Since the pandemic, we have been experiencing BTO delays in the range of 6 to 12 months and that has led to a surge in the resale market. Now that you have issued your Option to Purchase (OTP) and secured yourself a buyer, what’s next? In short, you will be required to complete the HDB resale application. It might sound like a taunting process for many 1st time sellers but it’s actually not as hard as you think.

Fret not, in this article we will outline in details what you need to know about your HDB resale application.

This is the next step after your buyer has exercised the Option to Purchase (OTP). At this stage, both your buyers and you are required to submit your respective portions to HDB, through the HDB Resale Portal. This is one of the final steps in the HDB resale process.

Quick tip:

Do remind your buyers to check on their eligibility conditions and resale requirements before submitting your resale application

The process takes around 15-30 minutes to complete. However, you do not need to worry if you are interrupted in between as you can save your application as a draft and then continue filling it out later on.

HDB will notify both the sellers & buyers of the acceptance of the application via SMS or email and will take about 8 weeks from the date of acceptance to process your application.

You may be required to provide soft copies of some of the following documents, so do get them prepared beforehand!

Your buyer will also have a number of documents to submit on their end, such as their personal income documents and HLE letter. On a side note, do ensure that your buyer has sufficient enough funds to buy the HDB flat and are familiar with the restrictions on usage of CPF and HDB loan.

Once you’ve submitted your HDB Resale Application, do remind the buyer to submit theirs within 7 calendar days. If you fail to do so, the application will lapse and you’ll lose your application fee!

*Note: If you’re using the proceeds from the sale of this HDB to buy a new flat, you’ll need to indicate that you’re applying for the Enhanced Contra Facility on the HDB Resale Application.

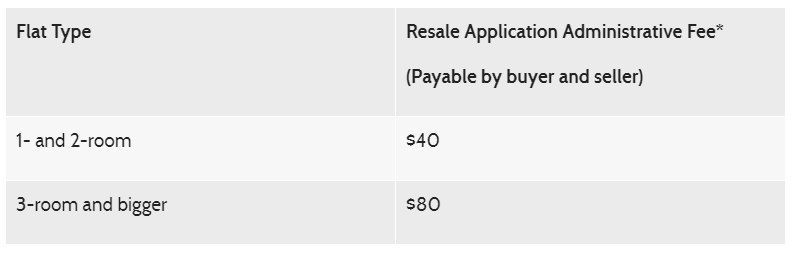

Both you and your buyer will have to pay an administrative fee when submitting the Resale Application. The exact amount differs depending on the size of the flat:

Source from: HDB

Payment can be via Visa / Mastercard on the HDB Resale Portal.

After you’ve paid up, HDB will send you an SMS within 10 working days. This message will either inform you that they’ve accepted your application or that you’ve missed something out. HDB’s official acceptance marks the beginning of the 8-week processing time.

(Read also: The Costs of Selling Your Property)

During the 8-week processing time, you’ll have a number of tasks to clear:

Throughout the 8-week timeframe, both you and the buyer can login to the HDB resale portal and check on your application status at any time.

You may require the buyer’s consent if you are doing it later on in the 8-week timeframe and keep in mind that the OTP is a legally binding contract that you’ll have to privately settle.

If you are firm on cancelling your HDB Resale Application, do write to HDB to inform them of your case.

Else, the application might also be cancelled under the following scenarios:

Assuming all the documents have been approved and the financing has come through, you will have to attend the Resale Completion Appointment with a HDB representative (applicable even if you have engaged a HDB solicitor to act for you). However, you do need to attend if you have engaged a private solicitor as he/she can attend this appointment on your behalf.

The date of the appointment is usually around 8 weeks after the resale application has been accepted. Both seller and buyer will be notified via SMS about the exact date and time.

The HDB resale procedure may seem like a long journey, but in most cases, it is not as painful as it sounds. The time taken from exercising the OTP to completion is typically between 3 to 4 months and most of the steps in this resale procedure can be performed online.

If you have any questions about the resale process, please feel free to reach out and schedule a non-obligatory consultation with our Bluenest advisor.

At Bluenest, we sell our properties faster, better and more efficient than the other agents in the market. This is the result of our AI tools, personalized marketing strategy & top-notch agents. At only 1% commission fees, you get to enjoy best-in-class service and expertise!

Speak to us at +65 3138 2554 or simply drop us a mail at hello@bluenest.sg

Check out our HDB success stories:

Choose the right blue. Choose Bluenest.

Your trusted advisor, all the time!