For HDB upgraders, new launch condos seem to have the best balance of affordability and potential capital appreciation.

But if you’re hoping to buy the new launch before selling your flat, you may run into cashflow issues given the higher cash outlay and Additional Buyer Stamp Duty (ABSD).

Is there a way to avoid ABSD entirely? And how do you maximise your loan for the 2nd property?

Enter Deferred Payment Schemes.

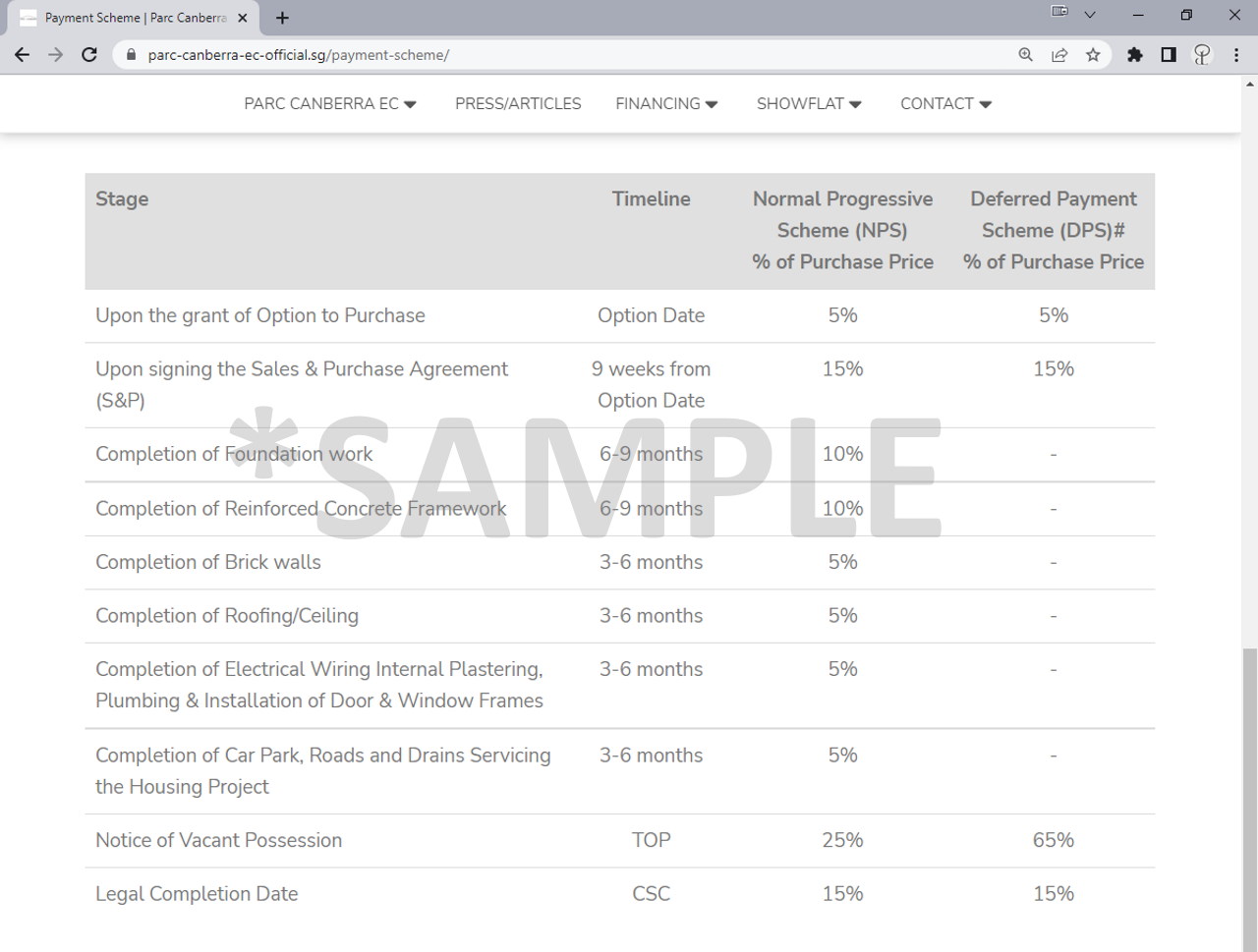

The Deferred Payment Scheme allows you to make a downpayment, and then pay the balance much later on (sometimes up to two years). It’s available only with new launches that have already TOP’ed.

In other words: book now, pay later.

This is attractive to HDB upgraders who want to secure a new launch before they sell their existing property. It gives them much more time to sell, with the assurance that they already have their next home prepared.

Read also: From HDB to Condo – Can You Get a Dual Key Condo At a Discount?

On the developer’s end, the scheme benefits them because it allows them to sell balance units more easily.

If you still have your heart set on the DPS, look at newly-TOP’ed condos (including in the last few years) with unsold units as a starting point. Many of these developers won’t publish the DPS online, so you’ll have to talk to the agents to find out if they offer it.

You’ll then have to check out the terms of the agreement. Here are a few things to ask about:

Most Deferred Payment Schemes only push the option period to 8 or 9 weeks.

