Congratulations! You’ve managed to find a buyer for your resale HDB or private property. You’ve gotten through the hardest part – but until the sale has been officially completed, you can’t rest easy just yet.

Now that you’ve gotten to this point, you may be wondering: “what else do I need to do in the meantime? How long does the whole process take?”

We’re here to give you the rundown of the private property or HDB resale process so you know exactly what to expect.

Click here to skip ahead to the relevant section: HDB Resale Transactions or Sale of Private Property

If you’re selling an HDB flat, you’ll have to do everything by the book.

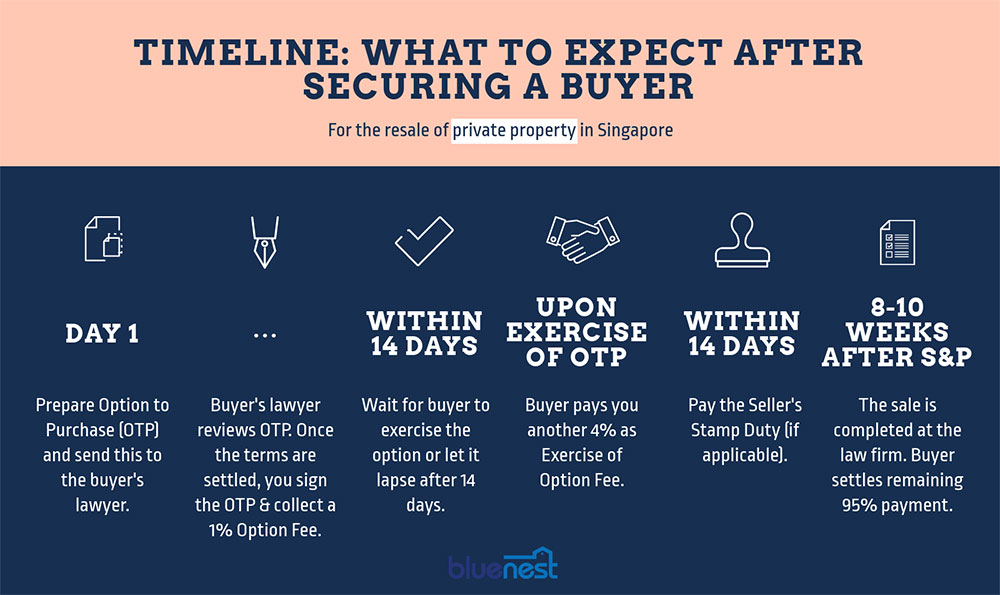

We’ve got an in-depth guide on everything you need to know about selling an HDB flat, but here’s a quick recap of the timeline in an infographic:

