One thing the Singapore government has done right is to make it easy for us to own our own homes. In 2021, 88.9% of Singaporeans owned their homes. In contrast, only 49% in Hong Kong did! The more fortunate of us even purchase more than one property for investment or rental purposes. For homeowners, property tax is a familiar “friend” whom we catch up with every year.

This “friend” can be tricky and troublesome to manage, as the taxes payable sometimes change every year. This article will answer your questions on property tax and make sure you’re paying no more than what you need to.

- Introduction to Property Tax in Singapore

- Who has to pay property tax?

- How are your property taxes used in Singapore?

- When do you pay property tax in Singapore?

- How can I pay the property tax?

- How do I calculate my property taxes?

- Case Study 1: A 4-room HDB Flat for Own Stay

- Case Study 2: 4-Room HDB Flat, Fully Rented Out

1. Introduction to Property Tax in Singapore

Property tax is the fee that IRAS charges you on all the property you own in Singapore. Whether the unit is currently occupied, unoccupied, or rented out, you’ll have to pay tax.

2. Who has to pay property tax?

- Anyone who owns a property in Singapore*

- The buyer and seller of any property transaction

- A tenant renting a property

* If you jointly own a property with someone else, the tax will be split according to the size of your respective shares.

3. How are your property taxes used in Singapore?

Property taxes are used to improve the public amenities and infrastructures that benefit you and your family. These include MRT stations, schools, healthcare services, recreational parks, and sheltered walkways.

All these amenities increase the market value of your property. This is relevant especially if you’re selling or renting out the unit. Look at the tax more as an investment than an expense. It can bring you more revenue than you think.

4. When do you pay property tax in Singapore?

Paying your taxes is an annual affair. You’ll receive your bill for the next year during November/December. All payments must be made by the 31st of January the following year.

It’s always better to be early than late with your payments. An additional 5% penalty will be charged for late payments.

5. How can I pay the property tax?

- GIRO – The most convenient payment method with an automatic deduction from your bank account when the bill is due. There’s no processing time (on your end) or any chance of late payment. To apply for GIRO, click here.

- Internet Banking – Like most of your bills, you can make payment via your respective bank accounts online.

- AXS/SAM/ATM (DBS/POSB/OCBC only) – One of these three is usually located in your neighbourhood. If you happen to pass by a terminal, you can make your payment there.

- Mobile Banking – You can now make payment via the AXS mobile app or DBS Paylah! app (for DBS users only). Now within a few buttons away.

6. How do I calculate my property taxes?

Property tax is calculated based on the following formula:

Annual Value of Property × Property Tax Rate = Property Tax |

The annual value refers to the income you’ll earn from your property if you were to rent it out for a year, minus your furniture and maintenance costs. The annual value differs each year in response to the property market. Once you have your annual value, you can plug the number in to this handy IRAS property tax calculator.

a. How do I calculate the annual value of my property?

The easiest way is to use the IRAS myTax Portal. You can look up the annual value of your property at any time.

You can do your own calculations by checking the rental rates for units comparable to your property, but this is really only necessary in the event of severe market dips (which affects the value of your property, and therefore the taxes payable). In such cases, the annual value displayed on the IRAS myTax Portal may not be the most reliable figures.

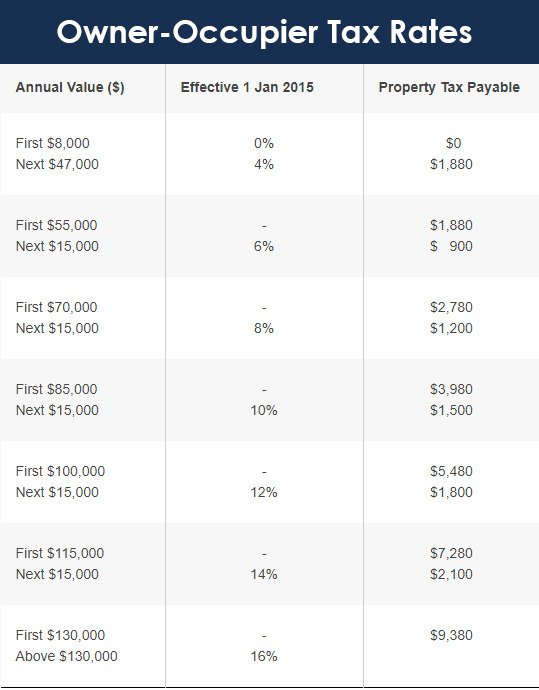

b. What are the property tax rates applicable in Singapore?

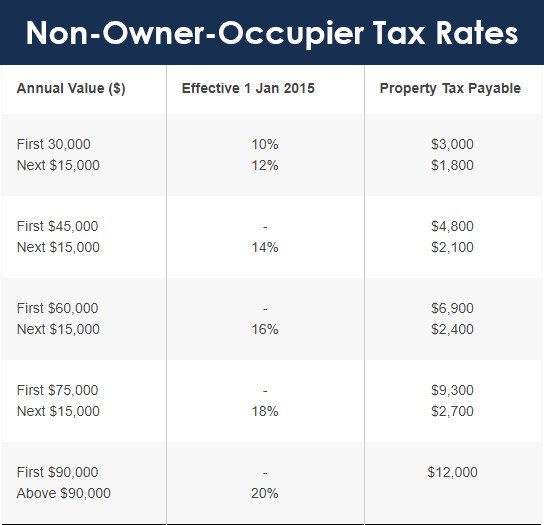

There are two types of rates in Singapore:

- Owner-Occupier Tax Rates

- Non-Owner-Occupier Residential Tax Rates

These apply to all types of residential properties: HDB, Condominiums, Private Property, and so on.

c. If my property is only partially rented out, which rate do I qualify for?

