As the world opens up again, more investors are looking towards the Asia-Pacific for diversification, yield, and growth.

It’s not surprising that Singapore, in particular, stands as an attractive hub for foreign investment. With its first-rate infrastructure, political stability, and favourable tax policies for both businesses and foreigners, the city-state is a safe haven for investors.

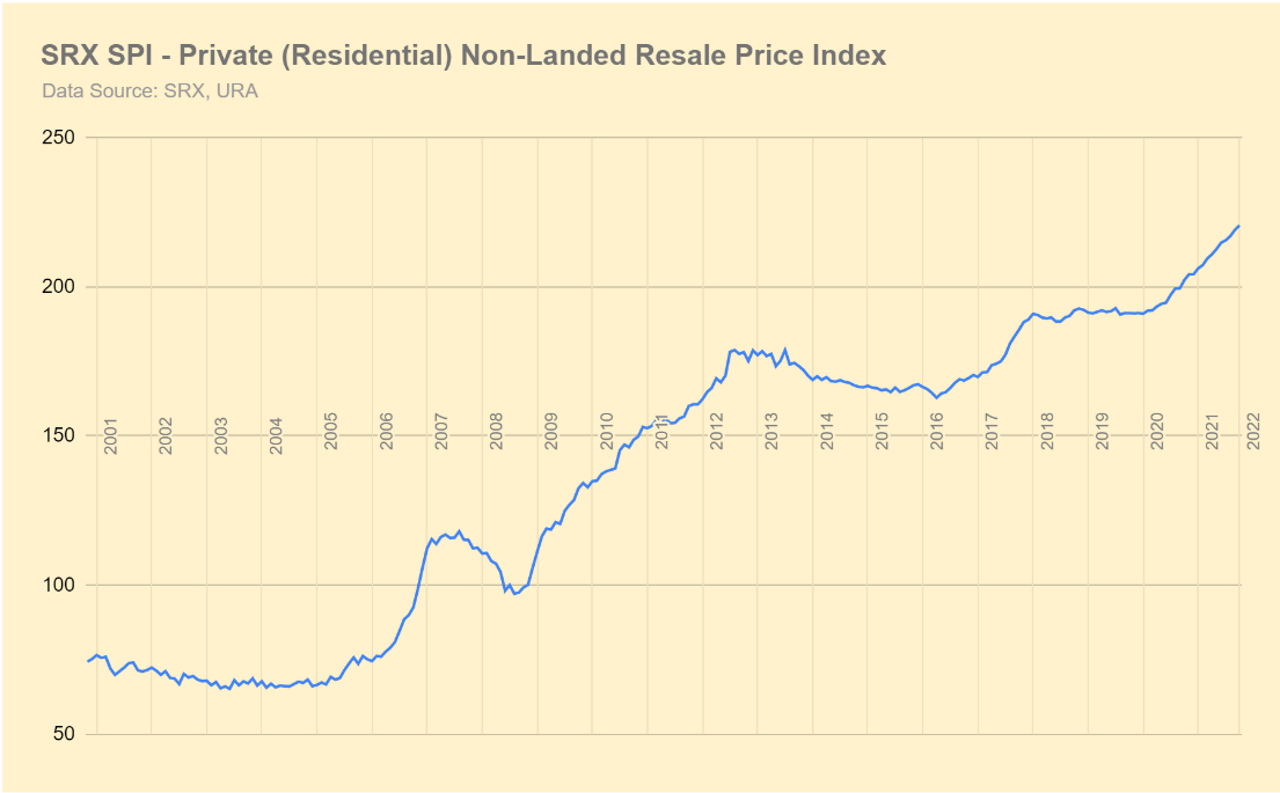

After all, Singapore has seen an unprecedented rise in property prices since 2006. Even with the 2008 Financial Crisis, COVID-19 epidemic, and several rounds of property cooling measures from the government, prices have continued their upward trend:

So it’s no wonder that both locals and foreigners alike see Singapore’s property market as a good hedge against inflation.

