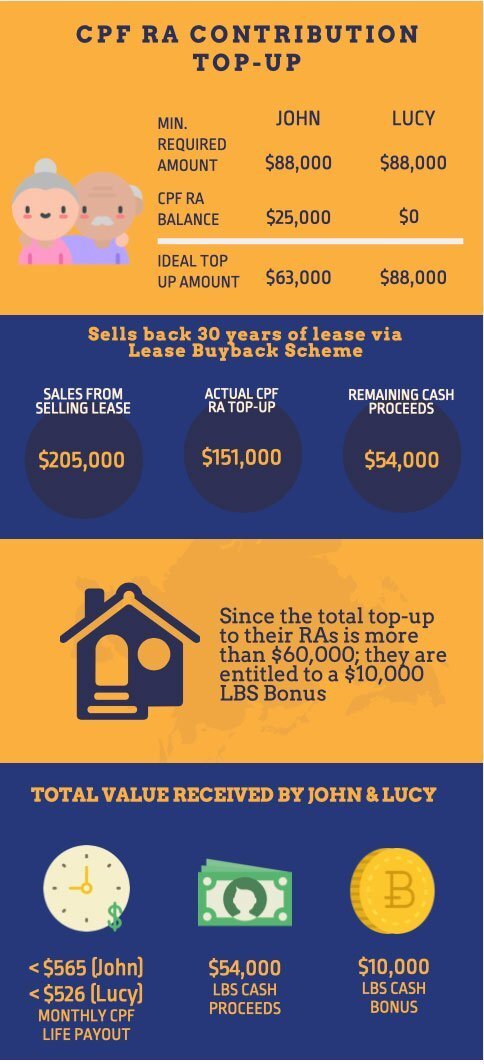

Case Study 1: John & Lucy, both Singaporean citizens aged 67 years old, own a 4-room flat with a balance lease of 60 years. The flat is valued at $450,000. Their tail-end 30-year lease is valued at $205,000.

John had prior CPF contributions for his RA at $25,000. Lucy has been a homemaker for her entire life with no CPF contributions.

Both John and Lucy top up their CPF RAs to the minimum required amount of $88,000. They receive the rest of the LBS proceeds in cash ($54,000). Based on their RA balances, we computed the maximum CPF LIFE payout each individual can receive every month.

Case Study 2: Jack (aged 72) & Jill (aged 65) own a 3-room flat with a balance lease of 55 years. Both are Singaporean Citizens. The flat is valued at $250,000. Their tail-end 25-year lease is valued at $54,000.

Jack had prior CPF contributions for his RA at $30,000. Jill has been a homemaker for most of her life with $3,000 in CPF RA contributions from work.

Jack & Jill need to top up their CPF RAs with $53,000 and $85,000 respectively to reach the minimum Basic Retirement Sum (BRS).

However, their Lease Buyback proceeds only amount to $54,000. Each of them receive a $27,000 top-up, so Jack and Jill’s actual RA balances are now $57,000 and $30,000 respectively.

Was this article helpful? Good things must share!

Can lease by back flat be inherited by siblings, upon owners death, and stay the remaining years ?

Hi Ho SC, thanks for reaching out! That would not be possible 🙂 Do hope this helps 😉