A record of 261 million-dollar HDB flats sold in 2021 and you might be thinking if 2022 is a good time to cash out and upgrade from your HDB flat. Similarly, we have a successful case where we sold a unit priced at around S$110,000 above valuation and was sold in just 3 days!

Assuming you’ve already fulfilled the Minimum Occupation Period (MOP) for your HDB, you’re now free to explore your options.

These could be:

Since your home is such a huge investment, you want to make sure all the dollars and timelines add up and that it makes sense to uproot your family.

After all, you don’t want to be caught in a horror story like this one, where a couple was asked to pay over $84,000 in cash upfront for their HDB.

In this article, we’ll talk about the financial aspects of upgrading – but we’ll also highlight all the traps you should avoid as you plan the purchase of your new home while upgrading from your HDB flat.

Upgrading Trap 1: Not fulfilling the Minimum Occupation Period (MOP) for your HDB.

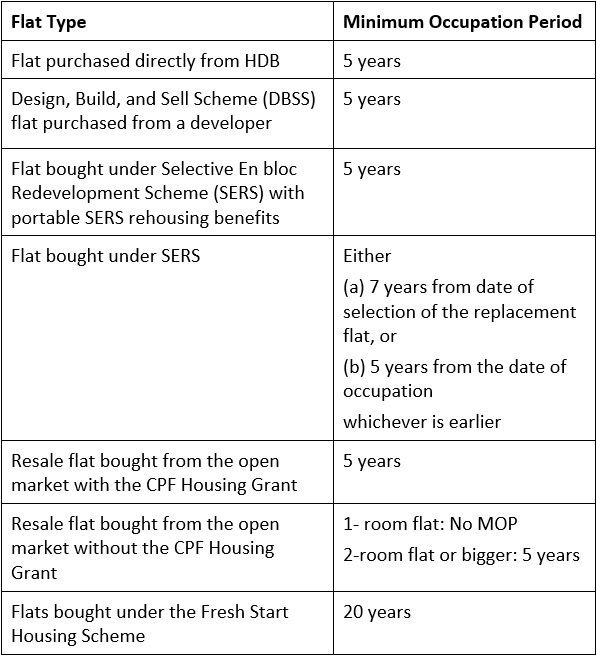

Upgrading Trap 1: Not fulfilling the Minimum Occupation Period (MOP) for your HDB.Most people know that they have to fulfill the MOP for their HDB flats before they can sell it off or purchase a private property. For most people, that also means that you have to stay in your HDB flat for 5 years before you upgrading to another dream home.

The standard MOP is 5 years (with a few exceptions). Check the table below to figure out your MOP:

However, what you may not know is how the MOP is calculated.

Under HDB guidelines, you’re required to physically occupy the flat for it to be counted towards the MOP. That means if you moved your family overseas for a year, that year doesn’t count towards the MOP.

Upgrading Trap 2: Not checking up on your current HDB flat value before you shop around for the new property.

Upgrading Trap 2: Not checking up on your current HDB flat value before you shop around for the new property.If you’ve got the cash to consider upgrading or purchase another property without selling off your current HDB flat, then this doesn’t matter so much.

But if you’re counting on using the sale proceeds to pay for the new house, then you’d better make sure your property gives you enough value. You can check on the average market rate for homes in your area via the HDB Resale Portal.

Hopefully, your home has appreciated in value since the time you bought it. (Read also: 10+ Tips to Increase Your Property’s Value – and Sell It FAST).

But if it hasn’t gone up by much, then you may be selling at a loss (after accounting for inflation).

Don’t forget that on top of paying off any home loans, you’ll have to refund the CPF used plus accrued interest, which can add up to quite a bit over the years.

Upgrading Trap 3: Overestimating the amount of cash you’ll get from the proceeds of the sale.

Upgrading Trap 3: Overestimating the amount of cash you’ll get from the proceeds of the sale.As we noted in the previous point, you’ll have to replenish your CPF account with the principal plus accrued interest – if you used any of your CPF monies for the purchase of your existing property.

