Buying a property is probably the single biggest purchase you’ll have to make in your life.

And unless you happen to have a ton of cash readily available, you definitely want to make sure you’re fully aware of all the cheques you’ll need to write along the way.

You probably know that it isn’t just the purchase price and the interest on the home loan you’ll have to pay.

There are many other costs when buying a property in Singapore – from HDB, IRAS, the banks, the property valuation professionals, and even insurance companies.

So without further ado, let’s dive right into it!

This applies for both HDB and private property, but the amounts are significantly different.

If you’re buying a new flat directly from HDB, you’ll pay a fixed Option Fee depending on your flat type:

This Option Fee counts toward your downpayment when you sign the Agreement for Lease at the next appointment. (There is no Option Exercise Fee for new HDBs.)

If you’re buying a resale HDB, the Option Fee will be set by the seller and can be anywhere from $1 to $1,000. The exact amount is negotiable, but the Option Fee + Option Exercise Fee shouldn’t exceed $5,000. These two amounts make up the deposit for the resale flat.

For private property: You’ll hand over 1% of the property’s purchase price as the Option Fee, then another 4% or 9% as the Option Exercise Fee (the exact percentage depends on the agreement).

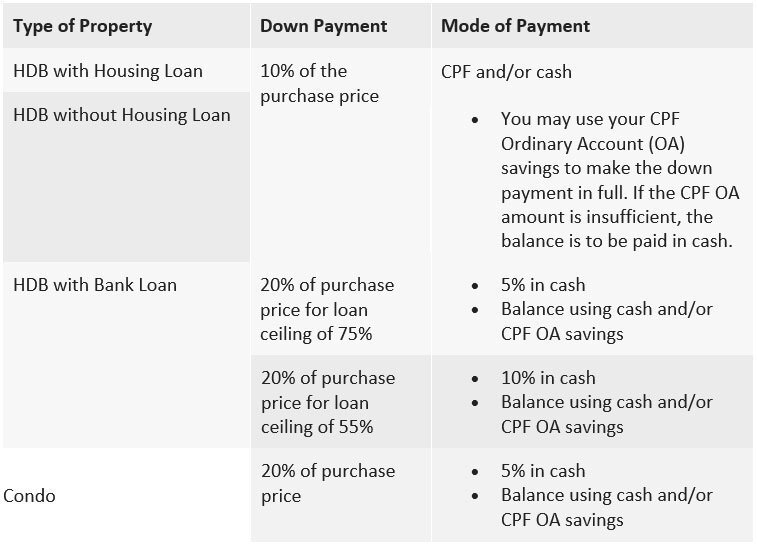

The amount you’ll fork out for the downpayment depends on the kind of housing loan you get (if any).

The table below details the amount you’ll need:

This is a small sum, but we’ve thrown it in just to be thorough.

If you’re applying for a new flat from HDB, it’s $10 to submit your application.

Executive Condominiums (EC) and DBSS flats also have application fees, but the developers determine the amount payable.

Resale flat application fees are pegged at $40 for one or two-roomers or $80 for larger units.

This is only if the seller needs more time before they move out of your (newly purchased) HDB resale flat. You can choose to grant them a Temporary Extension of Stay, in which case they can stay for up to 3 months more.

This is a favor to the sellers, though, and you can choose not to grant them the extension if your circumstances don’t allow it. There’s an administrative fee of $20 to apply for this, but the sellers should reimburse you.

You’ll need a valuation report if:

With HDB, you can submit a Request for Value after you’ve got the Option to Purchase from the seller. This will cost you a non-refundable $120 processing fee.

If you’re buying private property with a bank loan, the bank will typically have their own panel of licensed valuers. The cost of the valuation report can be anywhere from $200-$400.

If you’re buying an HDB flat, fire insurance is compulsory. It only costs $1.50 to $7.50 for 5 years though, so it won’t burn a hole in your pocket.

HDB flat owners using CPF monies are also automatically enrolled for CPF’s Home Protection Scheme. This protects you from losing your flat in the event that you can no longer pay off your housing loan because of terminal illness, disability, or death.

