Let’s face it: living in Singapore is expensive. And we’re not just talking about cars. While you can definitely take public transport, you can’t live on the streets. One of the unique policies of our government is that it prioritizes affordable housing for its citizens. But with land scarcity, keeping home prices affordable is becoming tough. In recent years, it’s become more and more difficult for Singaporeans to buy their first house.

The good news is that it’s still entirely possible. After all, we’ve got one of the highest home ownership rates in the world, and Singapore has consistently hovered around 90% home ownership. (Source: SingStat.gov.sg)

So how do you go about planning your finances to buy this seemingly “expensive” house of yours?

Many people begin house hunting by going onto one of the many property search portals in Singapore. They key in their criteria and start browsing the pictures of their potential dream homes.

It’s a little like looking for your perfect wedding dress or venue…until you realize the cost is way out of your budget. (Read also: What Kind of Property Can You Buy in Singapore?)

The same goes when you buy your first house. Start with knowing what you can afford, then work within your means to find a suitable home.

So your first step should be to figure out your ability to finance your home purchase.

You can estimate your total budget by taking into consideration the following:

For many people, the down payment could be the main financing problem as cash is required.

If you’re using an HDB Concessionary Loan, you’ll need to make a down payment of 10% of the purchase price or valuation, whichever is higher. The down payment can be paid using your CPF OA, cash, or a combination of both. (Read also: 3 Easy Keys to Help You Decide on HDB Loan vs Bank Loan)

If you’re using a private bank loan, you’ll need to make a down payment of 25% of the purchase price or valuation, whichever is higher. At least 5% of this down payment MUST be in cash and the remaining 20% can be paid with your CPF OA, cash, or a combination of both.

So using a $1,000,000 condominium unit as an example, you can expect to make a down payment of $250,000, of which $50,000 will be in cash.

Other than the down payment, another major initial cost you’ll need to note is the Buyer Stamp Duties (BSD). BSD is payable when you buy a house in Singapore. The amount of BSD you need to pay depends on whichever is the higher of the following:

The table below details the current BSD rates (accurate as of July 29th, 2019):

| Purchase Price / Market Value | Rates |

| First $180,000 | 1% |

| Next $180,000 | 2% |

| Next $640,000 | 3% |

| Remainder | 4% |

You can also use this Stamp Duty Calculator to help you figure out how much you’re liable to pay.

Depending on your residential status, you might be subjected to the Additional Buyer Stamp Duty (ABSD) as well:

| Profile of Buyer | ABSD Rates |

| Singapore Citizen buying 1st residential property | N.A. |

| Singapore Citizen buying 2nd residential property |

12% |

| Singapore Citizen buying 3rd and subsequent residential property | 15% |

| Singapore Permanent Residents (SPR) buying first residential property (with certain exceptions) | 5% |

| SPR buying second and subsequent residential property | 15% |

| Foreigners (FR) buying any residential property (with certain exceptions) | 20% |

Other than that, you’ll also have to set aside a budget for renovations and furnishing your home. This amount can vary widely depending on your preferences. Some take just about $10,000 to buy essential furniture, while others may spend 6-figure sums to renovate the house of their dreams.

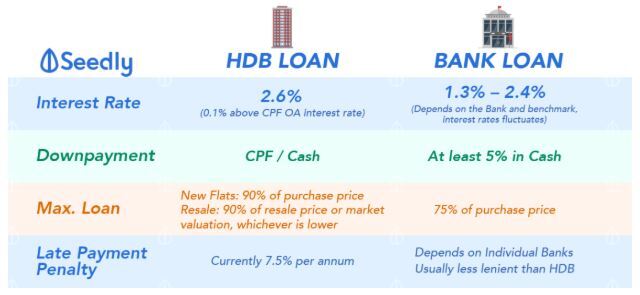

To finance the purchase of your home, you can use either a bank loan or an HDB Concessionary loan. What’s the difference?

(Source: Seedly)

(Source: Seedly)

As you can see from the graphic above, a bank loan usually charges a lower interest rate compared to an HDB loan. (Read also: 3 Easy Keys to Help You Decide on HDB Loan vs Bank Loan)

So why would anyone take up an HDB loan? For one, the maximum loan you can take is much higher (90% from HDB compared to 75% from banks). This would come in useful for those with less cash on hand.

To get a housing loan from HDB, there are eligibility criteria to fulfill which you can find out about here. You’ll also need to apply for an HDB Loan Eligibility letter or work out an estimated loan assessment using the Enquiry on Loan Estimate e-Service.

Your eligibility to apply for a mortgage loan depends on three important factors: Mortgage Service Ratio, Total Debt Servicing Ratio, and Loan-to-Value (LTV) ratio.

The Mortgage Servicing Ratio (MSR) refers to the portion of a borrower’s monthly income that goes towards repaying property loans. MSR is currently capped at 30% of a borrower’s gross monthly income.

This only applies to home loans for the purchase of an HDB flat or an executive condominium bought directly from a developer.

To calculate your MSR, use the following formula:

(Monthly repayment installments for all property loans / Gross monthly Income) x 100% ≤ 30%

So for instance, if your monthly repayments cost $1,000 and you earn $4,500 per month, your MSR will be 1000 / 4500 x 100% = 22%.

The objective of the MSR is to ensure that borrowers do not overextend themselves by borrowing more than they are able to pay.

If you’re taking out a home loan to finance a private property, then the TDSR applies to you.

TDSR refers to the proportion of your monthly income that is spent on repaying debt. According to MAS policy, your TDSR must not exceed 60%.

The monthly debt repayment covers not only mortgage loans, but also bank loans, car loans, renovation loans, and even outstanding credit card payments. You can use this handy calculator to help you calculate your TDSR.

The Loan-to-Value (LTV) limit determines the maximum amount an individual can borrow for a housing loan.

LTV refers to the loan amount as a percentage of the property’s price. For example, if you borrow $750,000 to purchase a property valued at $1 million, the LTV is 75%.

LTV = Loan amount / Property price

The bank or HDB will consider the following before granting the LTV:

The LTV limit is dependent on the number of outstanding housing loans a borrower has.

As of 6 July 2018, the following rules on LTV apply:

| Outstanding Housing Loans | LTV Limit | Minimum Cash Downpayment |

| 0 | 75% or 55% | 5% for LTV of 75% 10% for LTV of 55% |

| 1 | 45% or 25% | 25% |

| 2 or more | 35% or 15% | 25% |

The lower LTV limit applies if the loan tenure exceeds 30 years (or 35 years for non-HDB flats), or the loan period extends beyond the borrower’s age of 65 years.

You can use this mortgage calculator to help you estimate the monthly repayments for your dream home.

(Read also: The Step-by-Step Guide to Buying a Resale HDB Flat)

Joreen is the Sales Director at Bluenest and a seasoned property agent who's transacted over 600 properties since 2008. She specialises in residential properties and is adept at resolving complex queries for clients. Remarkably, Joreen was ranked top 20 in Singapore for the number of HDB properties transacted for the first half of 2019.