But that’s not all that’ll be deducted from your sale proceeds. You’ll also have to pay your agent a commission fee, cover the lawyer’s conveyancing fees, and settle all the other miscellaneous charges.

We detail the various costs in this article, but the bottom line is: you may not get much in cash after all the deductions.

This is important to note especially if you’re thinking about upgrading to a condo- HDB allows you to use your CPF for the whole down payment, you’ll have to fork out a minimum of 5% in cash for private property.

You’ll also have to cover the Buyer’s Stamp Duty (BSD) and Additional Buyer’s Stamp Duty (ABSD) in cash – which means you’ll need quite a lot of liquidity before you sign on the dotted line.

By the way, if you’re upgrading to a bigger and better resale HDB flat, you’ll want to look into HDB’s Enhanced Contra Facility Scheme. This allows you to sell your existing flat and put the sale proceeds directly into the new resale HDB, reducing the cash outlay and housing loan required.

Upgrading Trap 4: Overextending yourself with the loan for your new place.

Upgrading Trap 4: Overextending yourself with the loan for your new place.In 2013, roughly 5-10% of Singaporean mortgage-holders were overstretching themselves on their home loans. (Source: MoneySmart)

That’s why the Monetary Authority of Singapore (MAS) implemented the Total Debt Servicing Ratio (TDSR), which prevents people from borrowing too much money. Under this framework, your loan repayment obligations must not exceed 60% of your income.

This includes home loans, car loans, credit card debt, personal loans, and all other forms of debt. So if you’ve got a salary of $10,000 and have to repay $1,500 on your car loan per month, the bank will only consider a maximum of $4,500 when you apply for your home loan.

Still, even with this protective measure by the government, you’ll want to do your own calculations to make sure you’re not overextending yourself by taking on that new property.

For instance, unless you and your spouse have got iron rice bowls, you may not want to assume that you’ll continue drawing the same high salaries forever.

What if something happens and you’re no longer able to cover that repayment every month? And what if you need the money for something else – say, a parent’s medical bills?

Holding power is key here – as is picking the right property for your current income level. You don’t want to pick up that condo only to be forced to sell it at a loss a few years later because your finances are too strained.

Upgrading Trap 5: Not accounting for the higher cash payment required for condos.

Upgrading Trap 5: Not accounting for the higher cash payment required for condos.This is another trap that tends to affect those buying their second homes before selling off their first ones. However, it could still take its toll on you even if you’ve sold off your previous home first.

If you’re going for a private property, you’re obviously not going to qualify for that HDB loan anymore. But that also means you won’t be able to borrow as much – the Loan-to-Value (LTV) limit for banks is 75% compared to HDB’s 90%.

The remainder of the 25% downpayment can either be in cash or CPF, but at least 5% must be in cash. Given that condos can easily cost a million dollars now, you’d best have tens of thousands on hand.

There’s a cap on how much of your CPF you can withdraw to pay off the house as well. We detail those limits in our article in how to determine if you’re ready to sell your house, but in short: if you’re buying the new house before selling off your old one, expect an even lower LTV limit, lower CPF usage, and higher cash downpayment.

Upgrading Trap 6: Thinking you can avoid ABSD if you sell your current HDB flat soon after buying the new one.

Upgrading Trap 6: Thinking you can avoid ABSD if you sell your current HDB flat soon after buying the new one.This is actually true, but with one huge caveat: you’ll have to pay the tax first, then apply for an ABSD remission for your second property if your first property is sold within 6 months. (Source: IRAS)

On an $800,000 property, that means having an extra $56,000 in cash before you even sign those papers.

(Read also: 7 Things to Know About ABSD for Your 2nd Property)

The clock starts ticking from either a) the purchase date for the completed second property, or b) the date that the Temporary Occupation Permit (TOP) was issued, if the second property was still being built at the time of purchase.