A more significant sum to take note of is the cost of a comprehensive home insurance policy. HDB’s basic fire insurance really only covers fire damage to the structure of the building – meaning if your personal belongings or furniture have been reduced to ashes, you’re out of luck.

Depending on the coverage, a comprehensive policy will set you back $45 to $700+ per year.

This is similar to CPF’s Home Protection Scheme in that it protects you from losing your home in the event of some life-changing circumstance.

However, the Home Protection Scheme only applies to HDB flats, so if you’d like a similar guarantee for private property, you’ll have to get it from a private insurance company.

Certain banks will require you to get a Mortgagee Interest Policy (MIP) if you take up a home loan with them. This basically protects the bank if your collateral (i.e., your property) is damaged in some way, since the bank can claim insurance for the damage.

This is applicable if you decide to engage an agent to shortlist suitable properties or negotiate a good price on your behalf.

The amount you’ll pay depends on the type of property you’re buying. In general, though, it’s 2% of the purchase price for resale HDB flats (1% if you go with Bluenest) and free if you’re buying a private property.

Ever had someone offer you one cent on the first day, two cents on the second, double that on the third, double again on the fourth – and so on and so forth for a whole month?

By the 30th day, you’d be getting over five million dollars. It’s crazy how the power of compounding works, right?

Similarly, the interest on your home loan may seem insignificant compared to the lump sum of the purchase price, but it adds up over time.

This is why it’s worthwhile shopping around for the best loan interest rates, and why some people even refinance their home loans every few years. (Read also: HDB Loan vs Bank Loan – Which is Best for You?)

We cover this in our article on calculating your finances before purchasing a home, so we won’t go into too much detail here.

The main thing to keep in mind is that you’ll have to pay a Buyer Stamp Duty (BSD) on any property purchase – and an Additional Buyer Stamp Duty (ABSD) if this is your second property or beyond.

And if you’re a PR, you’ll need to pay a 5% ABSD even if it’s your first property (unless you happen to be from an exempted country).

You’ll definitely need a lawyer in the later stages of the purchase, since certain documents can only be filed by the lawyer.

Also, your lawyer will help to do the due diligence to make sure that the property you’re buying is actually owned by the person you’re buying it from (yes, such fraud cases do happen).

These conveyancing lawyers will charge you fees for the service, of course. HDB solicitors cost significantly less – you’ll pay only a few hundred bucks. If you go with a private law firm, be prepared to pay anywhere from $1,800 – $3,000.

Note that some lawyers will also charge you extra fees to apply for the use of your CPF.

This applies only if you’re buying a new HDB flat or Executive Condominium (EC).

There’s a survey fee of anywhere between $150 to $375 (depending on your unit type), which covers the cost of a surveyor inspecting the condition and value of your flat.

Then there’s the $38.30 flat fee for the lease in-escrow registration / mortgage in-escrow registration.

A caveat is basically an official notice that you’re buying the property. Your HDB solicitor / private law firm will file it on your behalf to prevent the property from being sold to other people.

The buyer’s caveat will cost $64.45, and the Title Search Fee will cost another $32.

If you got a home loan, you’ll have to get a Mortgagee’s Caveat and cough up another $64.45.

Since the housing loan is a legal process, it has its own set of legal fees.

The fees for HDB loans aren’t much compared to those of a bank loan. There’s a minimum fee of $20 if HDB acts for you in the mortgage, but other than that, you can get the exact amount with their handy calculator.

With a bank loan, you might get subsidies if the loan amount is above $300,000 (for HDB) or $500,000 (for private property), but if it isn’t, expect to pay somewhere around $1,800 for HDBs and $3,000 for private properties.

You’ll also have to pay stamp duty on the mortgage documents. This will cost 0.4% of the loan secured – but luckily, it’s capped at $500. You can pay for this using CPF as well.

In your scramble to get everything sorted out with the purchase, don’t forget to factor in the cost of doing up your new home!

The amount you’ll spend really depends on your aesthetic preferences. Some opt for the DIY route and only spend about $5,000 here. Others go all out with the custom-made furniture and interior design and end up spending over $100,000.

Swimming pools, gyms, clubhouses, and all that jazz cost money to maintain – and the condominiums have passed on these costs to you.

Maintenance fees vary from condo to condo, but expect to pay a few hundred a month.

