S$1,454. That’s the average cost of Singapore’s real estate per square foot. Now, that’s expensive. Not everyone are Crazy Rich Asians who can afford a 2nd property.

As the 2nd most expensive housing market in the world (according to CBRE), even our HDB flats cost at least $300K – $400K. No doubt most of us can’t afford to cover the entire cost up front – so we acquire mortgages to cushion the cost over the next three decades.

In this article, discover the two main factors to consider when applying for loans for your 2nd property. We understand that there could be many unfamiliar terms hence here’s our ultimate home loans glossary for your easy breakdown!

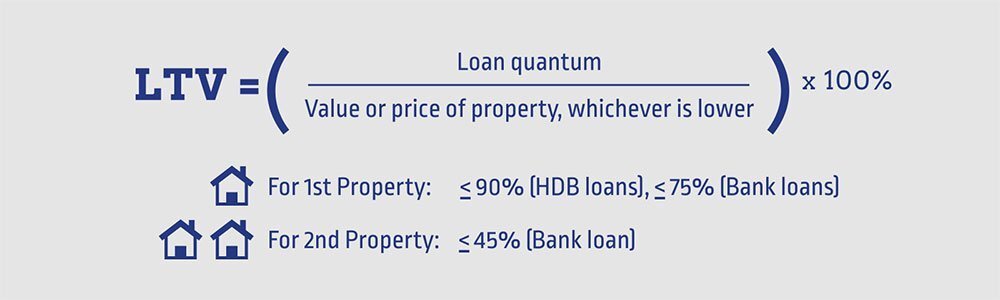

The LTV ratio determines the amount you can borrow based on the official valuation or the purchase price of your property, whichever is lower.

You probably know by now that with your 1st bank loan, you can borrow up to 75% of your property’s value. The remaining 25% can be paid via a combination of your CPF Ordinary Account funds or cash, but a minimum of 5% must be in cash.

With your 2nd bank loan, the regulations are far tighter. Housing loans for your 2nd property are capped at a 45% LTV limit.* This means you’ll need to have the other 55% (or more) already saved up.

Here’s how to calculate your LTV ratio for housing loans:

* Assuming you bought a flat as your first home, there’s an exception if the 2nd property you buy is also an HDB flat/EC. Since you’re not allowed to own more than one HDB at a time, you’ll be treated as though you have no outstanding mortgages — provided you’ve got evidence that you’re selling off that first flat within the stipulated time limit. (That means you can still borrow up to the 90% LTV limit for that HDB/EC.)

The higher the LTV limit, the higher the interest rates charged due to the larger amount loaned. The amount you can borrow decreases further with subsequent homes:

| 2nd home | 45% LTV limit |

| 3rd home onwards | 35% LTV limit |

Undesirable locations and the poor state of the property (e.g. lawsuits, defects, etc.) lower the LTV limit. Your loan will be further reduced for the following conditions:

You’re now able to afford a better life for your family after getting a hefty bump in your salary. You’re considering the new condominiums coming up in two years’ time. You intend to apply for a bank loan to help finance the purchase of your new home.

Our Recommendation:

Ideally, you’d have a good sum of cash on hand before you purchase the property. However, most Singaporeans have their funds locked into investments, insurance plans, or long-term illiquid assets. That’s why we recommend using your CPF funds, which could potentially cover the entire cost of your dream home.

As long as you’ve set aside the Basic Retirement Sum in your CPF Retirement Account (RA), you can use the additional funds to finance the remaining amount if:

However, even if you could afford to take on another loan, we wouldn’t encourage it considering the financial burden it may bring. You won’t want to compromise on your quality of life just to make ends meet.

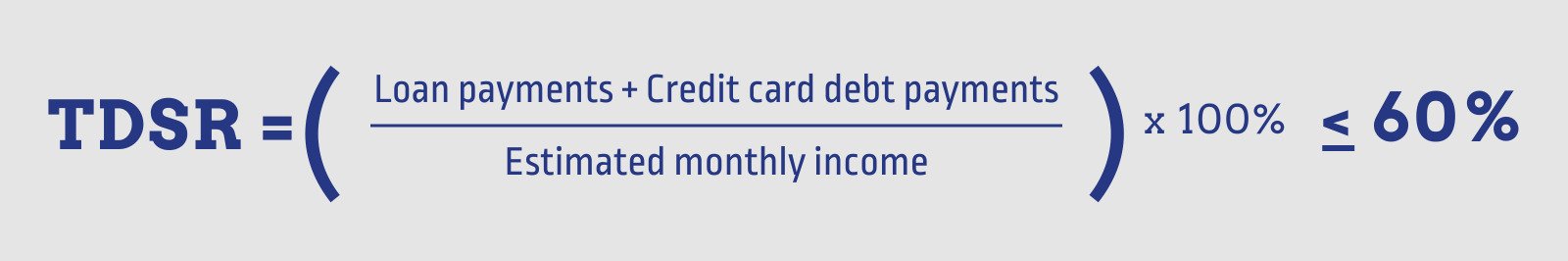

TDSR is a government initiative aimed at preventing overborrowing and helping people to manage their finances well.

