16 Dec 2021 marked a fresh round of property cooling measures, including an ABSD hike. And with the higher taxes deterring homebuyers, it’s understandable that condos with dual key units started getting more attention.

Who wouldn’t be enticed by ad copy like “two for the price of one!” or the prospect of renting out part of your home while retaining your privacy as a live-in landlord?

Still, dual key condos tend to be expensive. After all, there aren’t many on the market and demand tends to outstrip supply.

But what if we told you there’s a way to get a dual key condo at the same monthly instalments as an HDB flat?

No scams – read on to find out.

Condos with a dual key concept share the same main door but branch off into separate entrances for their individual units. They usually come in 3- or 4-bedroom configurations, with one segment turned into a studio apartment on its own.

This allows multigenerational families to stay close to each other in separate units – or the owner to rent out one unit while staying in the other. Because of the premium Singaporeans place on privacy, dual key units purportedly fetch a higher rental yield than their regular counterparts.

They’re also considered the same property in the eyes of tax authorities, so buyers don’t have to pay ABSD.

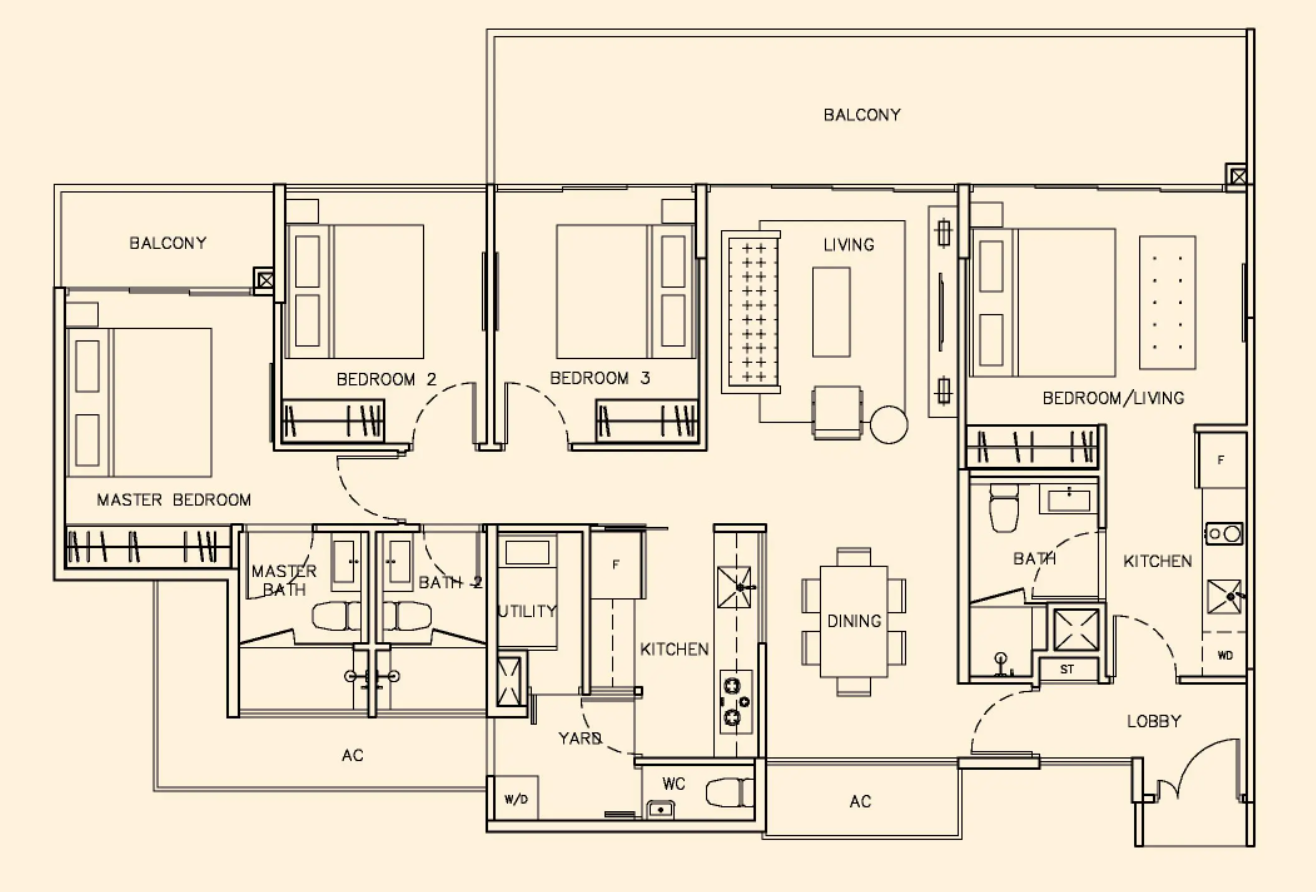

Here’s an example of a 4-bedroom dual key unit at Parc Olympia:

Still, dual key condos tend to be a niche investment. Part of the reason developers don’t make many of them is that they appeal to a smaller subset of the market.