Some condominiums charge up to a thousand, though, so make sure you check on the charges before you cough up that downpayment!

This is basically HDB’s version of the private condo maintenance fees. The Service & Conservancy Charges are what you contribute for the general upkeep of your neighborhood.

The exact amount depends on your area and flat type, so check with your Town Council for more details.

Last but not least: remember to factor property taxes and the cost of power, gas, and water into your housing expenses.

With the introduction of the Open Electricity Market (OEM) earlier in 2019, electricity prices have become significantly cheaper. Electrify.sg has a handy tool you can use to search for the best power provider, if you haven’t already made the switch.

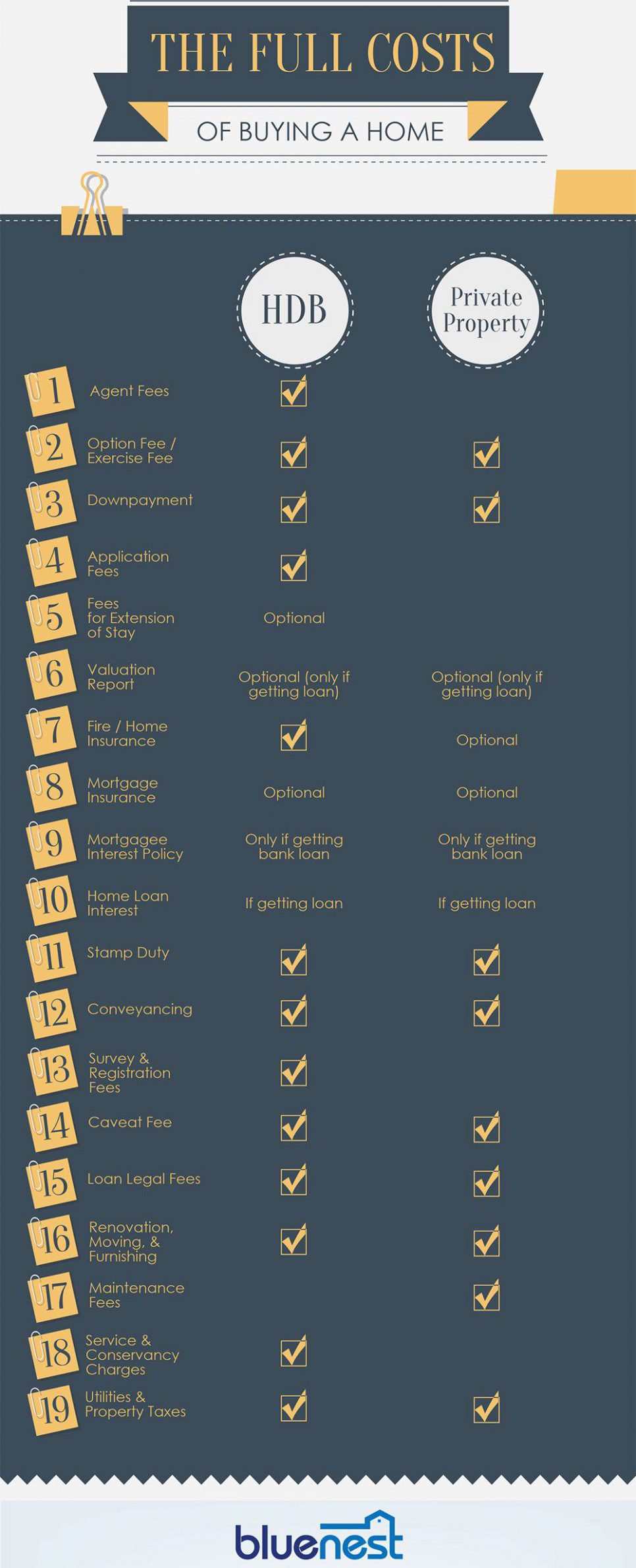

Finally, here’s a summary table of all the one-time and recurring costs you can expect to pay:

Meiling is an American-born Chinese living in Singapore. As a property owner herself, she enjoys doing research into the local real estate market and making highly technical topics easy to understand for readers. In her spare time, Meiling enjoys going for a long run or snuggling into her armchair with a good book.