Even with interest rates increasing from 1.5% to 3% this year, Singaporeans are taking on an alarming amount of debt — to the extent of living from paycheck to paycheck. The average household debt in Singapore is 2.1 times their current income.

The TDSR takes into account your monthly income versus all the debt you carry. This includes pre-existing loans (study, car, and other personal loans), credit card debts, and so on. TDSR ensures that your debt repayments are always capped at 60% of your salary.

Here’s how to calculate TDSR:

First off, Singapore’s interest rates are closely tied to USA’s federal interest rates. As seen below, there is a direct relationship between the fed rate and SIBOR.

| USA Federal Interest Rate | SIBOR | |

| Mar 2017 | 0.75% – 1.00% | 0.71% – 0.76% |

| Jun 2017 | 1.00% to 1.25% | 0.81% to 0.93% |

| Dec 2017 | 1.25% to 1.50% | 1.09% to 1.33% |

| Mar 2018 | 1.50% to 1.75% | 1.13% to 1.25% |

| Jun 2018 | 1.75% to 2.00% | 1.39% to 1.42% |

| Sep 2018 | 2.00% to 2.25% | 1.50% to 1.64% |

Because interest rates are constantly increasing, many choose to refinance their loans every few years to get the lowest rates possible. With a shorter loan tenure, they pay less interest overall. However, the TDSR may be an obstacle if your monthly loan repayments have already hit the 60% limit.

Taking into account all your existing loans, you may have already hit the maximum limit of 60%. Unless you’ve paid off most of your current loans or increased your income significantly, you may not be able to refinance and acquire a 2nd housing loan.

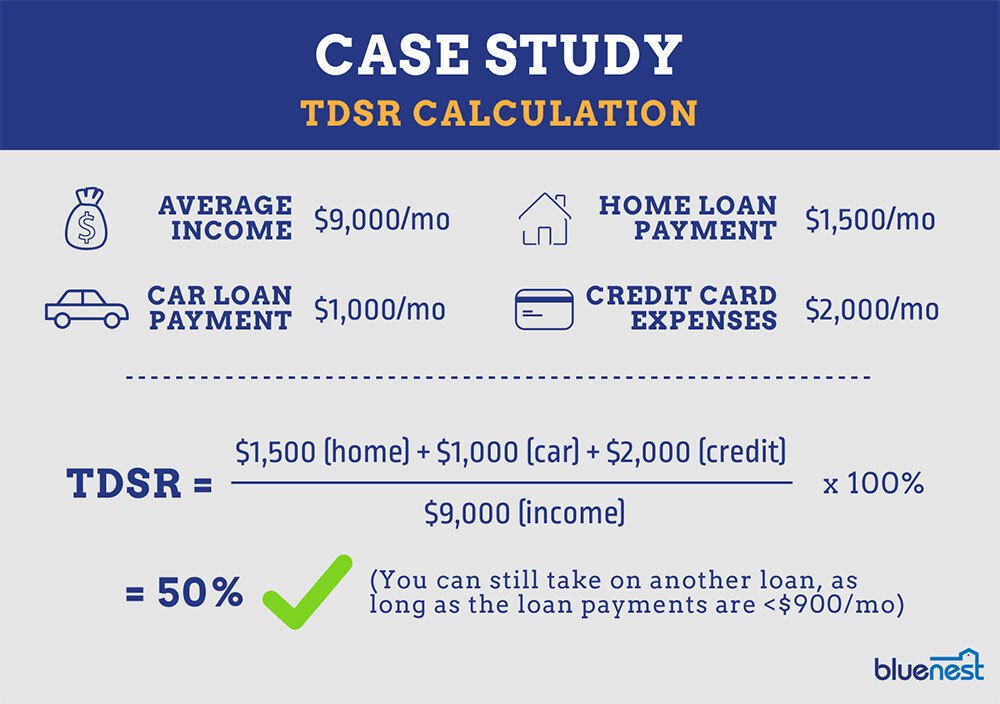

Both you and your spouse have been working for a few years. Let’s assume that you earn a combined monthly income of $9,000. You’re considering taking on an additional loan to finance a 2nd property for investment purposes. To determine how much can you borrow, you calculate your current TDSR.

As a general rule of thumb, everyone should spend within their means. Based on the above example, an average car and housing loan with credit card expenditures can easily take up 50% of your monthly household income.

If you take on another loan, it’s very likely that you’ll exceed the 60% TDSR limit. Unless you’re cash-rich, we’d advise amassing some more wealth first or paying off more of your existing loans.

Was this article helpful? Good things must share!

Comments are closed.

Thanks, very useful