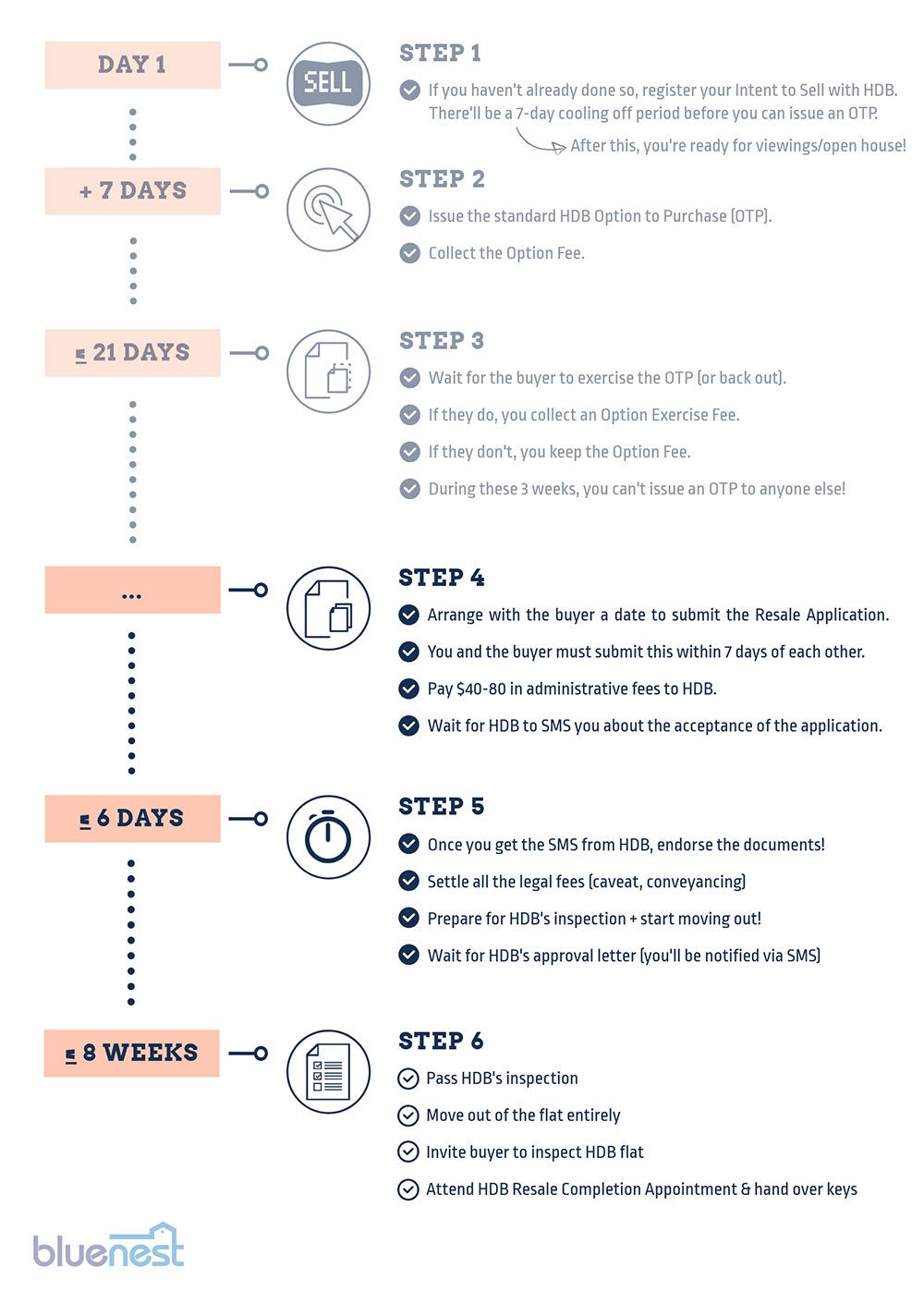

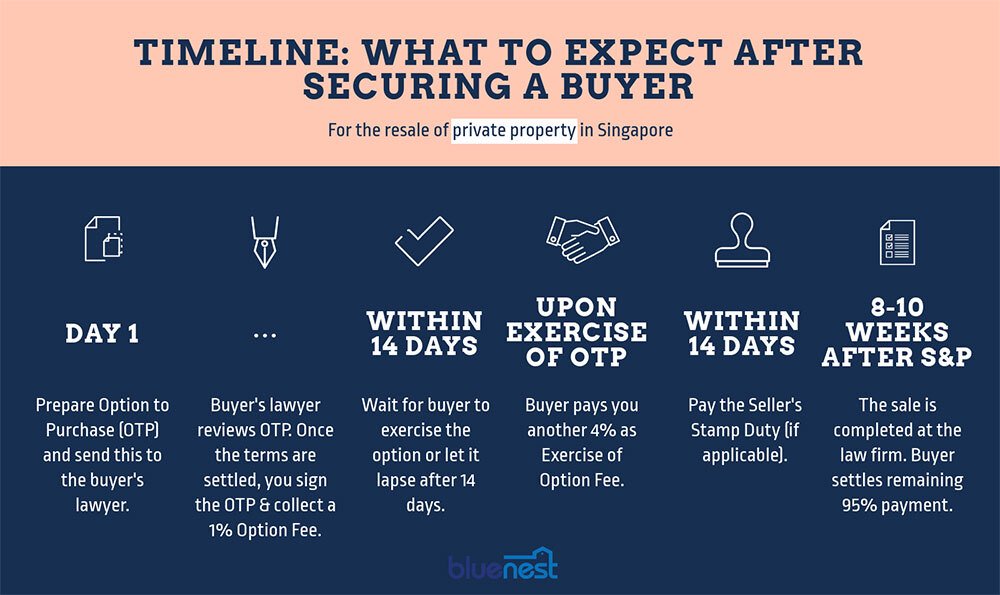

For condominiums, landed property, and so on, it typically takes 3 months to complete the entire sale once you’ve secured a buyer.

In that time, you’ll have to engage a solicitor and clear a few other tasks.

The breakdown of the steps are as follows:

vHere’s an infographic charting out the timeline:

vYou can actually engage a solicitor for this, but it’s not the cheapest route.

The lawyer would (ideally) specialize in conveyancing, which is the legal term to describe the transfer of property. He’ll settle everything from drafting the legal documents, registering them with the Singapore Land Authority, and coordinating with CPF/banks/the buyer’s lawyer.

But if you want to save the extra dough, the alternative would be to have your agent settle this for you. Bluenest’s property sale services include templates for the Option to Purchase. You can download them, tweak them, and then send it over to your buyer / buyer’s lawyer once you’re happy.

There may be some negotiation and amendments here, but eventually there should be an agreement on the terms of the sale.

Once the OTP document has been finalized, you’ll have to sign it so you (or your agent) can send it over to the buyer.

You’ll then collect 1% of the sale price as the Option Fee / Booking Fee.

You’ll now have to wait for the buyer to exercise the OTP – or let it lapse. The time frame for this is negotiable, but the industry standard is 14 days.

One of two things will happen:

If they proceed with the sale, yay! If not, you’ll have to put your place back on the market and look for another buyer.