There are also a few other conditions:

The main way to avoid ABSD entirely is to sign the contract to sell your current residential property before signing the Option to Purchase (OTP) for the new property. However, this requires quite a bit of skillful maneuvering to make sure you have a place to stay in the interim!

Upgrading Trap 7: Not factoring in renovation or ongoing costs for the new property.

Upgrading Trap 7: Not factoring in renovation or ongoing costs for the new property.This is mainly if you’re upgrading to a resale HDB or condo.

Depending on the age and condition of the place, you may have to do quite a few repairs and renovations before you even move in.

For instance, older HDB flats tend to be larger and more spacious than the newer developments, but you may run into more maintenance issues. Old piping, wiring, and flooring can all cause problems for you down the road.

You’ll also want to check on any peeling patches of paint (possible leaks) and all the wooden fixtures (termites, wood rot).

You can save a bit if you get a place that’s been recently renovated and move-in ready, but this will be factored into the price of the house. If you do the renovations after you buy the place, the work can easily add up to tens of thousands.

On top of that, you’ll also want to look up the maintenance fees and sinking fund charges if you’re getting a condo. Some condos charge upwards of $800 per month, so make sure you factor that into your calculations beforehand!

Upgrading Trap 8: “I can use CPF to cover the BSD/ABSD.”

Upgrading Trap 8: “I can use CPF to cover the BSD/ABSD.”Sure, you can use your CPF – but only after you’ve paid the BSD or ABSD in full. Afterwards, you can apply for a reimbursement from your CPF account.

Upgrading Trap 9: “I can apply for extensions with the payment of BSD / ABSD.”

Upgrading Trap 9: “I can apply for extensions with the payment of BSD / ABSD.”Nope. IRAS is rather unforgiving. No extensions will be given. You can’t pay in installments, either.

You only have 14 days to pay the BSD/ABSD. If you’re late, you may be liable for some hefty penalties:

Upgrading Trap 10: “I can buy the condo under my spouse/child’s name to avoid the ABSD.”

Upgrading Trap 10: “I can buy the condo under my spouse/child’s name to avoid the ABSD.”This works only if your spouse or child is Singaporean.

However, if he/she is a Singapore Permanent Resident (SPR), you’ll still have to pay the 5% ABSD up front.

Also note that if you’re getting a bank loan for the purchase, their salary must be enough to apply for the loan.

Upgrading Trap 11: “I can transfer my share of the house to my spouse/child, then purchase the additional property.”

Upgrading Trap 11: “I can transfer my share of the house to my spouse/child, then purchase the additional property.”This is a viable option often proposed by conveyancing lawyers and real estate agents.

Say you have a 10% share of the property and your spouse has 90%. You can transfer your 10% ownership to your spouse/child through a Sale & Purchase Agreement, after which you’ll be freed up to buy that additional property without incurring ABSD.

Just note that with this route, your family will still have to pay the gahmen BSD on the 10% share of the property being transferred. You may also be liable to pay the Seller’s Stamp Duty if you’ve had the property for less than 4 years. (Source: Singapore Legal Advice)

Was this article helpful? Good things must share!

Meiling is an American-born Chinese living in Singapore. As a property owner herself, she enjoys doing research into the local real estate market and making highly technical topics easy to understand for readers. In her spare time, Meiling enjoys going for a long run or snuggling into her armchair with a good book.

Comments are closed.

Great stuff. I hope to see something written about buying of hdb double storey shophouse which has a commercial and residential component.

I enjoyed reading your work. Thank you.

Ho SC

Thank you for your suggestion! We will keep that in mind and do stay tuned with us for that piece of content 🙂 Best, Jeff

Hi,

I would like to enquire on ABSD. If wife own 1 property and now buy over spouse 2nd property 50% of his share (private condo).Does wife need to pay ABSD? Any other charges beside ABSD?

Hello Terence, as long as there is a name in the ownership of the property, he/she will be subjected to pay for ABSD if he/she decided to purchase another property. There would be the standard Buyer Stamp Duty as well of 4% if you are looking to purchase a property of more than $1m. Do hope this helps!