In this guide, we’ll cover:

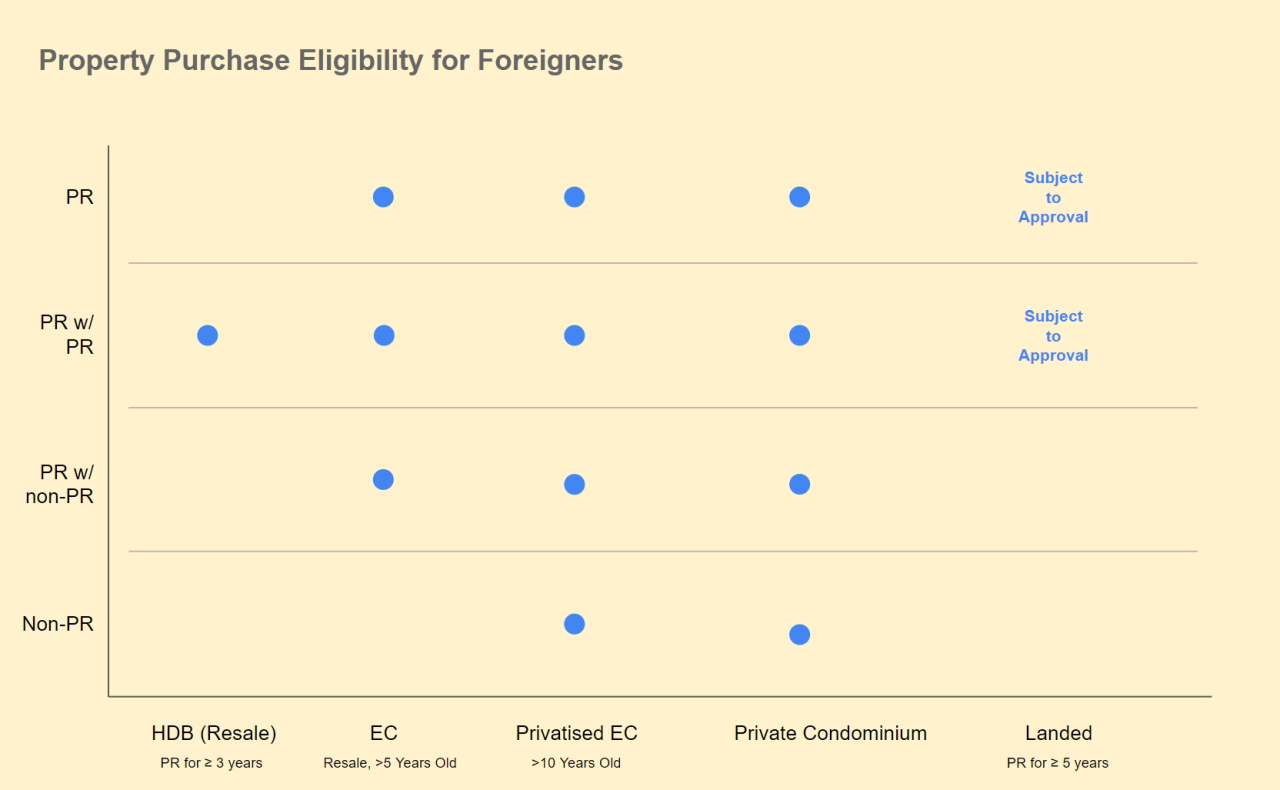

In short: yes. Although the local government policies favour citizens, you don’t need to be a Singapore citizen or permanent resident to buy property in Singapore.

There are restrictions as to what you can buy as a foreigner, though. Eligibility also depends on whether you’re married to a Singaporean citizen or PR, and whether you’re seeking to buy private or public housing.

Public housing, which includes HDB flats and Executive Condominiums (ECs), have the most restrictions for foreigners.

Currently, the private residential property foreigners can buy include:

Private condos tend to be the property of choice for foreigners because they have the fewest restrictions and are widely available.

Read also: How to Buy Resale Private Property in Singapore (Step-by-Step Guide)

Strata landed houses in condo developments are also rare and typically only seen in older estates.

Foreigners who become permanent residents in Singapore can also purchase public housing such as resale flats and Executive Condominiums (ECs). However, you’re subject to an income cap as well as stipulations on marital status and overseas property ownership. You can find detailed eligibility requirements on HDB’s website.