And because most dual key units are in newer developments, they come with a higher $psf and possibly fewer amenities.

But what if you could have the larger square footage and amenities of an older condo and the perks of a dual key condo?

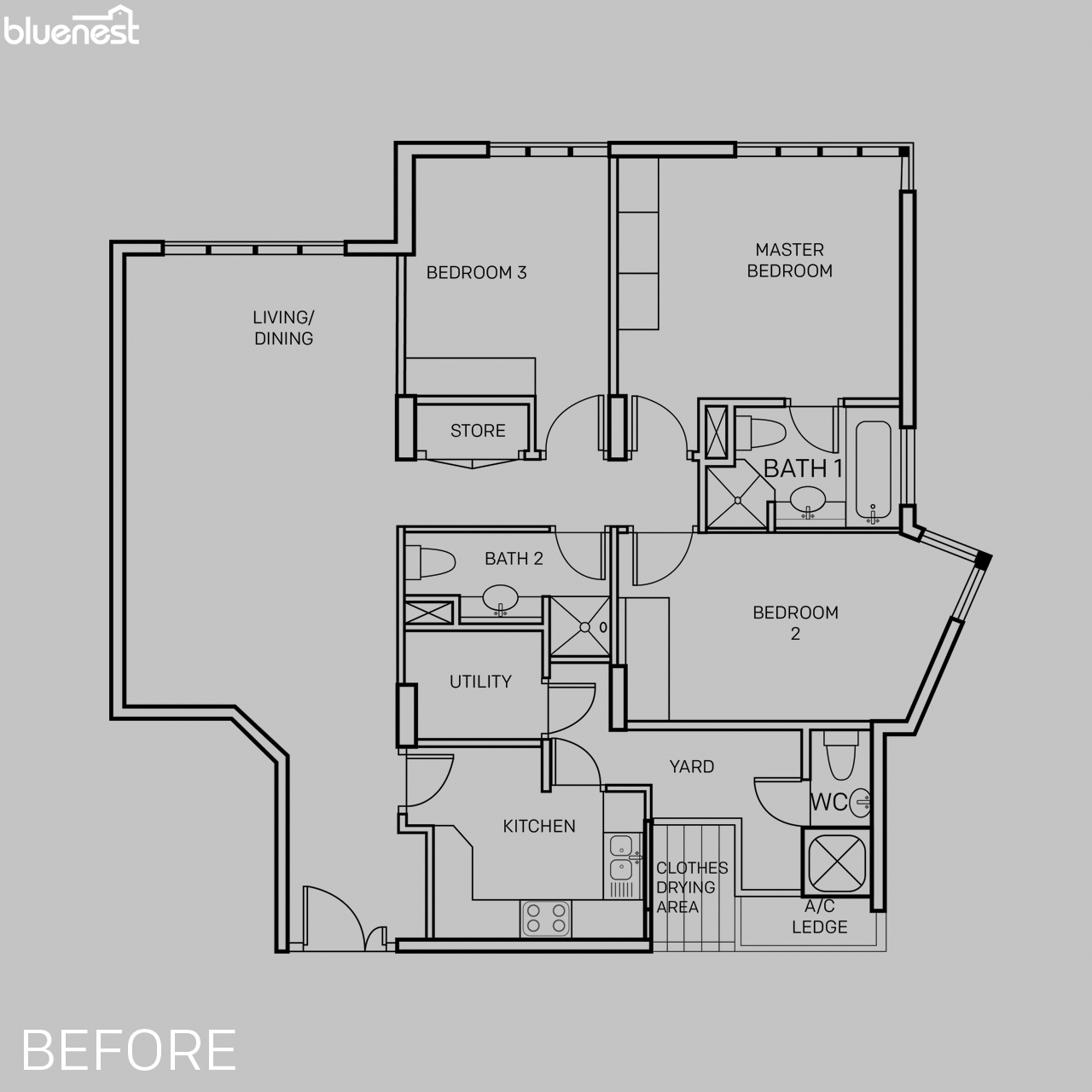

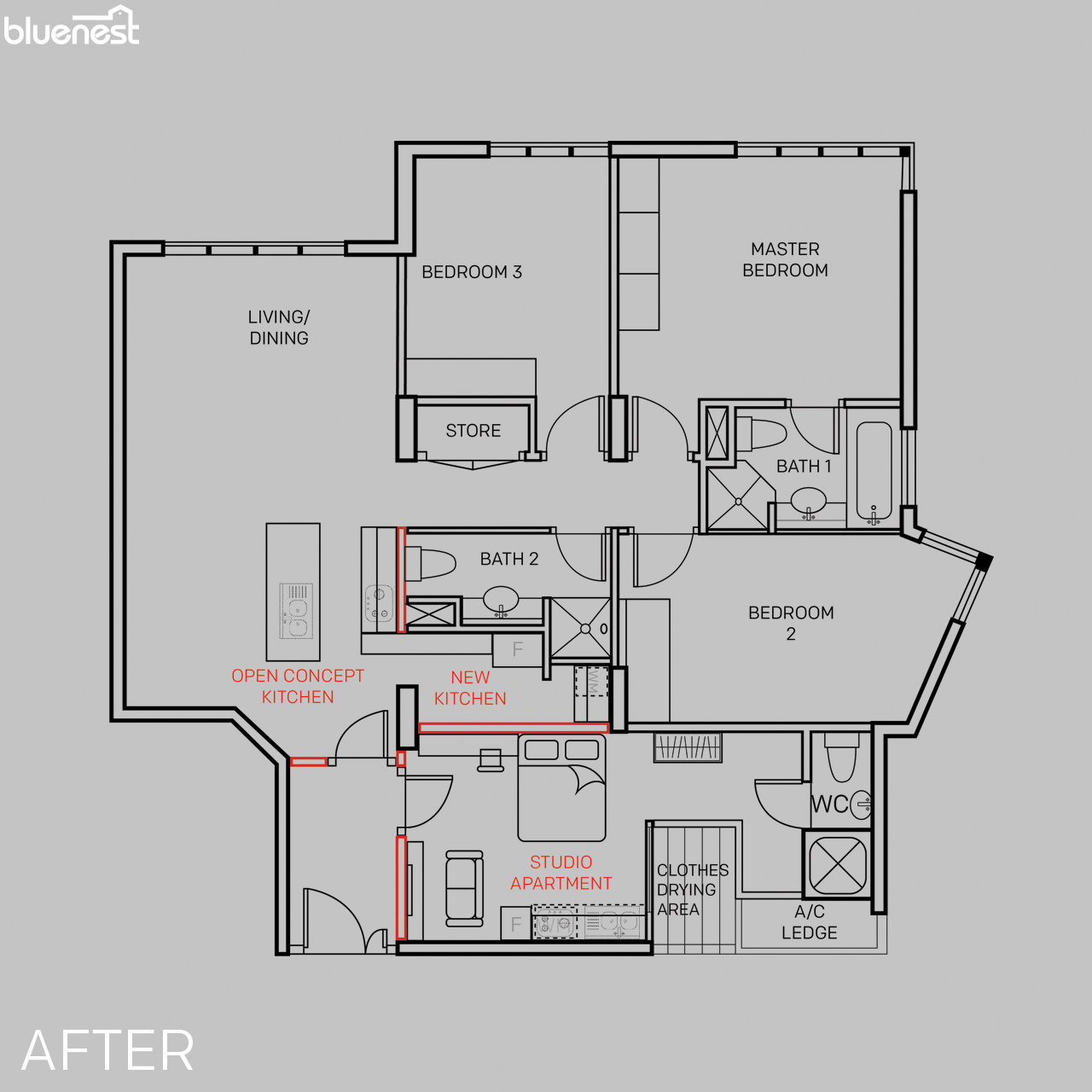

Since the idea is to have a segment of the unit split off into a standalone apartment, it’s possible to convert a regular 3- or 4-bedroom condo into your own dual key.

At Bluenest, we’ve done this for our clients over the past year to great effect.

Here’s how.

The floor plan above depicts a 3-bedroom condo that would work for the conversion. Only certain types of layouts make this a feasible renovation, like:

After converting your new place into a dual key unit, you’ll have about 800-900 sqft for the main unit and 400 sqft for the studio apartment. This makes the main unit about the same size as a 3-bedroom in a new development.