If your buyer chose to exercise the OTP, it’s now time to engage that solicitor (if you haven’t already). Only the lawyer can register the official documents with the Singapore Land Authority and make sure the transfer goes over smoothly.

On your buyer’s end, they’ll lodge a caveat after the conclusion of the contract. Also, if they got a bank loan for the purchase, their bank may also send a professional valuer down to formally evaluate your property.

During the 8-10 weeks following this, you’ll have to maintain the house in the same condition and move all your stuff out entirely. The buyer will also inspect your soon-to-be-former property to verify that it’s empty and intact.

Almost there!

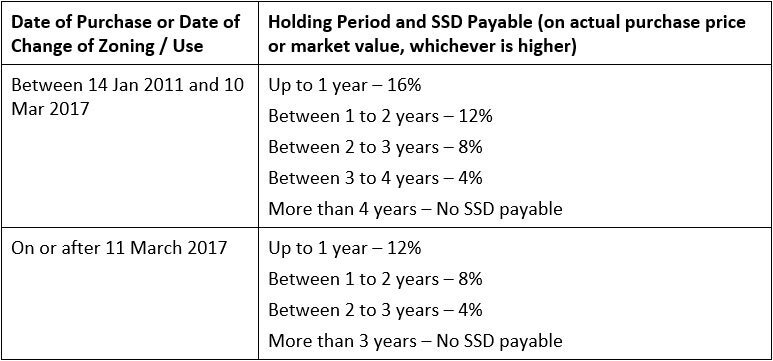

Once the Sale & Purchase Agreement has been signed, you now have to pay stamp duty – but only if you haven’t had the property for very long.

How much you’ll pay depends on when you bought the property. The table below details the rates:

Source: IRAS

You’re done! All that’s left is to head over to the lawyer’s office, collect the other 95% of the payment balance, and hand over the keys.

Meanwhile, the lawyers will handle the official transfer of the title deeds.

Was this article helpful? Good things must share!

Meiling is an American-born Chinese living in Singapore. As a property owner herself, she enjoys doing research into the local real estate market and making highly technical topics easy to understand for readers. In her spare time, Meiling enjoys going for a long run or snuggling into her armchair with a good book.