Generally no – you’ll have to get approval from the Singapore Land Authority (SLA) if you wish to do so.

The SLA will assess your request on a case-by-case basis. Approval depends on factors like:

Sentosa Cove is the one exception. If you want to buy landed property there, you’re much more likely to get fast-tracked approval. Just note that the properties there are leaseholds and have a reputation of being hard to resell.

For the most part, Singapore property laws are favourable for foreigners with a longer-term view. For instance, it’s legal to give your property away (say, to your children) without any monetary compensation. You do have to pay stamp duty on the market valuation of the property though.

Also, any profit you make from selling property isn’t taxed under Singapore laws, unless your main business is trading real estate.

But there are a few other questions you may have, such as:

Yes, but you’re subject to the Loan-to-Value (LTV) limit just like the locals. This dictates how much you can borrow based on your current leverage. If you don’t have an existing bank loan, you can borrow up to 75% of the purchase price. If you have one or more loans, you can borrow up to 45% or 35% respectively.

There are 3 main stamp duties of note to foreigners buying property:

Read also: 7 Things to Know About ABSD for Your 2nd Property

As with any investment, property purchases in Singapore have their own risks. This is especially true considering Singapore is one of the most expensive places in the world for private property.

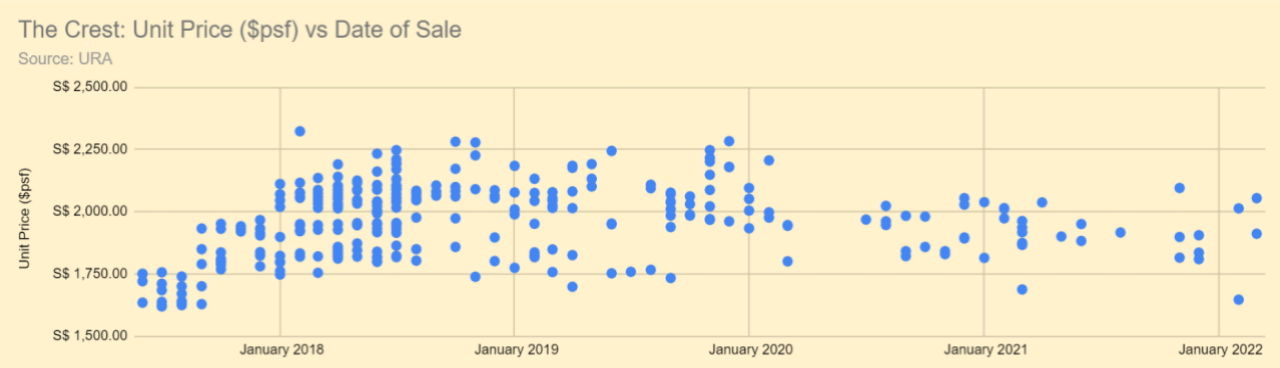

Pick the wrong development and you could be stuck with an asset with low capital appreciation and low liquidity.

One such development was Wing Tai’s The Crest, which had only 18% of units sold years after its launch. From 2017 to 2022 the price per square foot has fluctuated between S$1,628 – S$2,323, with the high of S$2,323 transacted in Feb 2018.

Then there’s also the fact that most properties in Singapore have a leasehold tenure. That means you’re technically not buying the property – you’re renting it for the duration of the remaining lease (or until you sell it). When that lease is up, the land returns to the government.

While it’s true that older properties have the potential to go en bloc (meaning developers buy up the land in hopes of redeveloping and selling it for higher), it’s also possible for those 99-year leases to go to zero.