If you’re unsure about units that would work for the conversion, it’s best to work with an agent who has experience in dual key conversions. This will help ensure the desired outcome and keep your renovation costs in check.

Drop us a note about how to get your own dual key conversion.

As a helpful comparison, here are the costs of:

All the units in this comparison are from listings in the same district (D25).

| 3-bed Converted Dual Key EC (1,200sqft) | 3-bed HDB 5-Room Flat (1,300sqft) | Ready-Made Dual Key (1,399sqft) | |

| Size (sqft) of 3-bedder | 800 sqft | 1,300 sqft | 900 sqft |

| Size (Attached Studio) | 400 sqft | – | 499 sqft |

| Total Cost of Property | 999,000 | 580,000 | 1,700,000 |

| 5% Cash Down Payment | 49,950 | 29,000 | 85,000 |

| 20% CPF Down Payment | 199,800 | 116,000 | 340,000 |

| Loan (75% LTV) | 749,250 | 435,000 | 1,275,000 |

| Est. Monthly Repayment | ~$3,150 | ~$1,684 | ~$4,710 |

| Est. Monthly Rental from Studio | ~$1,600 | – | ~$1,800 |

| Est. Nett Monthly Repayment | ~$1,550 | ~$1,684 | ~$2,910 |

In terms of upfront costs, a 1,300 sqft 5-room HDB flat with 3 bedrooms and 2 baths would cost S$580,000. This is just over half the cost of a 1,200 sqft Executive Condominium at S$999,000.

That’s where the dual key rental income comes in.

One of the main benefits of a dual key unit is that you can rent out some of your square footage while at the same time still enjoying the privacy of a 3-bedroom property. The rental income is like an offset to your monthly mortgage payments, so you’ll find yourself paying a similar amount – if not lower – than someone who bought a 5-rm HDB.

You’ll eventually own a property with a much higher market value and a higher likelihood of capital appreciation.

The renovation costs of converting the unit into a dual key can be minimal provided you select the right unit layout. In our experience, clients kept their renovation costs within the same budget they’d set aside to do up a 5-room HDB.

Talk to us to find out if a converted dual key would work with your finances.

We’d be remiss if we didn’t lay out some of the possible pitfalls:

This is especially relevant if you’re counting on rentals to be able to afford the place. It will take time to renovate, and you likely won’t get a tenant immediately after putting your place up on the market. Be prepared to have a financial buffer of at least 3-6 months.

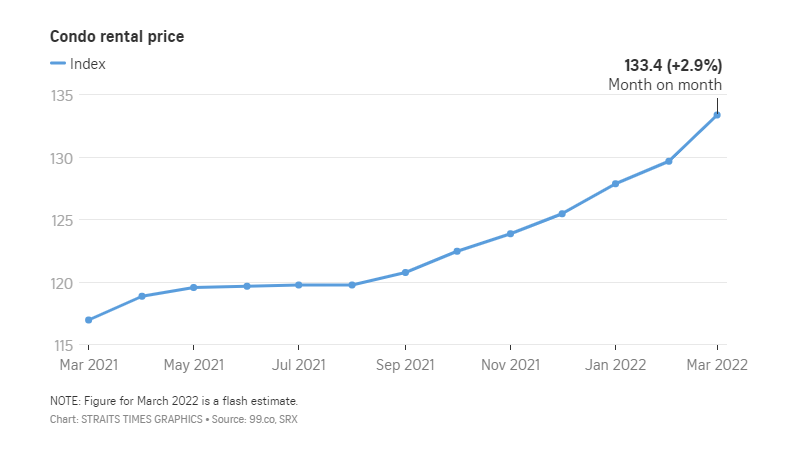

That said, the rental market is healthy right now, owing to the lower supply of newly completed homes and the relaxed restrictions on travel. Rental prices have gone up every month for almost two years now:

Many Singaporeans aspire to own a condo partially because property is seen as an ever-profitable asset. But as with any investment, condos aren’t guaranteed to have capital appreciation: it still takes a discerning eye to pick a good development. That’s why we recommend engaging someone you trust to help with the purchase of a new property.

Would you be interested in a converted dual key condo? Let us know in the comments!

Kenneth is Co-founder of Bluenest and helps to manage the real estate side of the business. He carries over 10 years of experience and was ranked top 10 in Singapore for the number of HDB properties transacted in 2019. Kenneth was featured in the news multiple times for his record-breaking transactions.