As long as you live in the unit, you’ll still be considered for the Owner-Occupier Tax Rates.

d. If my property is vacant, which tax rate do I fall under?

Like all investment or fully-rented-out properties, you’ll be considered under the Non-Owner-Occupier Tax Rates.

Still overwhelmed by the numbers? Here are a few examples to help you out.

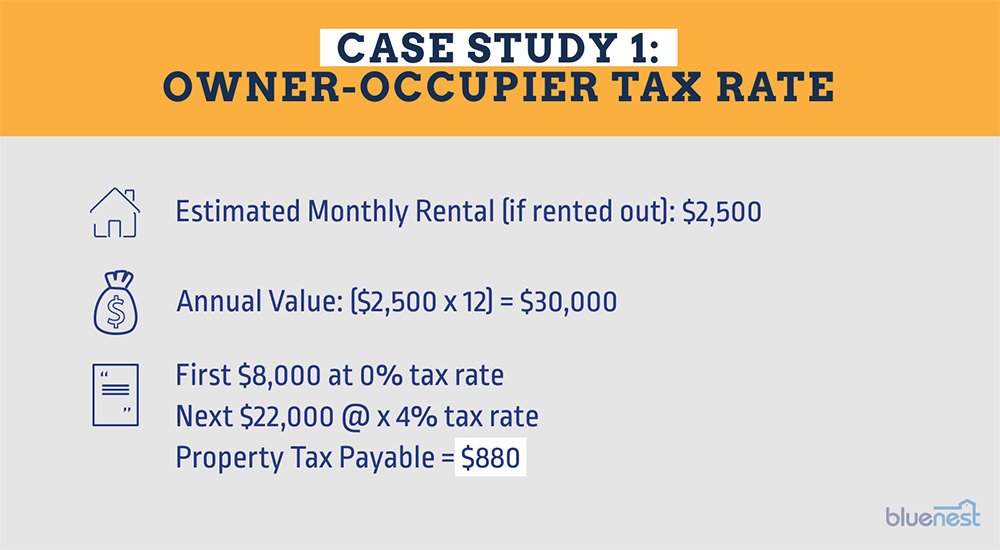

Case Study 1: 4-Room HDB Flat for Own Stay

John recently purchased a 4-room BTO HDB flat with his wife and their newborn son at Punggol. His property is estimated to fetch a monthly rental of $2,500.

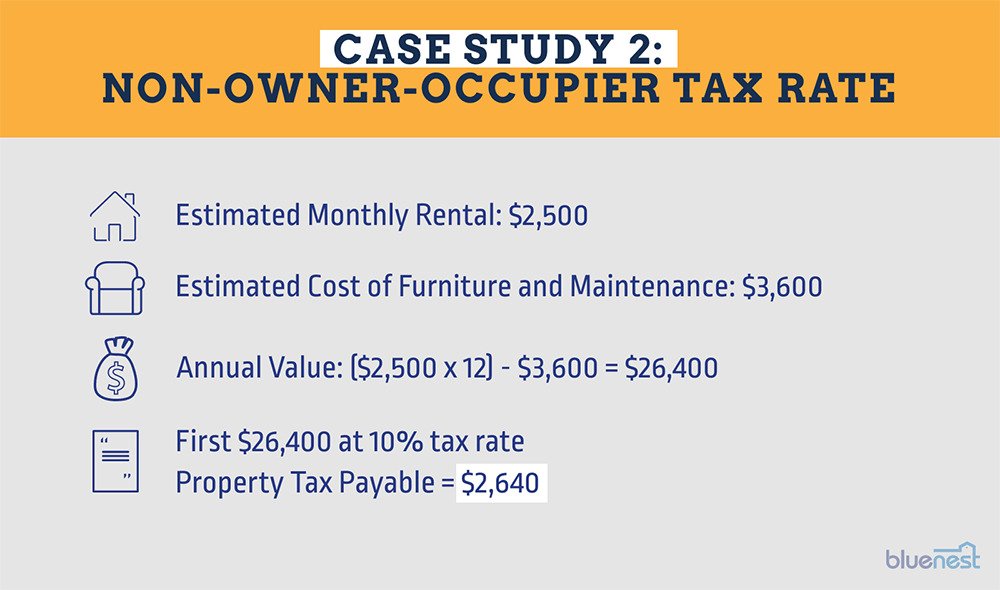

Case Study 2: 4-Room HDB Flat, Fully Rented Out

Five years have passed. John now rents out his entire HDB flat for $2,500 a month while his family has moved to a new place. What’s the tax due for his 4-room HDB flat?

Final Notes

Even though the unit evaluated in both Case Study 1 and 2 is the exact same unit, John pays a heftier tax in Case Study 2.

Herein lies the lesson: The tax payable differs significantly if you are occupying the property. Always consider the tax for rental properties. You may be undercharging your rental and making a loss.

Was this article helpful? Good things must share!