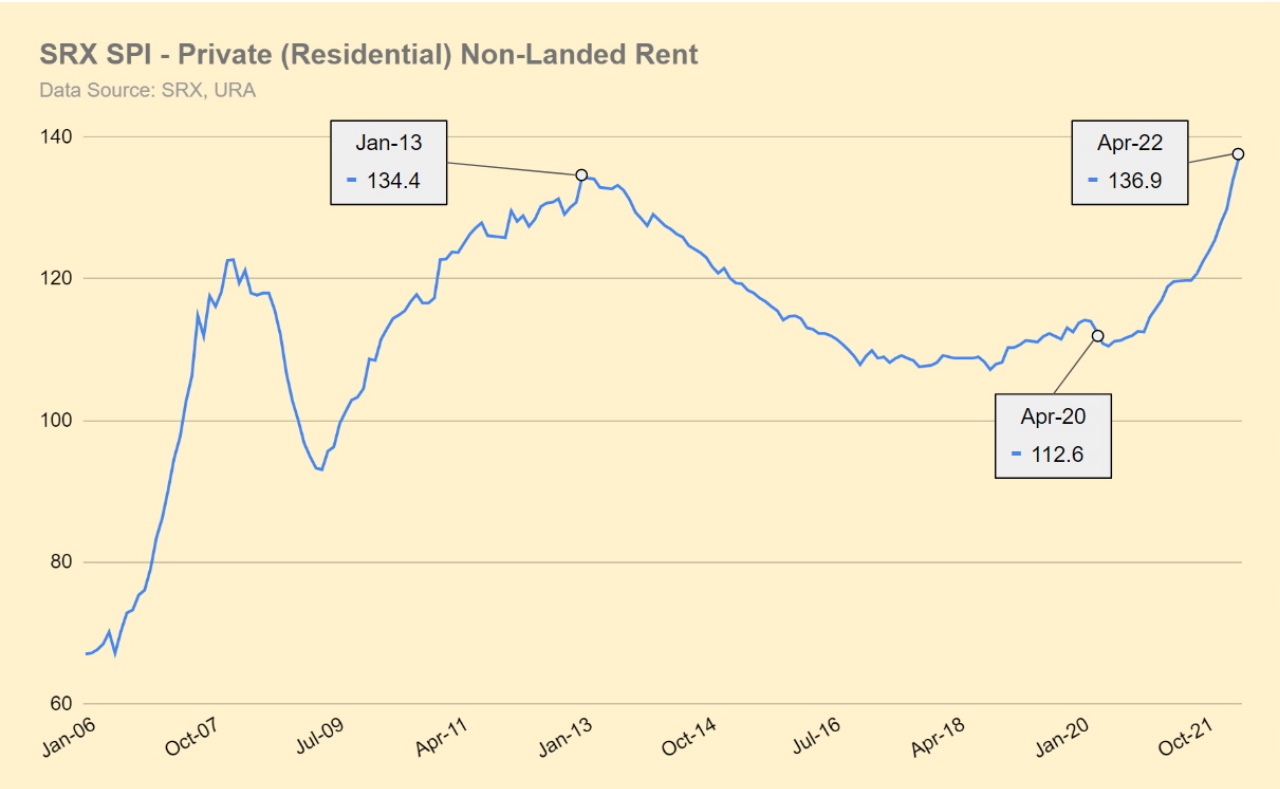

If you’re banking on the property as a source of rental income, be mindful of this risk. The rental market in Singapore has been thriving as of late, but the data shows that there are always peaks and troughs in the cycle:

When supply outstrips demand, prices tend to drop and there may be more vacant units on the market.

Read also: How to Determine Market Rental Rates for Private Property (2022 Guide)

If you’re still weighing whether to purchase real estate in Singapore, here’s our take on where the market currently stands:

At the end of 2021, the Singapore government introduced a new round of property cooling measures in a bid to stem the steep sales and rental price growth. Foreign buyers must now pay an ABSD rate of 30% (up from 20%).

In spite of these cooling measures, prices have continued to rise. Analysts have identified several potential drivers:

1. Lower-than-average new launches of private condos are expected throughout 2022. There will be a projected 7000 to 8000 new launches this year, which is a 25.5% drop from the average of 10,750. Reduced supply with increasing demand may lead to higher prices. (Source: The Business Times)

2. An increase in foreign buyers. 59 private condos were sold to foreigners in April 2022 – up from the average of 40 per month in 2021. (Source: The Straits Times) Even with the rise in ABSD, Singapore property remains an attractive investment.