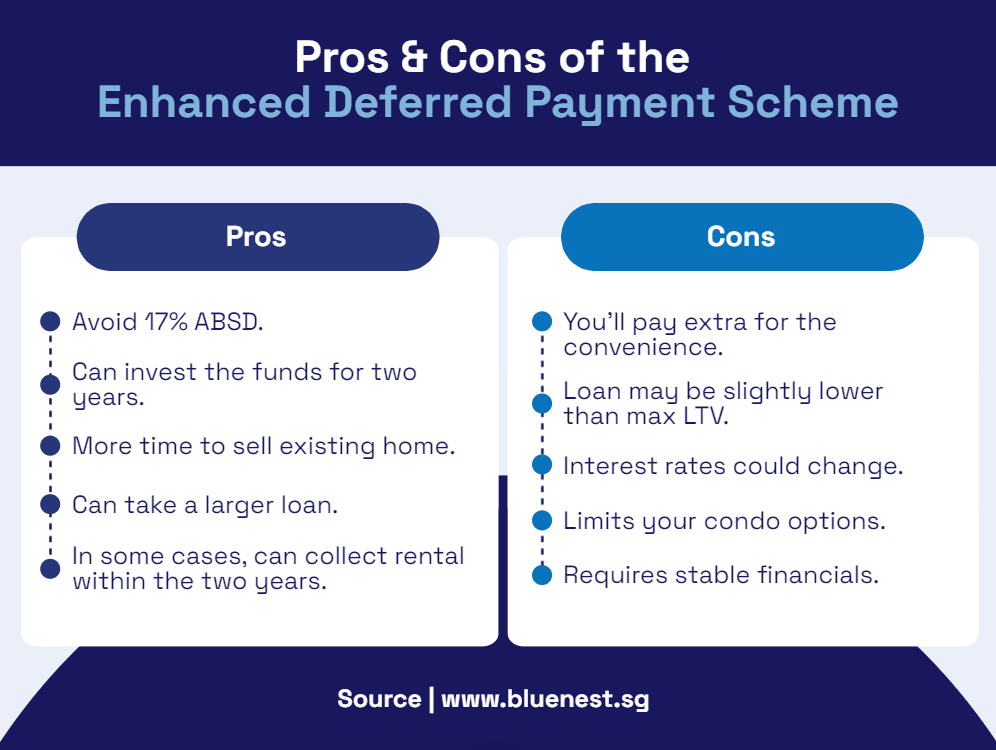

But there’s a rare version of the DPS (sometimes known as the Enhanced Deferred Payment Scheme) that allows you to exercise the option up to two years later.

This is ideal for those looking to escape ABSD and maximise their home loans. 8 weeks doesn’t give you much of a runway to sell your existing property and move to the new place.

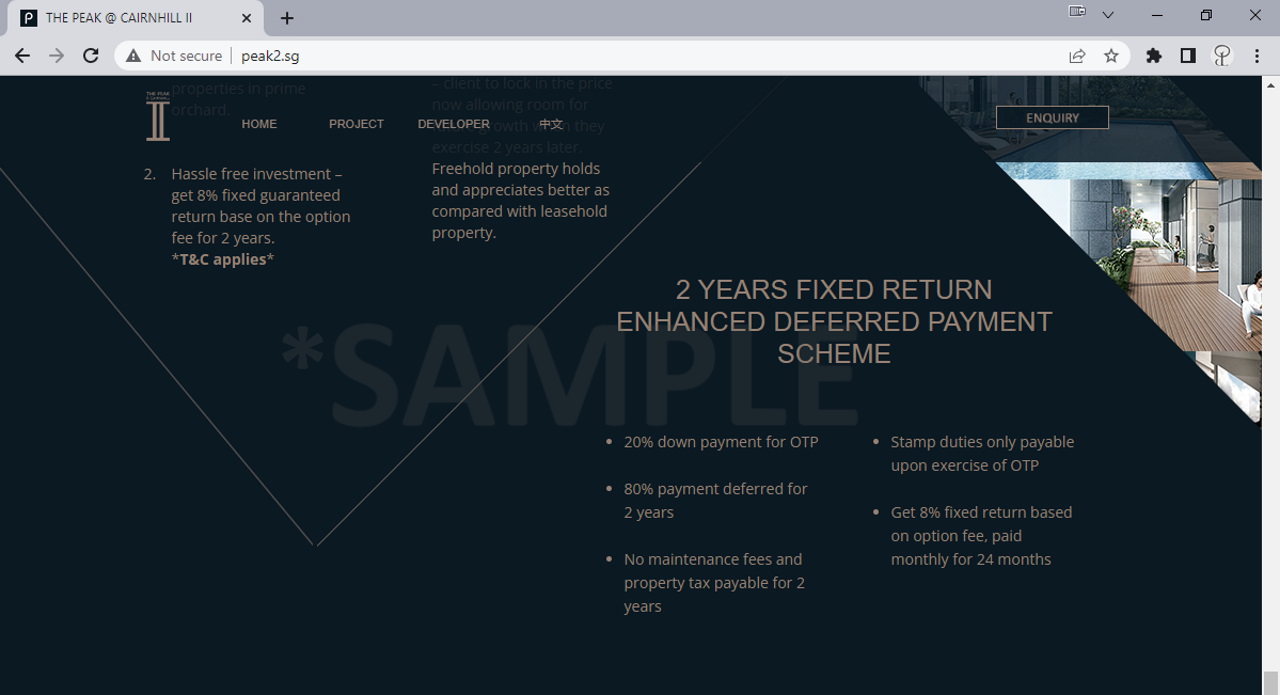

Developers have been known to offer very favourable terms in this area. Look out for an Enhanced DPS that requires 0% property tax and no maintenance fees until you exercise the OTP.

Of course, you’ll need to balance this with the other terms and conditions. For example, some developers may require a larger down payment in return.

And in the same train of thought, are you allowed to rent out the unit in the interim? Alternatively, does the developer provide fixed monthly returns on your downpayment? You may have to negotiate with the representative agent on this.

As of the time of writing, these were a few of the possible condos that offered an Enhanced Deferred Payment Scheme:

Joreen is the Sales Director at Bluenest and a seasoned property agent who's transacted over 600 properties since 2008. She specialises in residential properties and is adept at resolving complex queries for clients. Remarkably, Joreen was ranked top 20 in Singapore for the number of HDB properties transacted for the first half of 2019.