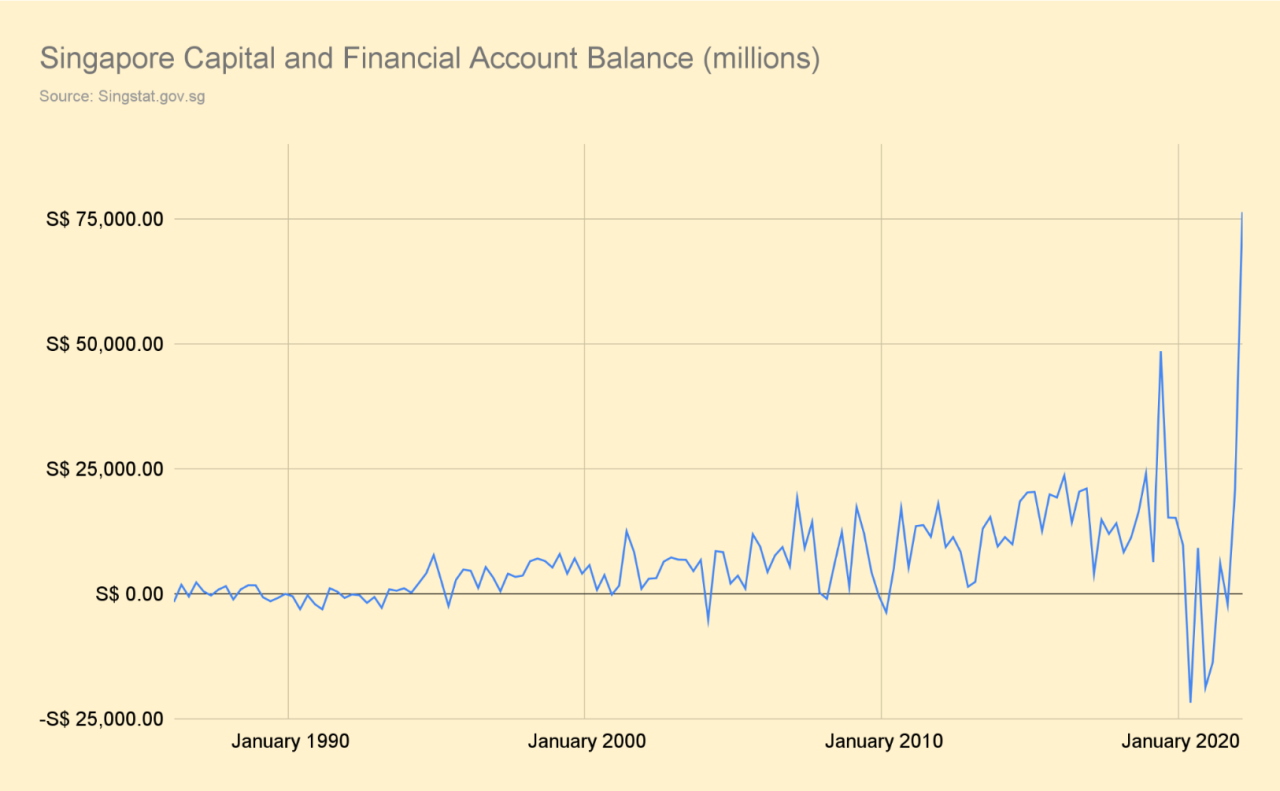

3. Global geopolitical tensions may be driving a capital flight to safety. In Q1 of 2022, Singapore saw a record-high capital and financial surplus of S$76 billion. This is the highest account balance on record:

4. Property is still a popular hedge against inflation, based on the widespread belief that land scarcity leads to property values keeping pace with consumer price increases. (We should add that this isn’t always true – it still depends on the price and quality of the real estate you’re buying.)

If inflation remains high amid record commodity prices (especially oil), household spending will decrease along with demand for property. Some may even be forced to sell to rein in their spending.

“We’re already seeing a drop in viewing enquiries since interest rates went up,” notes Bluenest CEO Jeff Lim. “Buyers seem to be on hold right now.”

And interest rates continue to climb. The US, UK, Australia, and South Korea are among the many countries that have raised their rates, with the US expecting four more rate hikes in 2022.

This will increase the cost of financing for new purchasers as well as funding costs for those with floating mortgages. In the 3rd quarter of last year, household debt in Singapore rose to a high of 70% of GDP – up from 67.1% a year prior.

Analysts also predict a global recession in the next two years. Historically, GDP contractions have led to depressed housing prices.